Wall Street Goes Full Crypto: Cantor Equity Partners Drops $458M on Bitcoin

Another day, another nine-figure bet on Bitcoin from traditional finance—because nothing says ’hedge against inflation’ like volatile digital assets.

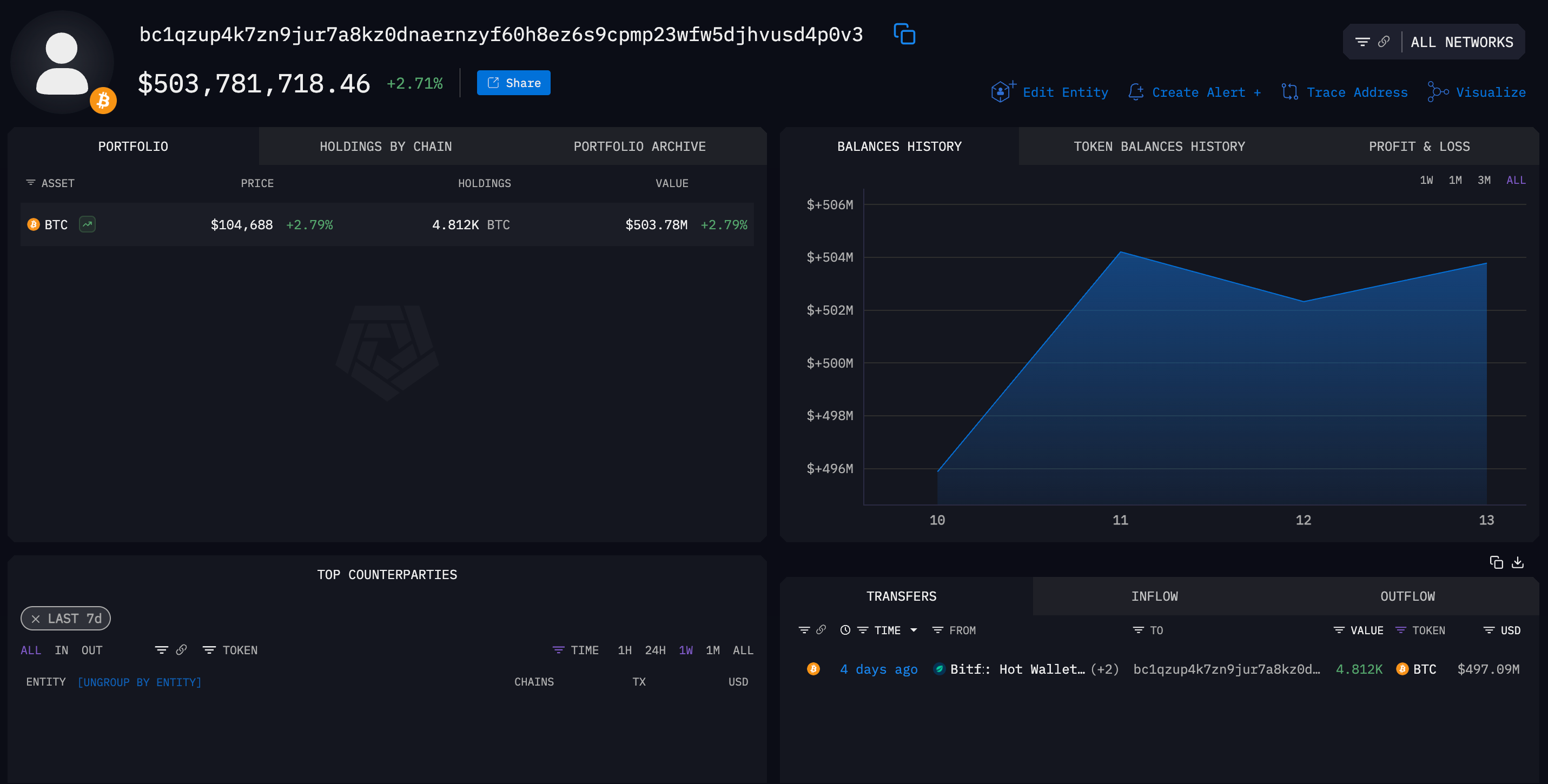

Cantor Equity Partners just joined the institutional FOMO party, disclosing a $458 million BTC purchase. The move screams ’late-cycle pivot’ as legacy finance scrambles to catch the crypto wave.

Who needs balanced portfolios when you’ve got laser-eyed conviction? The whales keep buying, but remember: even Cantor can’t repeal crypto winter.

Twenty One Capital is being launched by Brandon Lutnick—the son of U.S. Commerce Secretary and Cantor Fitzgerald chairman Howard Lutnick—via a SPAC structure using Cantor Equity Partners. The company will be led by Strike CEO Jack Mallers and majority-owned by Tether and Bitfinex’s parent company, iFinex. SoftBank will take a significant minority stake, the companies said

The company said it plans to have more than 42,000 BTC at launch.

CEP shares are higher by 3.7% in after hours trading.