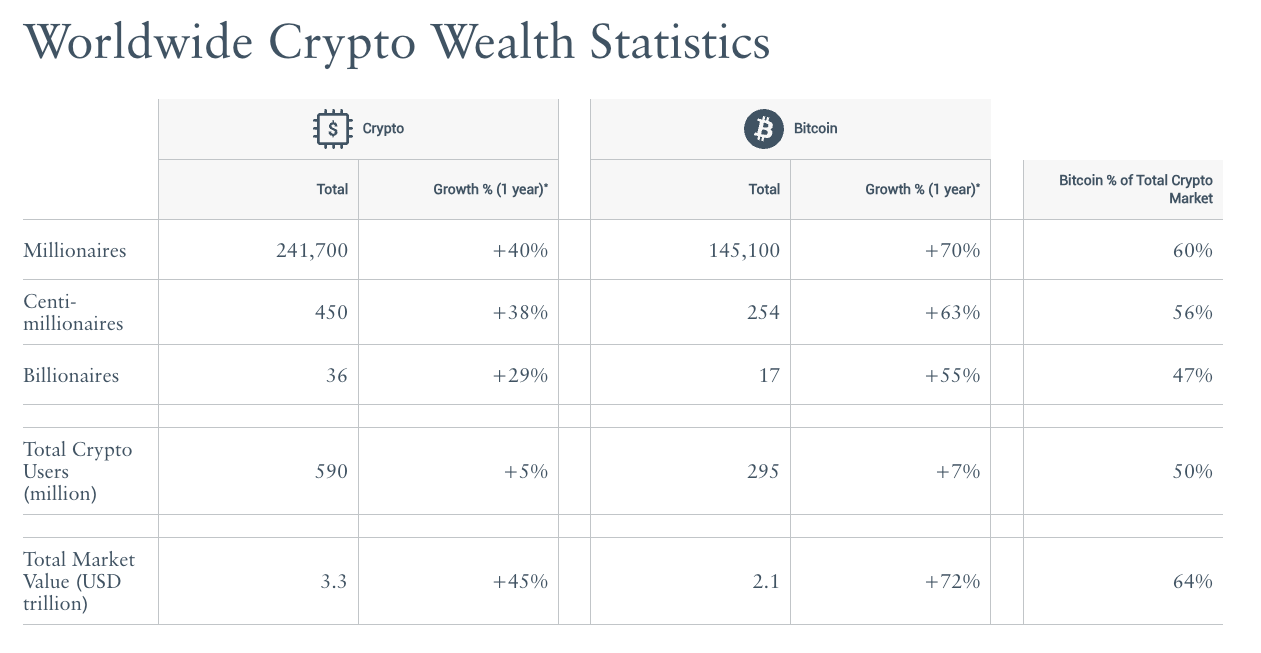

Crypto Millionaires Explode 40% as Bitcoin Leads Market to $3.3 Trillion Milestone

Digital wealth surges while traditional finance plays catch-up.

The Bitcoin Effect

Bitcoin's relentless climb created more crypto millionaires than hedge funds produced last decade. The original cryptocurrency continues to outperform legacy assets—much to Wall Street's dismay.

Market Momentum

That $3.3 trillion market cap isn't just a number—it's a gravitational shift pulling institutional money off the sidelines. Traditional portfolios now look incomplete without digital asset exposure.

Wealth Creation 2.0

Forty percent more millionaires emerged from crypto than traditional markets this cycle. Meanwhile, bankers still charge 2% fees for underperforming the S&P 500.

The new wealth class isn't waiting for permission—it's building the future while finance majors debate PowerPoint slides.

The report points to a shift in how digital assets are used, with Bitcoin increasingly treated as collateral rather than a speculative play. This evolution, observers say, is transforming the token into the base layer of a parallel financial system.

"Bitcoin is becoming the foundation of a parallel financial system, where [it] is not merely an investment for speculation on fiat price appreciation, but the base currency for accumulating wealth.” Philipp A. Baumann, founder of Z22 Technologies, said in the report.

Bordeless wealth

Crypto’s decentralized nature is also redrawing patterns of global wealth. Analysts note that investors are pursuing citizenship and residency programs to navigate regulatory uncertainty while securing access to banking and tax-efficient jurisdictions.

Henley’s annual Crypto Adoption Index ranks Singapore, Hong Kong, the U.S., Switzerland, and the UAE as the top five destinations for digital asset investors.

With over $14 trillion in wealth moving across borders last year, the report argues that crypto’s portability—secured by little more than a seed phrase—marks a fundamental break from centuries of place-based financial systems.

"Today, cryptocurrency has made geography optional — with nothing more than 12 memorized words, an individual can secure a billion dollars in Bitcoin, instantly accessible from Zurich or Zhengzhou alike," said Dominic Volek, Group Head of Private Clients at Henley & Partners.