Bitcoin Defies Gravity at $100K While Altcoins Stumble—Analysts Predict Summer Crypto Surge

BTC’s bull run leaves altcoins eating dust as traders pile into the OG crypto. Here’s why this rally might have legs.

The king stays king

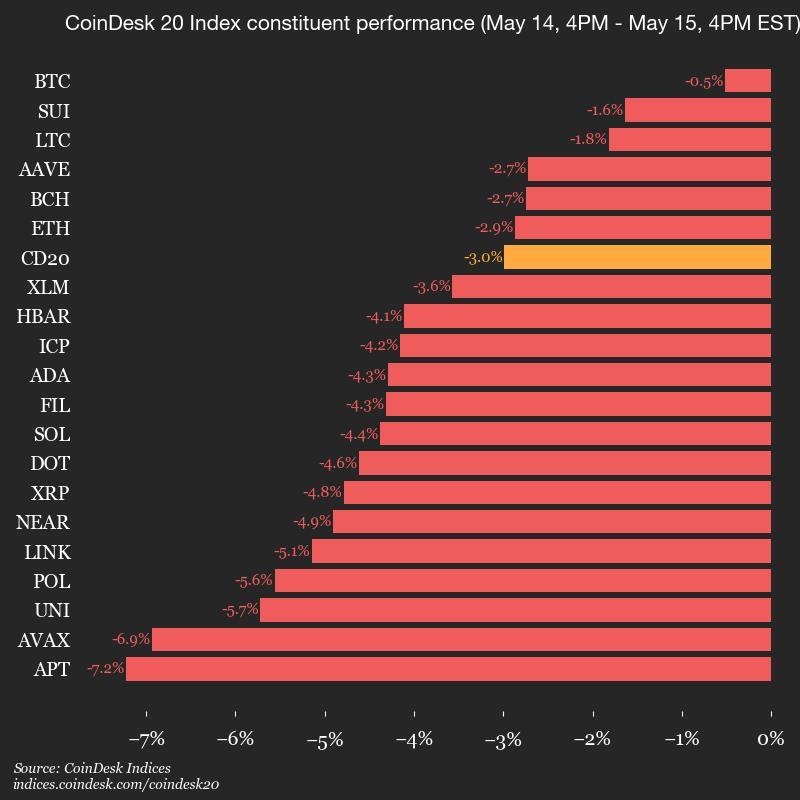

Altcoin carnage

Heatwave incoming?

Crypto investors shouldn’t sweat today’s pullback, analysts told CoinDesk.

"The current pullback appears to be a correction within a broader medium-term uptrend," said Ruslan Lienkha, chief of markets at YouHodler.

The upward momentum in equity markets moderated after the China-U.S. tariff delay, and short-term traders began locking in profits, he said. "This shift in sentiment has spilled over into riskier assets, including BTC."

"Anything below 5% [price move] can often be considered just market noise," said Kirill Kretov, trading automation expert at CoinPanel. "Some of this movement likely comes from profit-taking, as traders secure gains after the recent rally. With liquidity so thin, even modest sell-offs can quickly translate into noticeable corrections."

Backing away from short-term movements, the broader price action seems healthy with no clear signs of an imminent top.

Vetle Lunde, senior analyst at K33 Research, said BTC just exited one of its longest periods of below-neutral funding rates, a signal of defensive positioning

"This resembles the risk-averse patterns from October 2023 and 2024 and is far from resembling price action NEAR past local market peaks," wrote Lunde, who was optimistic that the lack of froth with BTC above $100,000 BTC paves the way for potential fresh record highs.

According to Steno Research, crypto tailwinds stem from a stealth expansion in private credit—especially in the U.S. and Europe. In past bull runs, crypto thrived on base money expansion: massive injections of reserves by central banks that fueled asset inflation across the board. This time, however, the balance sheets of the Fed and European Central Bank have continued shrinking through quantitative tightening.

“Many have pointed to China’s liquidity injections as the primary driver of the rally,” Samuel Shiffman wrote in a Thursday report. “But that misses the mark. The real support is coming from Western bank credit growth—a quieter, less visible engine behind this move.”

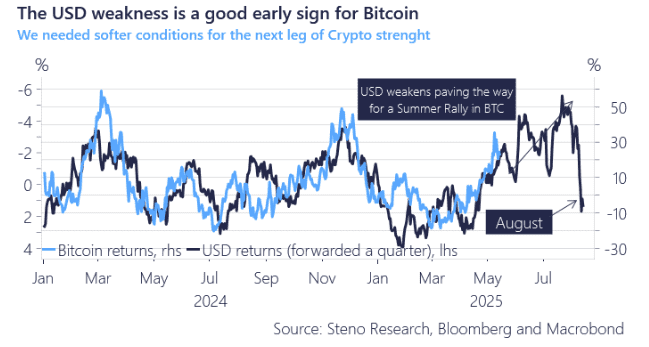

He said that forward-looking indicators project global financial conditions improving into the summer months, driven primarily by the U.S. dollar weakening. This has historically lead to higher BTC prices.

"We’ve likely got room through June and into early July before the picture begins to change," Shiffman said. "But once we approach the back half of July, the setup gets trickier. Our leading indicators suggest that the peak in financial easing might not last past August."