PEPE Mania Triggers Altcoin Gold Rush as ETH Leaves Bitcoin in the Dust

Ether’s relentless rally outshines Bitcoin yet again—while meme coin PEPE becomes the canary in the altcoin coal mine. Retail traders pile in, hedge funds pretend they saw it coming.

The ETH/BTC Flip:

No longer content playing second fiddle, Ethereum’s native token posts double-digit weekly gains against its older sibling. Scaling upgrades and ETF whispers fuel the fire.

Frogs to Riches:

PEPE’s 300% monthly surge signals degenerate capital rotating into riskier plays. ’Utility’ takes a backseat to green candles and Twitter hype cycles.

Wall Street’s Next Move:

Institutional desks quietly load up on ETH derivatives while publicly dismissing ’speculative altcoins’—a classic case of ’buy the rumor, sell the narrative.’

What to Watch

- Crypto:

- May 12, 1 p.m.-5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable on "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" will be held at the SEC’s headquarters in Washington.

- May 13: The Singapore High Court holds a hearing to determine whether Zettai, the parent company of WazirX, can proceed with restarting the India-based crypto exchange and compensating users affected by the July 2024 hack.

- May 14: Neo (NEO) mainnet will undergo a hard fork network upgrade (version 3.8.0) at block height 7,300,000.

- May 14: Expected launch date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to begin trading on the Nasdaq under the ticker symbol GLXY.

- Macro

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April consumer price inflation data.

- Inflation Rate MoM Prev. 0.56%

- Inflation Rate YoY Prev. 5.48%

- May 9, 8:30 a.m.: Statistics Canada releases April employment data.

- Unemployment Rate Est. 6.8% vs. Prev. 6.7%

- Employment Change Est. 2.5K vs. Prev. -32.6K

- May 9-12: Chinese Vice Premier He Lifeng will hold trade talks with U.S. Treasury Secretary Scott Bessent during his visit to Switzerland.

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April consumer price inflation data.

- Earnings (Estimates based on FactSet data)

- May 9: TeraWulf (WULF), pre-market

- May 12: Exodus Movement (EXOD), post-market

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: KULR Technology Group (KULR), post-market

Token Events

- Governance votes & calls

- A Sei Network developer proposed ending support for Cosmos to simplify the blockchain and align more closely with Ethereum to reduce complexity and infrastructure overhead and boost Sei’s adoption.

- May 15, 10 a.m.: Moca Network to host a Discord townhall session discussing network updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating supply worth $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating supply worth $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating supply worth $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating supply worth $17.7 million.

- Token Launches

- May 9: OKX lists Jito with JITOSOL/USDT pair.

- May 9: BitMart lists Minutes Network Token with MNTX/USDT pair.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- Day 1 of 2: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

