Monero’s Suspicious Pump: Blockchain Sleuth Points to $100M Hack as Catalyst

Privacy coin XMR rockets 30% in 48 hours—just as stolen funds from a major exchange breach hit mixing services.

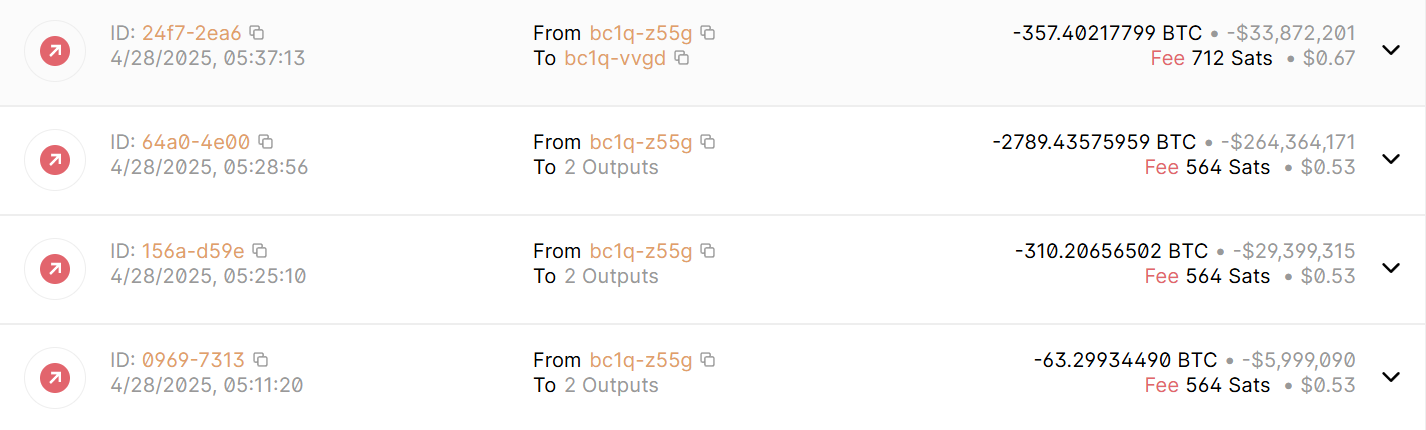

ZachXBT’s damning timeline: On-chain data shows stolen funds moving through Wasabi Wallet coinciding with Monero’s volume spike. ’Too clean to be retail FOMO,’ tweets the investigator.

The cynical twist: Another case of crypto’s ’crime-to-price pipeline’ at work? Traders seem to reward opacity when it’s not their wallets getting drained.

Market data shows a spike in volatility coming from an excess in buy orders for the XMR-BTC order book.

Market observers initially had a hard time determining what caused the major spike as metrics such as active wallets and network activity hadn’t risen accordingly.

Liquidity for XMR has been limited during the past few months as major exchanges delisted the privacy token in a bid to fight dark net markets. The lack of liquidity would have made any sizeable buy a catalyst for outsized pricing gains. CoinGecko data shows that the order depth for XMR is significantly smaller than for tokens of similar market cap.

XMR is trading for over $300 according to CoinDesk markets data.