Aster Explodes Past HyperLiquid With 800% Trading Volume Surge: Crypto Markets Roar

Aster just rewrote the DEX rulebook—leaving HyperLiquid choking on its wake with eight times the trading volume.

Market Domination Unleashed

While traditional exchanges fiddle with compliance paperwork, Aster's volume multiplier proves decentralized finance doesn't need permission to win. The 8x gap isn't just a metric—it's a market verdict.

Liquidity Tsunami Hits DeFi

Traders are voting with their wallets, flooding Aster's pools while HyperLiquid watches from the sidelines. Because nothing says 'bullish' like abandoning centralized bottlenecks for raw, unfiltered market power.

Wall Street's still trying to figure out custody solutions while DeFi protocols are busy actually moving money. Some things never change—except trading volumes, apparently.

What to Watch

For a more comprehensive list of events this week, see CoinDesk's week-ahead note.

- Crypto

- Sept. 30: FTX begins $1.6 billion, third creditor payout under its bankruptcy plan through BitGo, Kraken and Payoneer. Creditors must complete KYC and tax forms to qualify.

- Sept. 30: Starknet (STRK) starts BTC staking on mainnet, enabling wrapped BTC tokens staking with 25% consensus weight; un-staking period cut to 7 days; rewards start.

- Macro

- Sept. 30, 10 a.m.: U.S. Aug. JOLTS report. Openings Est. 7.1M, Quits (Prev. 3.208M).

- Sept. 30, 10 a.m.: U.S. Sept. CB Consumer Confidence. Est. 96.

- Sept. 30: Deadline for the U.S. Congress to pass the annual federal appropriations bill funding government operations.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk's week-ahead note.

- Governance votes & calls

- GnosisDAO is voting on a resubmitted proposal to create a $40,000 pilot fund. This would allow the community to directly finance small ecosystem projects using a conviction voting pool. Voting ends Oct. 1.

- Unlocks

- Sept. 30: Optimism (OP) to unlock 1.74% of its circulating supply worth $20.46 million.

- Token Launches

- Sept. 30: Soon (SOON) airdrop claim period ends.

- Sept. 30: ZkVerify (VFY) to be listed on Binance. KuCoin, Gate.io and others.

Conferences

For a more comprehensive list of the week's conferences, see CoinDesk's week-ahead note.

- Day 2 of 2: Sonic Summit 2025 (Singapore)

- Sept. 30: Digital Assets Summit 2025 (Singapore)

- Sept. 30: Tokenized Capital Summit 2025 (Singapore)

Token Talk

By Oliver Knight

- The derivatives exchange battle between Aster and HyperLiquid is heating up.

- Daily trading volume on BNB Chain-based Aster has rocketed to $64 billion, dwarfing HyperLiquid's $7.6 billion, DefiLlama data shows.

- According to BoltLiquidity core contributor Max Arch, the shift is due to Aster's offering of between 100x and 300x leverage. HyperLiquid's markets are mainly capped at 40x.

- "Traders are following the leverage, regardless of underlying platform quality, but we’ll see how the increased risk that comes with higher leverage caps impacts platforms like Aster long-term," Arch wrote on X.

- Arch notes that around 6% of Aster's trading volume can be attributed to wash trading, far less than some skeptics had estimated.

- The exchanges' native tokens, ASTER and HYPE, have performed poorly over the past week; with the former sliding from $2.39 on Sep. 25 to $1.80, while HYPE is down from Sep. 18's high of $58.92 to $44.32.

- The bearish token performance relative to trading activity can be attributed to a wider altcoin sell-off that led to the removal of $200 billion from the sector's total market cap last week, according to CoinMarketCap data.

Derivatives Positioning

- The market is showing signs of a potential shift back to a bullish bias as derivatives metrics, including open interest and basis, show a pickup.

- Overall BTC futures open interest rose to roughly $31 billion from a recent monthly low of $29 billion. This increase indicates a renewed interest from traders, with Binance still leading at $12.7 billion.

- The three-month annualized basis is also recovering, climbing to 7% from around 6%, which makes the basis trade more profitable.

- The BTC options market is still presenting a complex and somewhat contradictory picture.

- While the 25 delta skew for short-term options continues to drop, suggesting traders are paying a premium for puts and signaling a desire for downside protection, the 24-hour put-call volume is telling a different story.