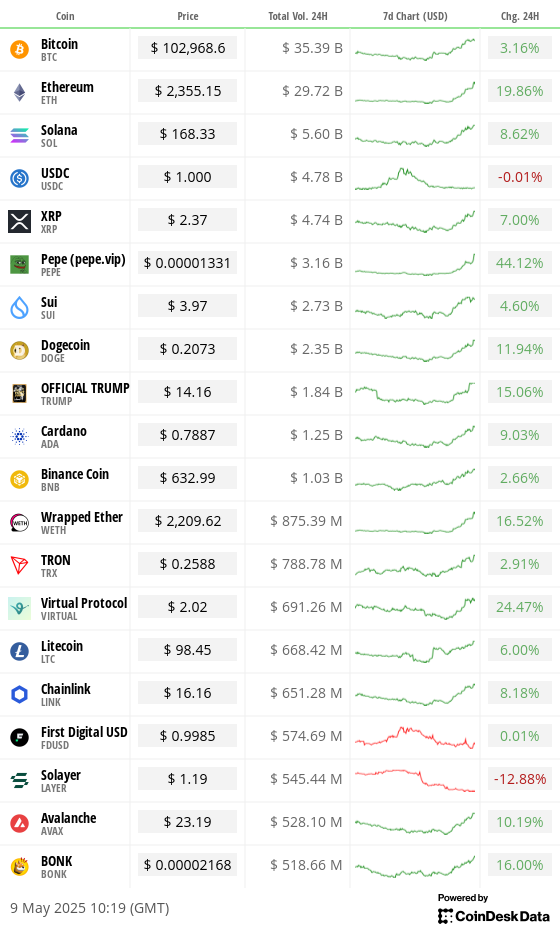

- PEPE is up more than 40% in the past 24 hours, outperforming most major tokens as traders continue to treat it as a high-beta ETH play — a speculative vehicle to gain outsized exposure to ether (ETH).

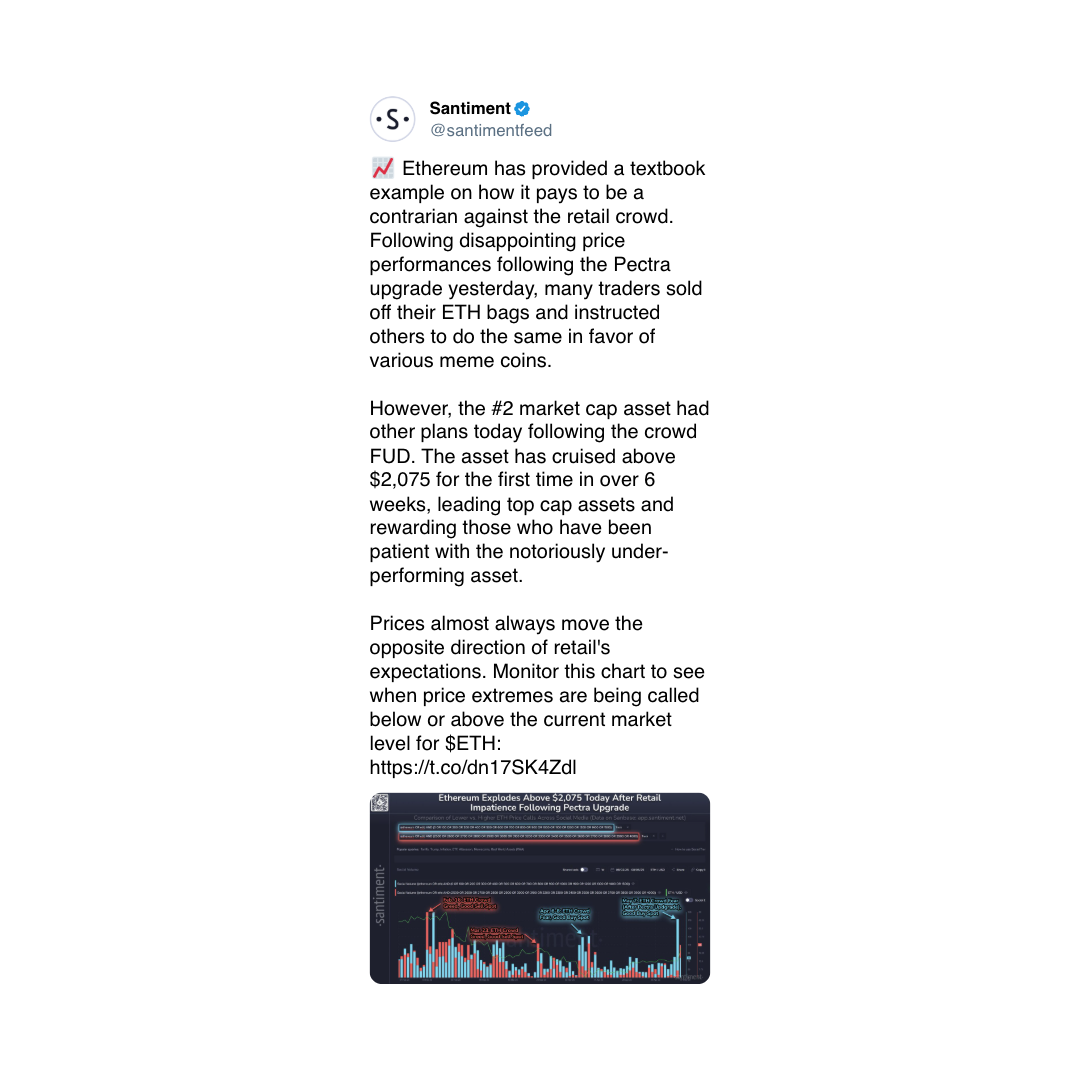

- The memecoin has become a proxy for ETH upside since early 2024 because the PEPE price tends to react strongly to ETH narratives such as the recent Pectra upgrade, which preceded a 20% jump in the second-largest cryptocurrency.

