Fintechs and Funds Stack Sats While Bitcoin Takes a Breather—Wall Street Still Doesn’t Get It

Bitcoin’s price action might be cooling off, but institutional players aren’t hitting pause. Fintech firms and hedge funds keep accumulating BTC like it’s a Black Friday sale—even as retail traders nervously check charts.

Meanwhile, traditional finance scrambles to justify its 2% bond yields. Some things never change.

What to Watch

- Crypto:

- May 16, 9:30 a.m.: Galaxy Digital Class A shares begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- May 16, 10 a.m.: The University of Michigan releases (preliminary) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 53 vs. Prev. 52.2

- May 20, 8:30 a.m.: Statistics Canada releases April consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Prev. 0.3%

- Inflation Rate YoY Prev. 2.3%

- May 16, 10 a.m.: The University of Michigan releases (preliminary) May U.S. consumer sentiment data.

- Earnings (Estimates based on FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 on Ethereum in Oku and add Unichain on Oku in a bid to enhance Uniswap’s reach and liquidity migration to V4. Voting ends May 18.

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- May 20, 12 p.m.: Lido to host its 28th Node Operator Community Call.

- May 21: Maple Finance teased an announcement on the future of asset management.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream

- May 22: Official Trump to announce its “next Era” at the day of the dinner for its largest holders.

- Unlocks

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating supply worth $38.1 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating supply worth $39.44 million.

- May 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $87.8 million.

- May 19: Polyhedra Network (ZKJ) to unlock 5.3% of its circulating supply worth $31.24 million.

- May 19: Pyth Network (PYTH) to unlock 58.62% of its circulating supply worth $354.45 million.

- Token Launches

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: CoinDesk’s Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

Token Talk

By Shaurya Malwa

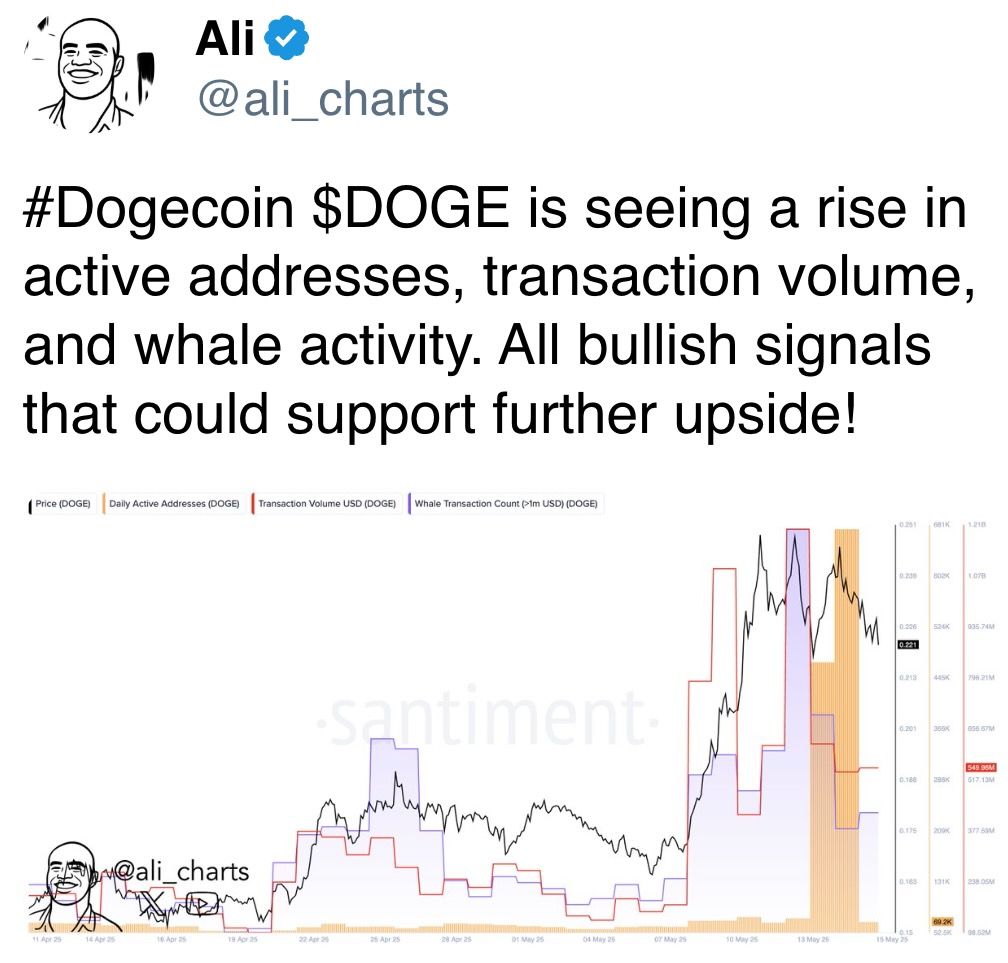

- Berachain’s native token, BERA, has dropped 9% in the past week despite a jump in the broader market, with majors like xrp (XRP) and ether (ETH) and memecoins dogecoin (DOGE), mog (MOG) and others adding more than 15%.

