Bitcoin Traders Are Betting Big on a $300K BTC Call—Here’s Why It’s Their Hail Mary Play

Crypto’s high-stakes gamblers are piling into outlandish options contracts—because when has rationality ever stopped a bull market?

The Lottery Ticket Mentality

With Bitcoin hovering around $60K, the $300K December calls trade at pennies on the dollar. They’re the ultimate ‘what if’ bet for degens who think this cycle hasn’t even started cooking with gas.

Institutional FOMO Meets Retail YOLO

Hedge funds use these OTM calls as cheap portfolio hedges. Retail? Pure adrenaline. Either way, it’s a liquidity mirage—try unloading 1,000 contracts when volatility spikes.

The Cynical Kick

Wall Street invented options to manage risk. Crypto reinvented them as a dopamine delivery system—with better marketing and worse margin calls.

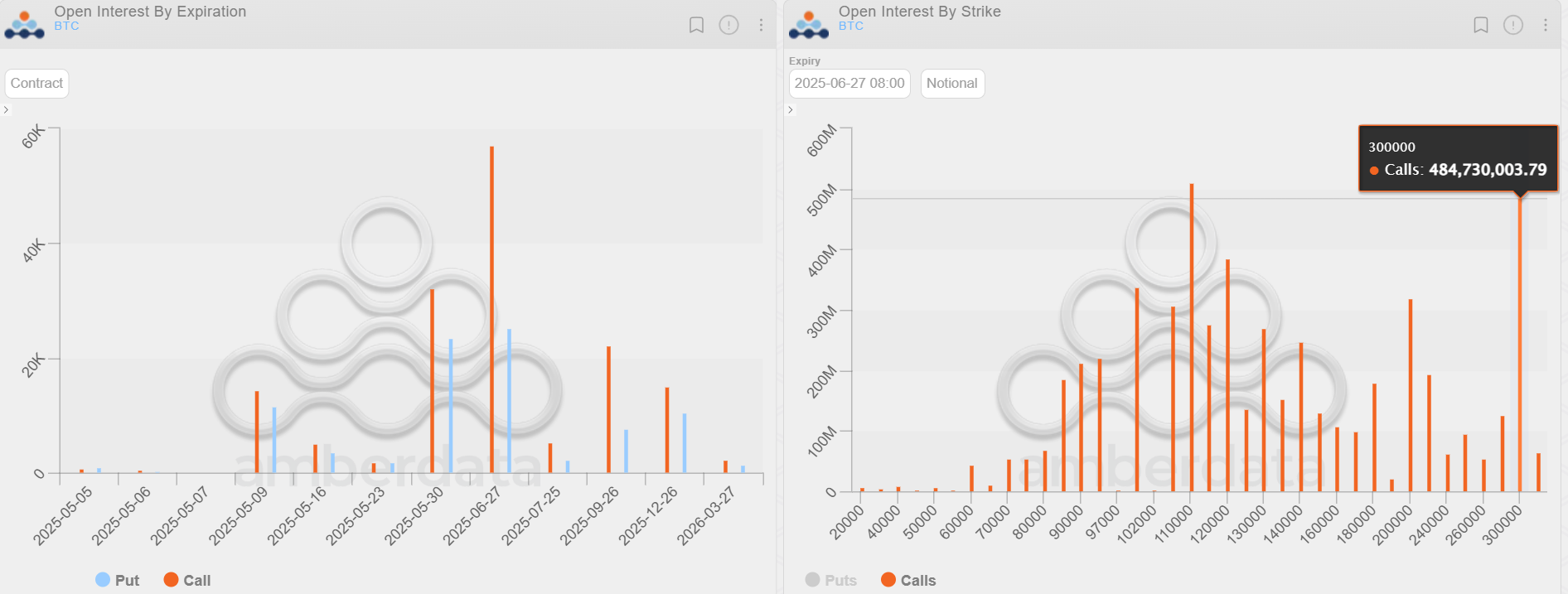

The chart shows that the June 26 expiry is the largest among all settlements due this year, and the $300K call has the second-highest open interest buildup in the June expiry options.

Explaining the chunky notional open interest in the $300K call, GSR’s Trader Simranjeet Singh said, "I suspect this is mostly an accumulation of relatively cheap wings betting on broader U.S. reg narrative being pro-crypto and the ’wingy possibility’ (no pun intended) of a BTC strategic reserve that was punted around at the start of the administration."

On Friday, Senator Cynthia Lummis said in a speech that she’s "particularly pleased with President Trump’s support of her BITCOIN Act.

"The BITCOIN Act is the only solution to our nation’s $36T debt. I’m grateful for a forward-thinking president who not only recognizes this, but acts on it," Lummis said on X.

Who sold $300K calls?

According to Amberdata’s Director of Derivatives, notable selling in the $300K call expiring on June 26 occurred in April as part of the covered call strategy, which traders use to generate additional yield on top of their spot market holdings.

"My thought is that the selling volume on April 23 came from traders generating income against a long position," Magadini told CoinDesk. "Each option sold for about $60 at 100% implied volatility."

Selling higher strike OTM call options and collecting premium while holding a long position in the spot market is a popular yield-generating strategy in both crypto and traditional markets.