Revolutionizing Private Credit: How On-Chain Rails Are Transforming Finance

Blockchain technology just bulldozed another financial institution—this time it's coming for the $1.2 trillion private credit market.

The Infrastructure Shift

On-chain rails cut settlement times from weeks to seconds while bypassing traditional intermediaries. Smart contracts automate covenant enforcement and payment distributions—no more manual paperwork delays or banker holidays holding up billion-dollar deals.

Transparency Meets Privacy

Zero-knowledge proofs give investors verified exposure data without revealing counterparty identities. The tech finally delivers what Wall Street promised but never delivered: actual transparency with institutional-grade privacy.

The Liquidity Revolution

Tokenization fragments large debt positions into tradable digital assets. Suddenly pension funds can trade private credit exposures like public bonds—while VCs quietly wonder if their 2-and-20 fee structure just became obsolete.

Traditional finance firms are scrambling to adapt, but let's be honest—watching legacy institutions try to innovate feels like watching your grandfather discover TikTok. The real question isn't if on-chain rails will dominate private credit, but how many middlemen will still have jobs when the dust settles.

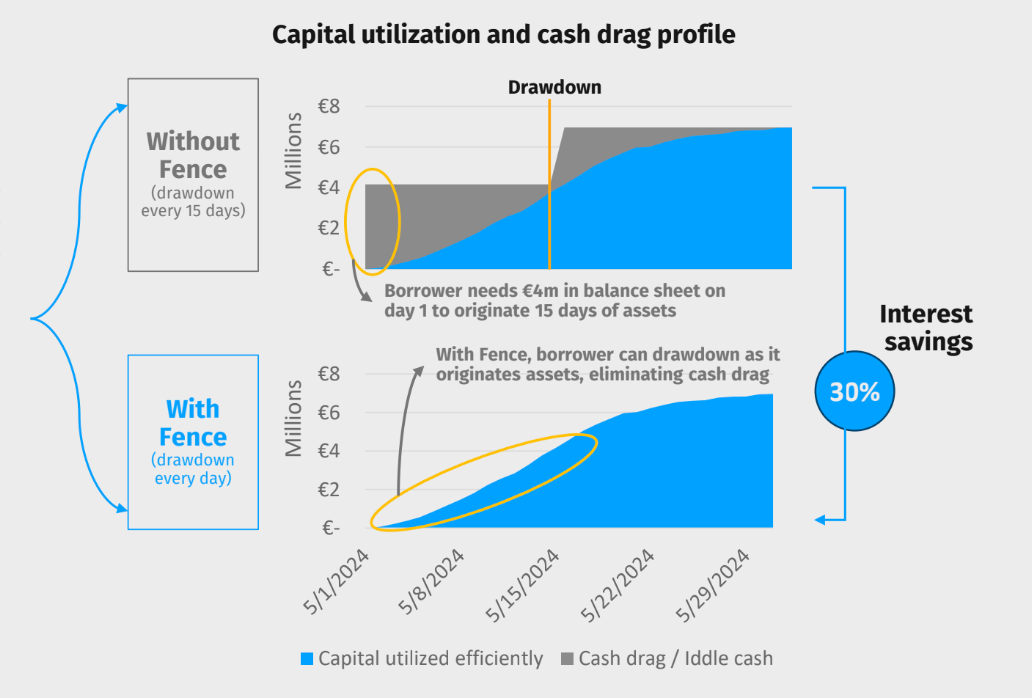

Source: Fence.Finance

The implications are profound. Large managers like Apollo and Blackstone can shed operational bloat, while smaller funds, emerging managers and family offices can participate without needing armies of staff. On-chain infrastructure can ultimately help to democratize access to a market that has historically been closed off to all but the largest institutions. Over time, incumbents who remain tied to manual processes leveraging traditional rails risk losing ground to specialist credit funds adopting on-chain infrastructure.

Amid renewed enthusiasm for crypto and the spotlight on stablecoin issuance, ABF is already applying the tech to solve real frictions and capture the rapidly expanding market opportunity. Watch this space.