- Trading volumes for PEPE surged past $3.5 billion in the past 24 hours, several times more than Wednesday’s $500 million.

- This marks one of the token’s strongest weeks in the past year and signals a return of risk appetite in the memecoin space.

- Derivatives data shows rising open interest and funding rates for PEPE futures, suggesting a wave of leverage-fueled bets are targeting the frog-themed token in the hope of higher volatility ahead.

- Meanwhile, Solana-based hippo token MOODENG rallied over 150%. The project, known for its absurdist branding based on a viral Thai hippo, is popular among Asian trader circles.

- Cat-themed MOG also posted double-digit gains, but PEPE remains the most liquid and visible memecoin in the current ETH-beta trade.

Derivatives Positioning

- BTC and ETH annualized futures basis on the CME has surprisingly held steady near 7% despite the price rallies. That could be a sign of market maturity as cash and carry arbitrage narrows price discrepancies.

- On off-shore exchanges, perpetual funding rates for BTC, ETH and most major tokens are hovering between annualized 10% and 14%, reflecting a bullish bias.

- In the options market, BTC and ETH risk reversals show call bias. Block flows featured a short position in the $95K put expiring on May 15 and calendar spreads in May and June expiries.

Market Movements

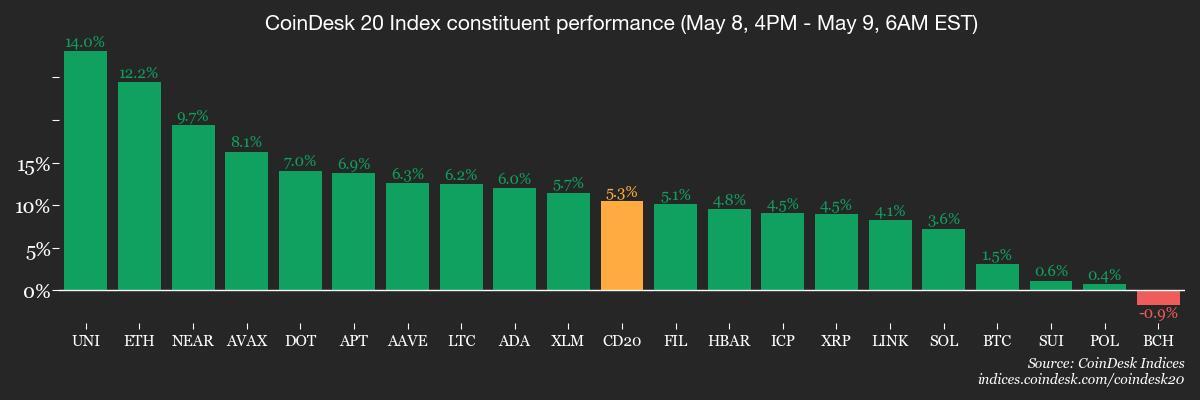

- BTC is up 1.19% from 4 p.m. ET Thursday at $102,725.44 (24hrs: +2.92%)

- ETH is up 9.9% at $2,328.10 (24hrs: +20.03%)

- CoinDesk 20 is up 4.59% at 3,116.42 (24hrs: +8.86%)

- Ether CESR Composite Staking Rate is up 15 bps at 3.04%

- BTC funding rate is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.26% at 100.38