- In a clear reversal from recent trends, calls now dominate the volume, making up 65% of the contracts traded. This sharp increase indicates that despite the cautious sentiment reflected in the skew, a significant number of traders are actively positioning for a short-term rally.

- This divergence highlights a highly polarized market, where a mix of hedging strategies and speculative bets creates a state of mixed sentiment.

- Funding rates on major venues like Binance and OKX have turned positive, rising to around 7% and 10% respectively. This indicates a growing appetite for leveraged long positions, where long traders are now paying shorts, a classic sign of positive market sentiment.

- While the funding rate on Hyperliquid remains volatile, the trend on key exchanges suggests that traders are once again becoming confident and willing to take on bullish exposure

- Coinglass data shows $316 million in 24 hour liquidations, with a 44-56 split between longs and shorts. ETH ($73 million), BTC ($70 million) and others ($29 million) were the leaders in terms of notional liquidations. The Binance liquidation heatmap indicates $115,000 as a core liquidation level to monitor, in case of a price rise.

Market Movements

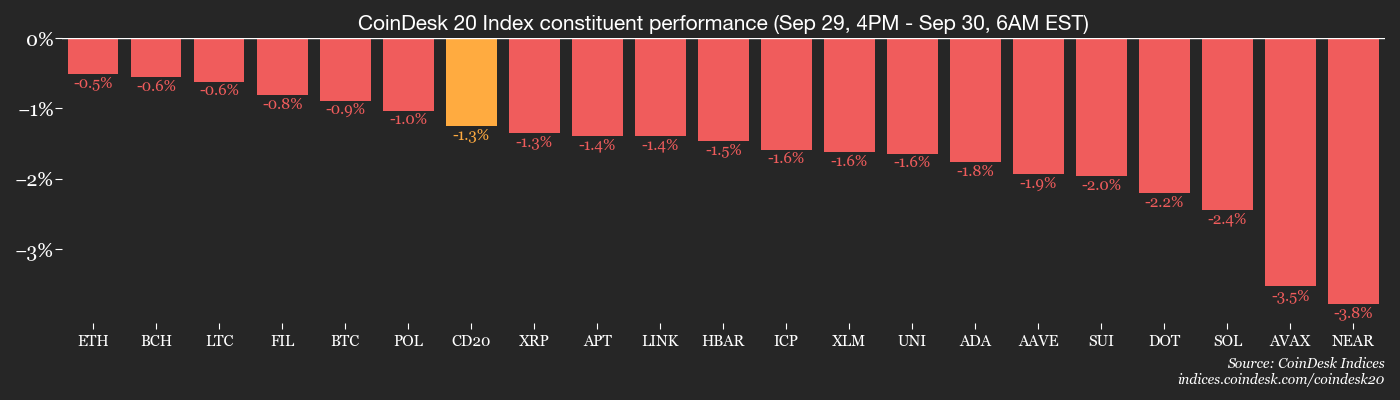

- BTC is down 1.3% from 4 p.m. ET Monday at $112,840.60 (24hrs: +0.71%)

- ETH is down 2.13% at $4,138.84 (24hrs: +0.71%)

- CoinDesk 20 is down 2.34% at 3,971.18 (24hrs: -0.16%)

- Ether CESR Composite Staking Rate is up 12 bps at 2.93%

- BTC funding rate is at 0.0056% (6.1276% annualized) on Binance

- DXY is unchanged at 97.82

- Gold futures are up 0.76% at $3,884.40

- Silver futures are unchanged at $47.01

- Nikkei 225 closed down 0.25% at 44,932.63

- Hang Seng closed up 0.87% at 26,855.56

- FTSE is unchanged at 9,299.84

- Euro Stoxx 50 is up 0.13% at 5,506.85

- DJIA closed on Monday up 0.15% at 46,316.07

- S&P 500 closed up 0.26% at 6,661.21

- Nasdaq Composite closed up 0.48% at 22,591.15

- S&P/TSX Composite closed up 0.71% at 29,971.91

- S&P 40 Latin America closed up 0.84% at 2,945.34

- U.S. 10-Year Treasury rate is down 1.6 bps at 4.125%

- E-mini S&P 500 futures are down 0.1% at 6,706.50

- E-mini Nasdaq-100 futures are unchanged at 24,814.75

- E-mini Dow Jones Industrial Average Index are down 0.13% at 46,550.00

Bitcoin Stats

- BTC Dominance: 58.88% (0.12%)

- Ether to bitcoin ratio: 0.03673 (-0.33%)

- Hashrate (seven-day moving average): 1,041 EH/s

- Hashprice (spot): $50.55

- Total Fees: 3.32 BTC / $376,516

- CME Futures Open Interest: 133,005 BTC

- BTC priced in gold: 29.5 oz

- BTC vs gold market cap: 8.32%

Technical Analysis

- After testing the 20-day exponential moving average (EMA) on the weekly chart, bitcoin has rebounded to the $114,000 level and is now holding above all major daily EMAs.