- At $3.55, the BERA price is now more than 80% below its peak of $14.83. The slide follows a substantial $2.7 billion token unlock on May 6, which introduced increased selling pressure into the market.

- The grim price action illustrates how hype and short-term incentives aren’t enough to buoy prices of even fundamentally strong and utility-focused projects in the current market environment.

- The total value locked in Berachain’s DeFi protocols has dropped from a peak of $3.5 billion to around $1.2 billion as of Friday. Before the token issuance, it had been one of the most viral and hyped blockchains in recent years.

- Meanwhile, inflows to Solana and Ethereum have increased, suggesting a potential shift in investor sentiment or a redistribution of assets within DeFi.

- Berachain’s stablecoin market capitalization has seen a significant reduction, with a 36% drop in just seven days to $250 million. This decline could influence liquidity among ecosystem applications.

- Berachain application revenue has hovered around $10,000 per day since late April, a stark drop from the above $100,000 level in January and February, DefiLlama data shows.

Derivatives Positioning

- Funding rates in perpetual futures tied to major coins remain below an annualized 10%. It shows positioning remains bullish, but not overcrowded.

- ETH, UNI, HYPE, BNB, XRM and AAVE have all seen an increase in open interest in perpetual futures in the past 24 hours.

- In options market, front-end skews have flipped bearish for BTC and ETH. Major flows featured buying BTC puts financed by selling calls, according to OTC desk Paradigm.

Market Movements

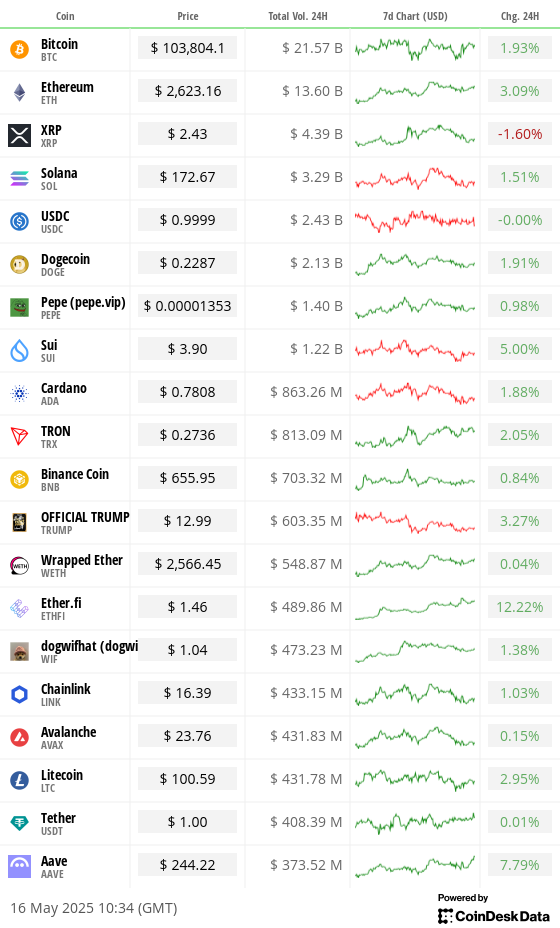

- BTC is up 0.28% from 4 p.m. ET Thursday at $103,688.48 (24hrs: +1.82%)

- ETH is up 2.62% at $2,610.41 (24hrs: +3.06%)