- Gold is up 0.67% at $3,325.99/oz

- Silver is up 0.45% at $32.60/oz

- Nikkei 225 closed +1.56% at 37,503.33

- Hang Seng closed +0.4% at 22,867.74

- FTSE is up 0.48% at 8,572.92

- Euro Stoxx 50 is up 0.38% at 5,308.85

- DJIA closed on Thursday +0.62% at 41,368.45

- S&P 500 closed +0.58% at 5,663.94

- Nasdaq closed +1.07% at 17,928.14

- S&P/TSX Composite Index closed +0.37% at 25,254.06

- S&P 40 Latin America closed +1.8% at 2,557.27

- U.S. 10-year Treasury rate is unchanged at 4.38%

- E-mini S&P 500 futures are up 0.11% at 5,690.75

- E-mini Nasdaq-100 futures are up 0.23% at 20,193.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 41,445.00

Bitcoin Stats

- BTC Dominance: 63.94 (-0.80%)

- Ethereum to bitcoin ratio: 0.2282 (6.79%)

- Hashrate (seven-day moving average): 925 EH/s

- Hashprice (spot): $55.50

- Total Fees: 6.54 BTC / $655,033

- CME Futures Open Interest: 149,545 BTC

- BTC priced in gold: 31.3 oz

- BTC vs gold market cap: 8.86%

Technical Analysis

- BTC’s dominance rate, or the largest cryptocurrency’s share of the crypto market, might soon drop below a trendline, characterizing BTC outperformance relative to the broader market since December.

- The breakdown will likely mean the onset of the altcoin season.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $414.38 (+5.58%), up 1.75% at $421.65 in pre-market

