Bitcoin Stalls Around $112K as Whales Trigger Selling Frenzy

Bitcoin hits resistance at $112,000 as major holders lead the charge toward exits.

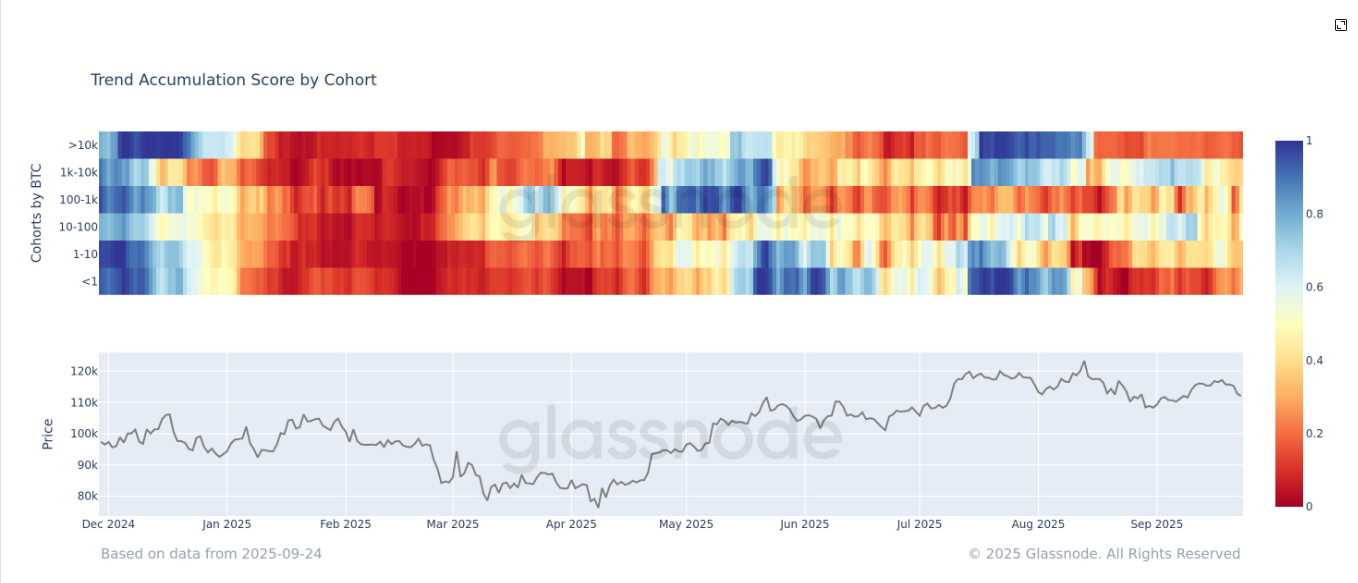

Whale Movements Dominate

Large-scale transfers flood exchanges while retail investors watch nervously. The $112,000 level becomes a battleground between profit-takers and long-term believers.

Market Psychology Shifts

Traders scramble to interpret the whale activity—strategic repositioning or loss of confidence? Meanwhile, traditional finance analysts suddenly remember they 'always had concerns' about volatility.

Technical Levels Tested

Support zones face intense pressure as selling volume spikes. The market holds its breath waiting for the next big move.

Just another day where crypto moves faster than your average hedge fund's risk assessment committee meeting.

Looking at long-term holder supply, the percent of circulating supply unmoved for at least 1 year has dropped sharply from 70% to 60%. The peak was in November 2023, when Bitcoin traded near $40,000. At the same time, 2+ year holders also began to sell, with their share declining from 57% to 52%.

The three year plus cohort now sits just above 43% and has been steadily falling since November 2024. These wallets largely represent buyers from the previous cycle top in November 2021 at around $69,000, many of whom accumulated more during the 2022 bear market when prices hit lows of $15,500. With bitcoin’s recovery, these investors are realizing gains.

By contrast, five year plus holders remain steady, reflecting that the longest-term investors are not participating in the sell-off.

This trend shows that investors sitting on unrealized profits from this cycle are continuing to realize profits, adding to the ongoing selling pressure.