The Making of an Asset Class: Staking’s Next Chapter - Why Institutions Are Betting Big on Crypto Yield

Wall Street's latest obsession isn't stocks or bonds—it's digital asset staking, and the institutional floodgates are finally opening.

The Yield Revolution Hits Main Street

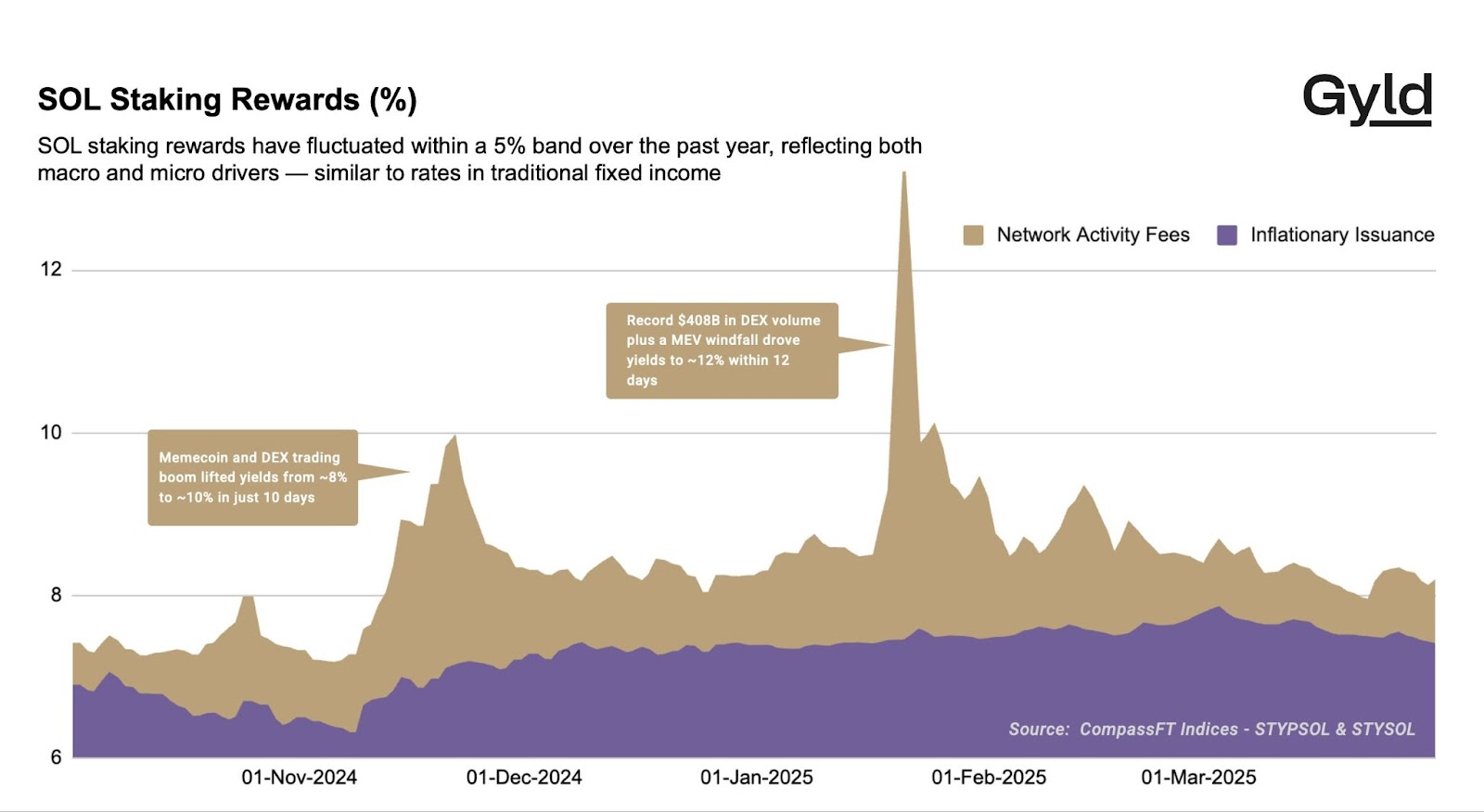

Forget traditional savings accounts paying fractions of a percent. Staking protocols now deliver yields that make bond traders blush—some networks offer returns that would take decades to match in conventional markets.

Institutional Adoption Accelerates

Major financial players are quietly building staking operations that dwarf retail participation. They're not just dipping toes—they're diving headfirst into proof-of-stake networks, drawn by the siren song of predictable returns in unpredictable markets.

Regulatory Hurdles Remain

While the SEC continues its trademark confusion about whether everything is a security, sophisticated investors are building infrastructure that could survive any regulatory outcome. Because nothing says 'mature asset class' like lawyers outnumbering developers.

The future of finance isn't just digital—it's actively working for you while you sleep. Unless you're still holding cash, in which case your money's actively losing value while you watch.