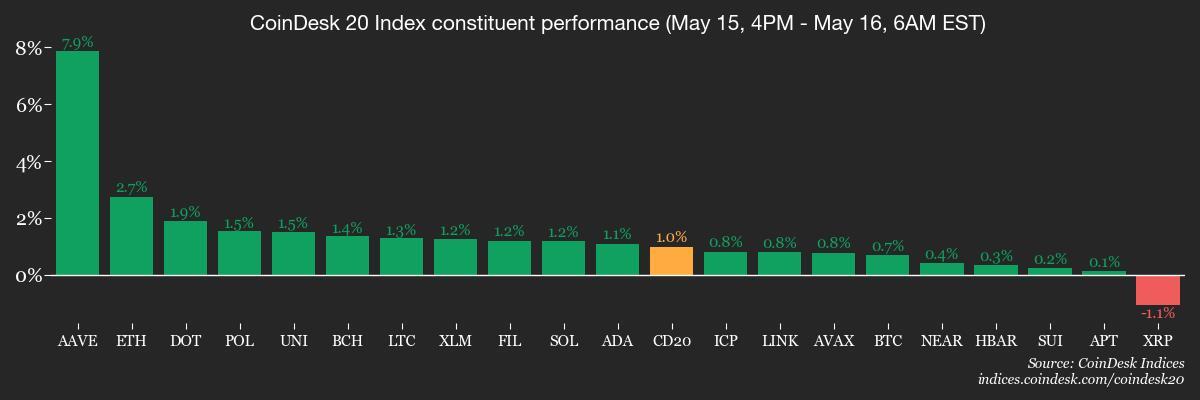

- CoinDesk 20 is up 0.92% at 3,241.45 (24hrs: +1.44%)

- Ether CESR Composite Staking Rate is down 7 bps at 3.03%

- BTC funding rate is at 0.0066% (7.2544% annualized) on Binance

- DXY is down 0.12% at 100.76

- Gold is down 0.47% at $3,209.33/oz

- Silver is down 0.66% at $32.30/oz

- Nikkei 225 closed unchanged at 37,753.72

- Hang Seng closed -0.46% at 23,345.05

- FTSE is up 0.61% at 8,686.08

- Euro Stoxx 50 is up 0.57% at 5,443.14

- DJIA closed on Thursday +0.65% at 42,322.75

- S&P 500 closed +0.41% at 5,916.93

- Nasdaq closed -0.18% at 19,112.32

- S&P/TSX Composite Index closed +0.8% at 25,897.48

- S&P 40 Latin America closed -0.53% at 2,631.31

- U.S. 10-year Treasury rate is down 3 bps at 4.405%

- E-mini S&P 500 futures are up 0.21% at 5,946.00

- E-mini Nasdaq-100 futures are up 0.22% at 21,446.50

- E-mini Dow Jones Industrial Average Index futures are up 0.32% at 42,519.00

Bitcoin Stats

- BTC Dominance: 62.89 (-0.65%)

- Ethereum to bitcoin ratio: 0.02528 (2.93%)

- Hashrate (seven-day moving average): 848 EH/s

- Hashprice (spot): $55.41

- Total Fees: 5.42 BTC / $562,026.90

- CME Futures Open Interest: 149,515 BTC

- BTC priced in gold: 32.2 oz

- BTC vs gold market cap: 9.12%

Technical Analysis

- The chart shows the ratio between solana and ether’s dollar-denominated prices (SOL/ETH) has dropped to a trendline characterizing the uptrend from September 2023 lows.

- A break below the line, if confirmed, would signal a prolonged switch to ether outperformance relative to SOL.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $397.03 (-4.73%), up 1.28% at $402.10 in pre-market

- Coinbase Global (COIN): closed at $244.44 (-7.2%), up 1.44% at $247.95

- Galaxy Digital Holdings (GLXY): closed at $30.57 (-4.35%)

- MARA Holdings (MARA): closed at $15.68 (-1.2%), up 1.15% at $15.86

- Riot Platforms (RIOT): closed at $8.7 (-2.36%), up 1.26% at $8.81

- Core Scientific (CORZ): closed at $10.51 (+1.84%), up 1.81% at $10.70

- CleanSpark (CLSK): closed at $9.36 (-2.6%), up 1.28% at $9.48

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.57 (-2.24%), up 2.11% at $16.92

