Bitcoin Eats the Market as FOMC Jitters Spark Volatility Warning

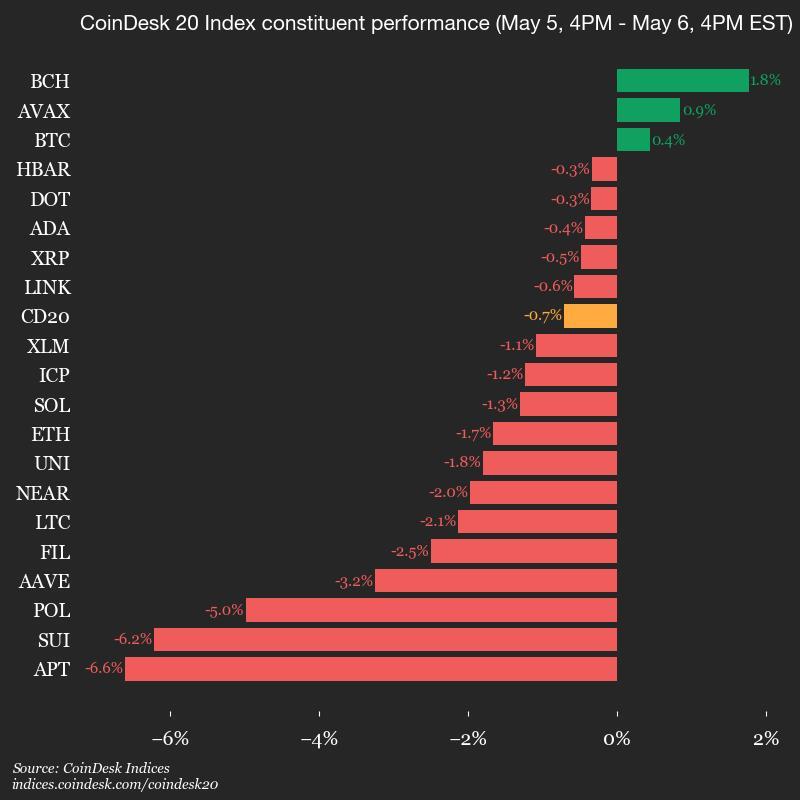

Crypto’s alpha predator flexes its dominance—BTC gobbles up altcoin liquidity while traders brace for Powell’s next move. The king coin now commands over 54% of total crypto market cap, its highest share since 2021’s manic bull run.

Market mechanics at play: With the Fed’s rate decision looming, capital’s fleeing speculative plays for Bitcoin’s relative safety. Liquidity’s drying up faster than a DeFi project’s TVL after a hack.

Volatility trap set: Analysts see coiled-spring price action—any FOMC surprise could trigger 10%+ BTC swings. Meanwhile, altcoins bleed out like overleveraged degens after margin calls.

The cynical take: Wall Street’s suddenly rediscovered its ’risk appetite’—just in time to front-run the retail crowd before the halving pump. How...convenient.

A check on traditional markets showed stocks booking back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, once again underperforming BTC.

Despite the lack of major price action, focus has increasingly turned to bitcoin’s growing share of the overall crypto market: The so-called Bitcoin Dominance metric surpassed 65%, its highest reading since 2021 January, according to TradingView data, signaling capital consolidating into the asset perceived as the most resilient in the face of macroeconomic uncertainty.

Joel Kruger, market strategist at LMAX Group, described the current landscape as one of pause and anticipation. "The cryptocurrency market has remained largely stagnant since the weekly open, with prices settling into a holding pattern as investors await a pivotal catalyst," he noted. "This impetus may arise from traditional markets, driven by updates on tariff-related economic impacts or the Federal Reserve’s anticipated FOMC decision on May 7."

The Federal Reserve is widely expected to hold interest rates steady, according to the CME FedWatch Tool, but traders are on edge for any shift in Fed Chair Jerome Powell’s tone that could impact risk appetite.

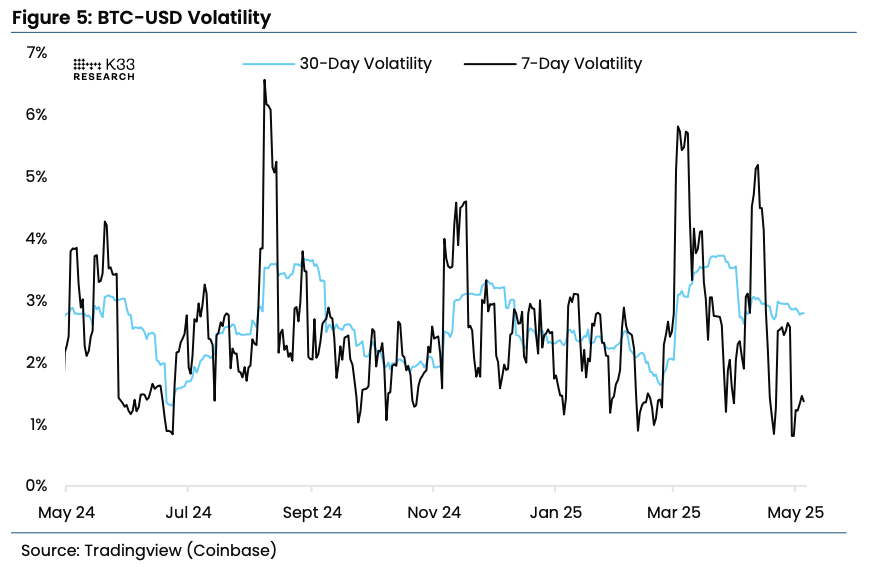

Bitcoin volatility burst on the horizon

With bitcoin’s recent price action being extremely flat, the upcoming FOMC meeting "is rigged to cause significant volatility," said Vetle Lunde, head of research at K33. He noted in a Tuesday report that BTC’s short term volatility is "abnormally compressed," with the 7-day average dropping to the lowest level last week in 563 days.

"Such low volatility regimes in BTC tend to be short-lived," Lunde said. "Violent volatility outbursts typically follow this form of stability once prices start to move, as Leveraged trades are unwound and traders are reactivated into the market."

He said that a significant cascade lower is unlikely, as funding rates for perpetual swaps are consistently negative. Similar periods historically offered good buying opportunities for medium and long-term investors, Lunde added, favoring "aggressive spot exposure" ahead.