Solana Stages a Comeback: On-Chain Metrics Signal Renewed Investor Confidence

After months in the crypto doghouse, Solana’s blockchain is showing flickers of life—and Wall Street’s algo-traders are the first to smell blood in the water.

Rebound or dead cat bounce? On-chain data reveals a 37% surge in active addresses since April, while DeFi TVL claws back toward $1B. ’Institutional-grade infrastructure’ suddenly matters again when APYs outpace Treasury bonds.

The usual suspects are piling in: arbitrage bots front-running retail, VC funds recycling last year’s narratives, and that one hedge fund intern who still thinks ’SOL’ stands for ’surefire overnight lambo.’

Solana’s Lazarus act faces its real test when the next meme coin frenzy hits—can the network handle the traffic without crumbling like a stale croissant? For now, the suits are back. Until the next ’risk-off’ tantrum, anyway.

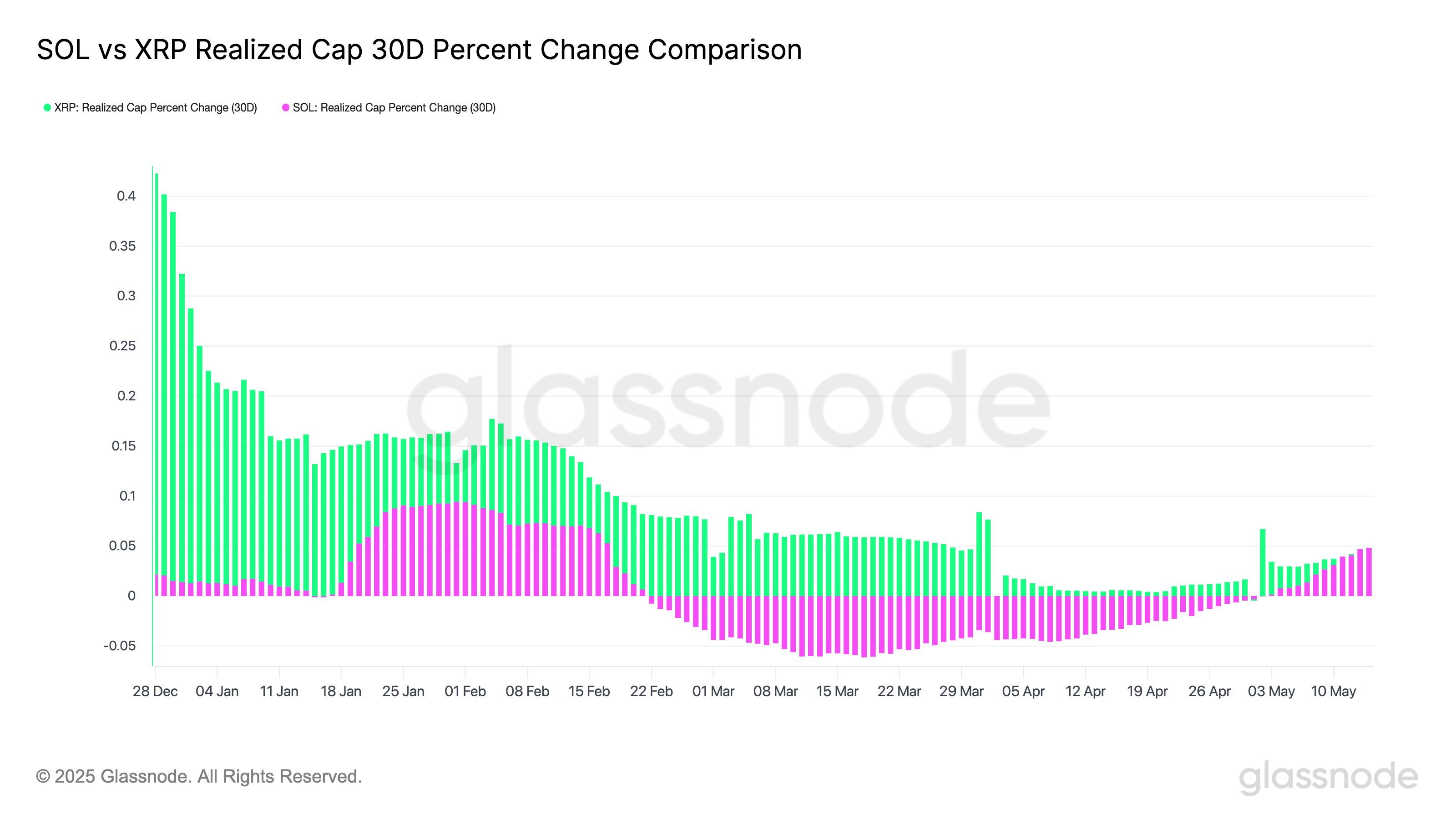

Realized cap inflow is a metric used to gauge actual capital entering or exiting an asset, based on the USD value of coins as they last moved on-chain. It filters out noise from speculative price spikes and instead tracks where holders are actually deploying capital.

For Solana, that number turning green again could indicate that buy-side pressure is finally returning, even if price action hasn’t fully reflected it.

Inflows into realized cap often serve as a leading indicator, suggesting some traders are positioning ahead of a potential bounce, or at the very least, a sign that capitulation has run its course.