- Semler Scientific (SMLR): closed at $31.79 (-2.3%), up 1.67% at $32.32

- Exodus Movement (EXOD): closed at $35.76 (+2.52%), up 2.07% at $36.50

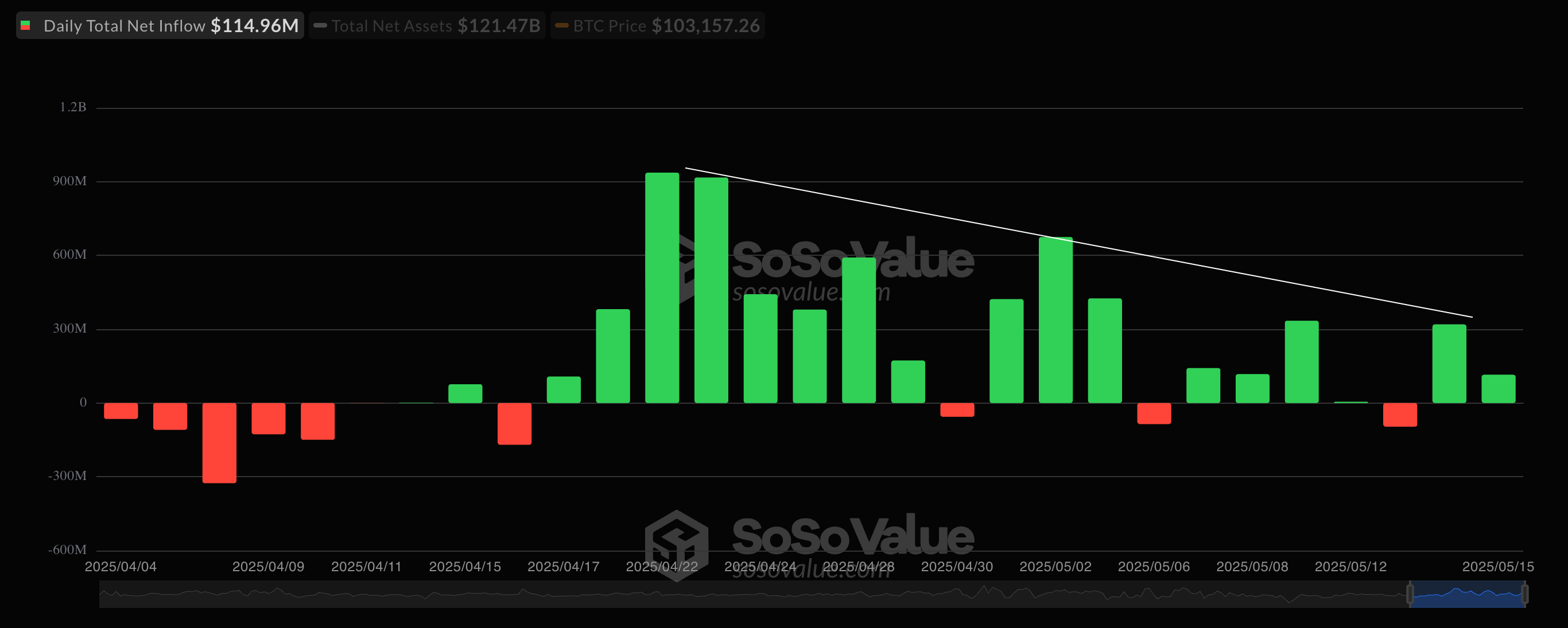

ETF Flows

- Daily net flow: $114.9 million

- Cumulative net flows: $41.49 billion

- Total BTC holdings ~ 1.17 million

- Daily net flow: -$39.8 million

- Cumulative net flows: $2.50 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows net inflows into the U.S.-listed spot bitcoin ETFs have slowed.

- The drop has probably played a role in keeping the BTC price range bound.

While You Were Sleeping

- Gold Set for Worst Week in Six Months as Trade Calm Dents Appeal (Reuters): Gold faced pressure from easing U.S.-China tensions, though the price dips are attracting buyers amid lingering uncertainty over global growth and inflation.

- Japan’s Economy Shrinks for First Time in a Year (Wall Street Journal): Japan’s GDP shrank 0.2% in the first quarter, worse than the expected 0.1% drop, raising recession fears as concerns mount that U.S. tariffs could curb exports and hinder investment.

- XRP Slides 4% as Bitcoin Traders Cautious of $105K Price Resistance (CoinDesk): XRP led declines among the biggest cryptocurrencies and, after a week of steady trading, bitcoin appears to be signaling a correction amid equity weakness and gold profit-taking, according to FxPro’s Alex Kuptsikevich.

- Bitcoin Bulls Face $120M Challenge in Extending ’Stair-Step’ Uptrend (CoinDesk): Bitcoin’s climb from $75,000 to $104,000 has slowed near heavy sell walls, though analysts expect bullish momentum to eventually absorb the resistance and push prices higher.

- FTX to Pay Over $5B to Creditors as Bankrupt Estate Gears Up for Distribution (CoinDesk): Disbursements beginning May 30 will return between 54% and 120% of claims based on November 2022 valuations, with BitGo and Kraken handling transfers in one to three business days.

- Qatari Cybertrucks, Elite Camels and Trillion-Dollar Vows: Why Gulf Countries Are Going All Out for Trump’s Visit (CNBC): The Gulf’s record investment pledges were less about competing with one another and more about strengthening U.S. ties and securing advanced technologies, said economist Ahmed Rashad.

In the Ether