- For bulls, the key objective will be to push through the daily order block between $116,000 and $118,000, which would confirm a market structure break and signal a potential trend reversal.

- On the downside, a close below Monday’s high at $114,870 would leave bitcoin open to the possibility of retesting Monday’s lows. This level also aligns with the EMA100 on the daily chart, making it an important area of confluence to watch.

Crypto Equities

- Coinbase Global (COIN): closed on Monday at $333.99 (+6.85%), -1.77% at $328.09 in pre-market

- Circle Internet (CRCL): closed at $133.66 (+5.25%), -1.22% at $132.03

- Galaxy Digital (GLXY): closed at $34.29 (+10.97%), -1.90% at $33.64

- Bullish (BLSH): closed at $62.3 (-0.46%), -1.56% at $61.33

- MARA Holdings (MARA): closed at $18.66 (+15.69%), -2.63% at $18.17

- Riot Platforms (RIOT): closed at $19.78 (+11.81%), -2.38% at $19.31

- Core Scientific (CORZ): closed at $17.33 (+2.85%), -0.52% at $17.24

- CleanSpark (CLSK): closed at $14.87 (+14.74%), -2.02% at $14.57

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $44.21 (+8.86%), -1.02% at $43.76

- Exodus Movement (EXOD): closed at $28.95 (+1.54%), +1.38% at $29.35

- Strategy (MSTR): closed at $326.42 (+5.62%), -2.34% at $318.77

- Semler Scientific (SMLR): closed at $29.24 (+3.29%), -0.14% at $29.20

- SharpLink Gaming (SBET): closed at $17.26 (+7.88%), -2.61% at $16.81

- Upexi (UPXI): closed at $5.62 (+7.77%), -1.25% at $5.55

- Lite Strategy (LITS): closed at $2.54 (-0.78%), 1.57% at $2.50

ETF Flows

Spot BTC ETFs

- Daily net flows: $518 million

- Cumulative net flows: $57.3 billion

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily net flows: $546.9 million

- Cumulative net flows: $13.69 billion

- Total ETH holdings ~6.46 million

Source: Farside Investors

While You Were Sleeping

- SEC Willing to Engage With Tokenized Asset Issuers, SEC’s Hester Peirce Says (CoinDesk): The SEC Commissioner said tokenization raises complex questions about how digital and traditional securities coexist, urging issuers to seek guidance as the market expands toward multitrillion-dollar potential.

- Vance Says U.S. ‘Headed to a Shutdown’ After Meeting With Democrats (Reuters): A standoff over health funding has stalled negotiations, raising the prospect of furloughs, court closures and delayed services if government funding lapses tomorrow.

- Visa Tests Pre-Funded Stablecoins for Cross-Border Payments (Bloomberg): The pilot using Circle’s USDC and EURC aims to let banks and remittance firms avoid pre-funded accounts, speeding cross-border transfers and improving capital efficiency on Visa Direct.

- Deutsche Börse, Circle to Integrate Stablecoins Into European Market Infrastructure (CoinDesk): The initiative starts with Circle’s EURC and USDC trading on 360T’s 3DX and via Crypto Finance, with custody managed by Clearstream through Crypto Finance’s German entity as sub-custodian.

- Societe Generale’s Crypto Arm Deploys Euro and Dollar Stablecoins on Uniswap, Morpho (CoinDesk): SG-FORGE’s EURCV and USDCV went live on Uniswap and Morpho, enabling borrowing against crypto and tokenized T-Bills, with Flowdesk providing spot market liquidity.

- Investors Are Fretting That the Stock-Market Rally Is on Borrowed Time (The Wall Street Journal): Concerns over rampant speculation, record valuations, tariff-driven inflation risks and October’s rocky history are fueling warnings that Wall Street’s record-setting rally may be vulnerable to a sharp reversal.