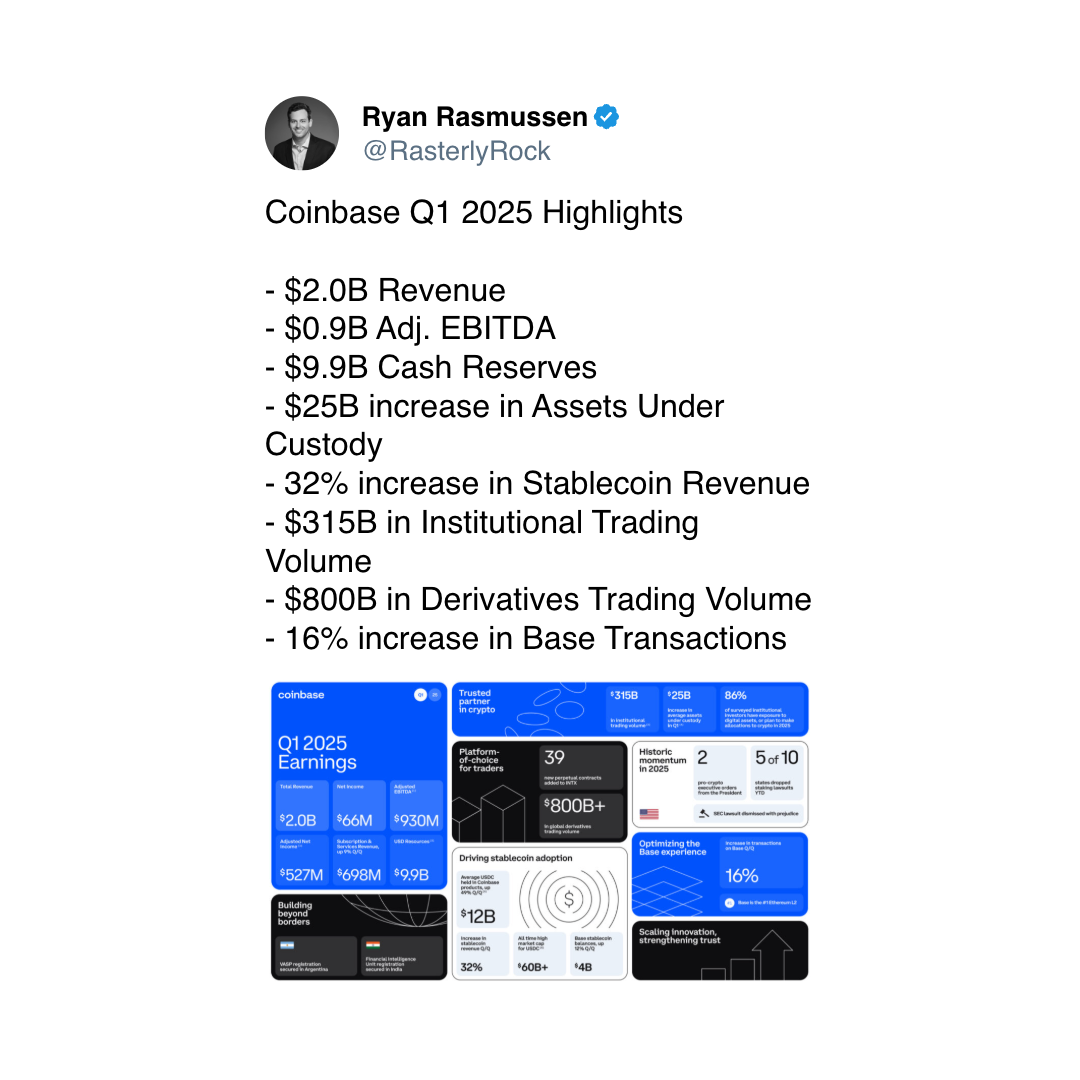

- Coinbase Global (COIN): closed at $206.5 (+5.06%), down 1.33% at $203.76

- Galaxy Digital Holdings (GLXY): closed at $27.67 (+4.45%)

- MARA Holdings (MARA): closed at $14.29 (+7.2%), down 1.33% at $14.10

- Riot Platforms (RIOT): closed at $8.44 (+7.65%), up 1.42% at $8.56

- Core Scientific (CORZ): closed at $9.45 (+6.18%), up 2.54% at $9.69

- CleanSpark (CLSK): closed at $8.68 (+8.09%), down 1.73% at $8.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.53 (+6.44%)

- Semler Scientific (SMLR): closed at $35.24 (+6.63%) , up 1.87% at $35.90

- Exodus Movement (EXOD): closed at $42.49 (+6.2%), unchanged in pre-market

ETF Flows

- Daily net flows: $117.4 million

- Cumulative net flows: $40.81 billion

- Total BTC holdings ~ 1.17 million

- Daily net flows: -$16.1 million

- Cumulative net flows: $2.47 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the expected volatility in the U.S. Treasury market that underpins global finance, has nearly reversed the late March to early April spike.

- The decline supports increased risk-taking in financial markets, including cryptocurrencies.

While You Were Sleeping

- Danger Grows as India and Pakistan Appear to Escalate Military Clash (The New York Times): India said it intercepted drone and missile attacks on its military sites and struck Pakistani air defenses near Lahore. Pakistan said it downed over two dozen Indian drones.

- Bitcoin Sees Surge in Institutional Confidence, Deribit-Listed BTC Options Market Reveals (CoinDesk): Strong demand for bitcoin call options at $110,000 and calendar spreads targeting $140,000 suggests traders expect a rally to potentially extend into September.

- Metaplanet Plans a Further $21M Bond Sale to Buy More BTC (CoinDesk): The Tokyo-based company’s directors agreed to issue the zero-coupon bonds to EVO FUND, marking its third such deal in a week.

- Florida Pharma Firm Will Use XRP for Real-Time Payments in $50M Financing Deal (CoinDesk): Wellgistics Health said XRP’s 3- to 5-second settlement time will enable near real-time payments across pharmacies, suppliers and manufacturers, with blockchain records supporting compliance, rebate tracking and auditability.

- Poland to Open Way for French Nuclear Shield Talks With a Treaty (Bloomberg): Polish Prime Minister Donald Tusk and French President Emmanuel Macron will sign a treaty Friday pledging mutual military aid in the event of armed conflict.

- China’s Exports to U.S. Plunge, in Sign of Bite From Trump Tariffs (The Wall Street Journal): China’s exports to the U.S. sank 21% year over year in April, while shipments to ASEAN, Latin America, Africa and the EU surged by more than 10%.

In the Ether