Gold’s Correction Could Fuel Bitcoin’s Next Rally—Here’s Why

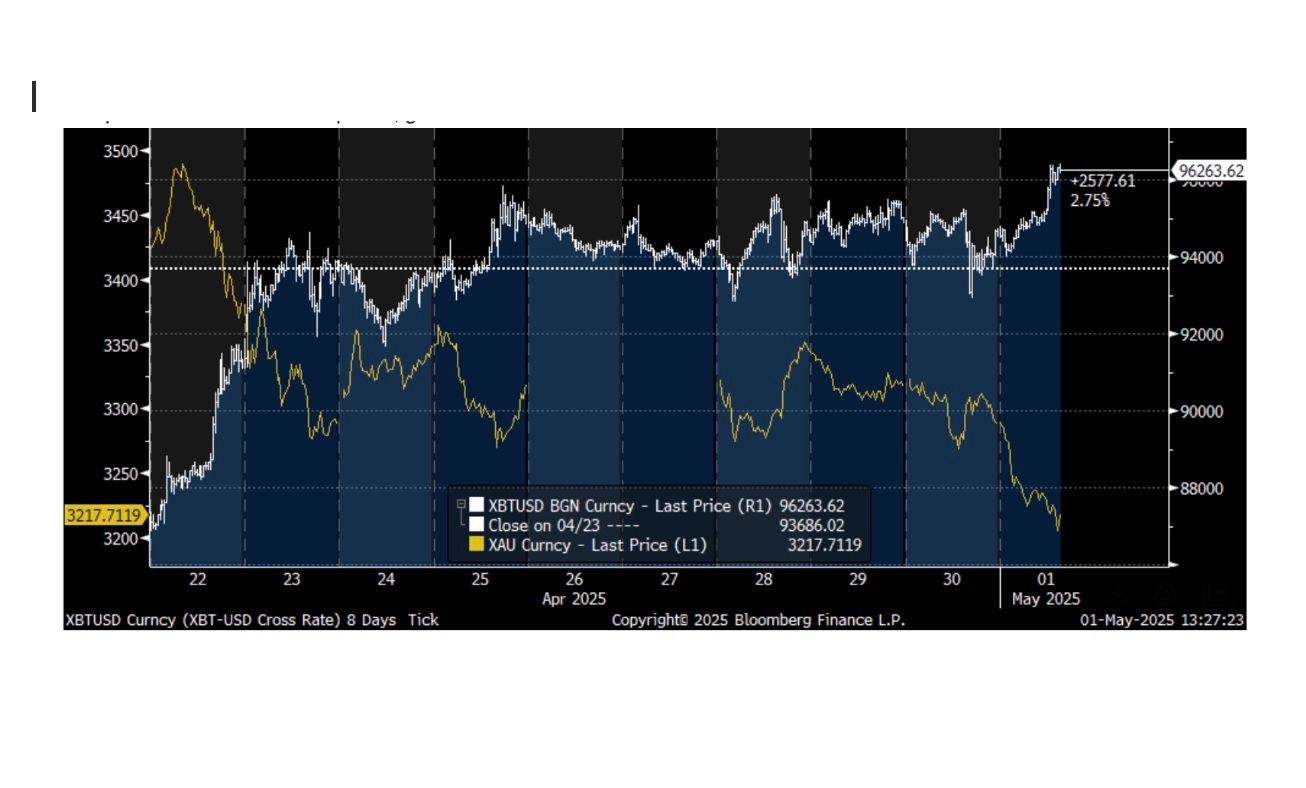

As gold stumbles through its third straight week of declines, crypto traders are eyeing a historic pattern: when traditional safe havens wobble, Bitcoin tends to catch bids.

The Great Rotation Play

Institutional flows show hedge funds already shifting from gold ETFs to crypto futures—just like they did during 2023’s banking crisis. This time, spot Bitcoin ETFs are vacuuming up the spillover.

Macro Math Favors Digital

With real yields squeezing gold and the Fed playing ’will-they-won’t-they’ with rate cuts, Bitcoin’s fixed supply looks increasingly attractive. Never mind that both assets are essentially bets against central bank competence.

Watch the $61K BTC support level. If gold keeps bleeding, the king crypto might just feast on its lunch—again.

"I think bitcoin is a better hedge than gold against strategic asset reallocation out of the U.S.," said Standard Chartered’s Geoff Kendrick.

Kendrick took note that the ETF inflow situation has flipped along with the price, with money headed into bitcoin funds surging past that headed into gold funds.

Further, said Kendrick, the last time bitcoin ETF inflows had such a wide margin over gold was the week of the U.S. presidential election. Two months later, the price of bitcoin had risen more than 40% to above $100,000.