Apollo’s Tokenized Credit Fund Jumps Into DeFi—With a Levered-Yield Twist

Wall Street meets crypto as Securitize and Gauntlet team up to launch Apollo’s credit fund on-chain. The play? A high-octane, leveraged-yield strategy that’s either genius or another way to repackage risk for yield-starved degens.

Forget boring old bonds—this fund tokenizes Apollo’s private credit portfolio, letting DeFi traders chase yield with built-in leverage. Because why settle for market returns when you can 10x your risk exposure?

Gauntlet’s risk models will supposedly keep things from imploding (famous last words), while Securitize handles the regulatory tap-dance. Just don’t ask what happens when a private credit loan goes sour—and the blockchain can’t repo your Tesla.

DeFi strategy built on tokenized asset

The introduction comes as tokenized RWAs — funds, bonds, credit products — gain traction among traditional finance giants. BlackRock, HSBC, and Franklin Templeton are among the firms exploring blockchain-based asset issuance and settlement. Tokenized U.S. Treasuries alone have pulled in over $6 billion, according to data from RWA.xyz.

While institutions are experimenting with tokenization, the next challenge is making these assets usable across DeFi applications. That includes enabling their use as collateral for loans, margin trading or building investment strategies not possible on legacy rails.

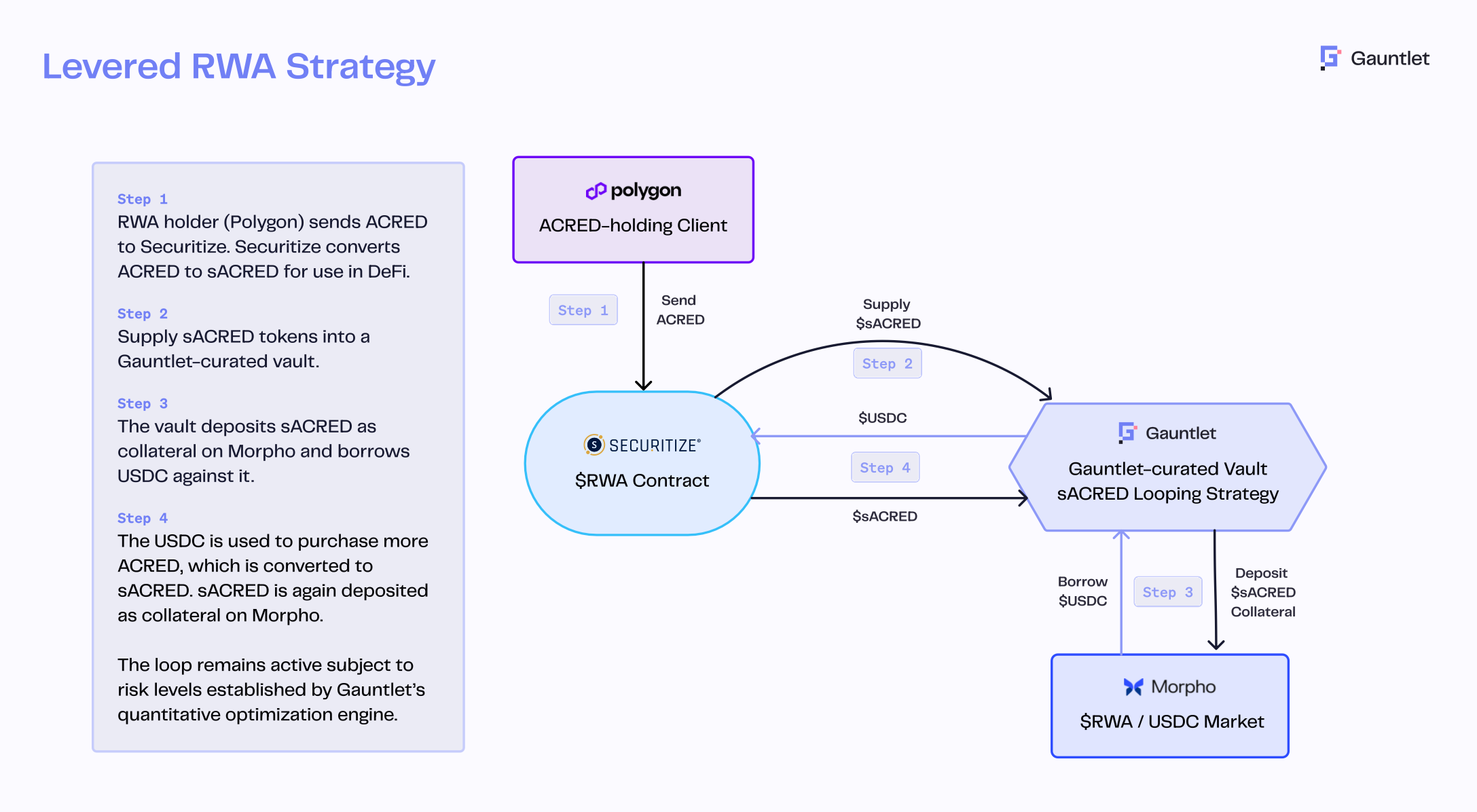

The strategy employs a DeFi-native yield-optimization technique called "looping", in which ACRED tokens deposited into a vault are used as collateral to borrow USDC, which is then used to purchase more ACRED. The process repeats recursively to enhance yield, with exposure adjusted dynamically based on real-time borrowing and lending rates.

All trades are automated using smart contracts, reducing the need for manual oversight. Risk is actively managed by Gauntlet’s risk engine, which monitors leverage ratios and can unwind positions in volatile market conditions to protect users.

"This is expected to deliver the institutional-grade DeFi that our industry has promised for years," Morpho CEO and cofounder Paul Frambot said. "This use case uniquely demonstrates how DeFi enables investors in funds like ACRED to access financial composability that is simply not possible on traditional rails.”

The vault is also one of the first uses of Securitize’s new sToken tool, which allows accredited token holders to maintain compliance and investor protections within decentralized networks. In this case, ACRED investors first mint sACRED that they can use for broader DeFi strategies without breaking regulatory rules.

"This is a strong example of the institutional-grade DeFi we’ve been working to build: making tokenized securities not only accessible, but compelling to crypto-native investors seeking strategies that objectively outpace their traditional counterparts,” Securitize CEO Carlos Domingo said in a statement.