DOGE Flashes Classic ‘1-2 Pattern’ as Bulls Eye $0.28–$0.30 Breakout

DOGE just triggered a textbook bullish signal—and traders are positioning for a potential surge toward $0.30.

The Setup: Classic 1-2 Pattern in Play

Dogecoin’s recent price action mirrors a historically reliable pattern that often precedes sharp upward moves. The so-called “1-2 pattern” suggests momentum is building beneath the surface.

Breaking Down the Levels

A clean break above $0.28 could open the door to a swift run toward $0.30—a psychological barrier that’s captivated both retail and institutional interest. Past that? Things could get interesting.

Why This Matters Now

With memecoins back in the spotlight and macro sentiment shifting, DOGE remains a high-beta play on crypto’s risk-on mood. It’s either going to print—or remind everyone why traditional finance types still roll their eyes at ‘joke assets with utility.’

News Background

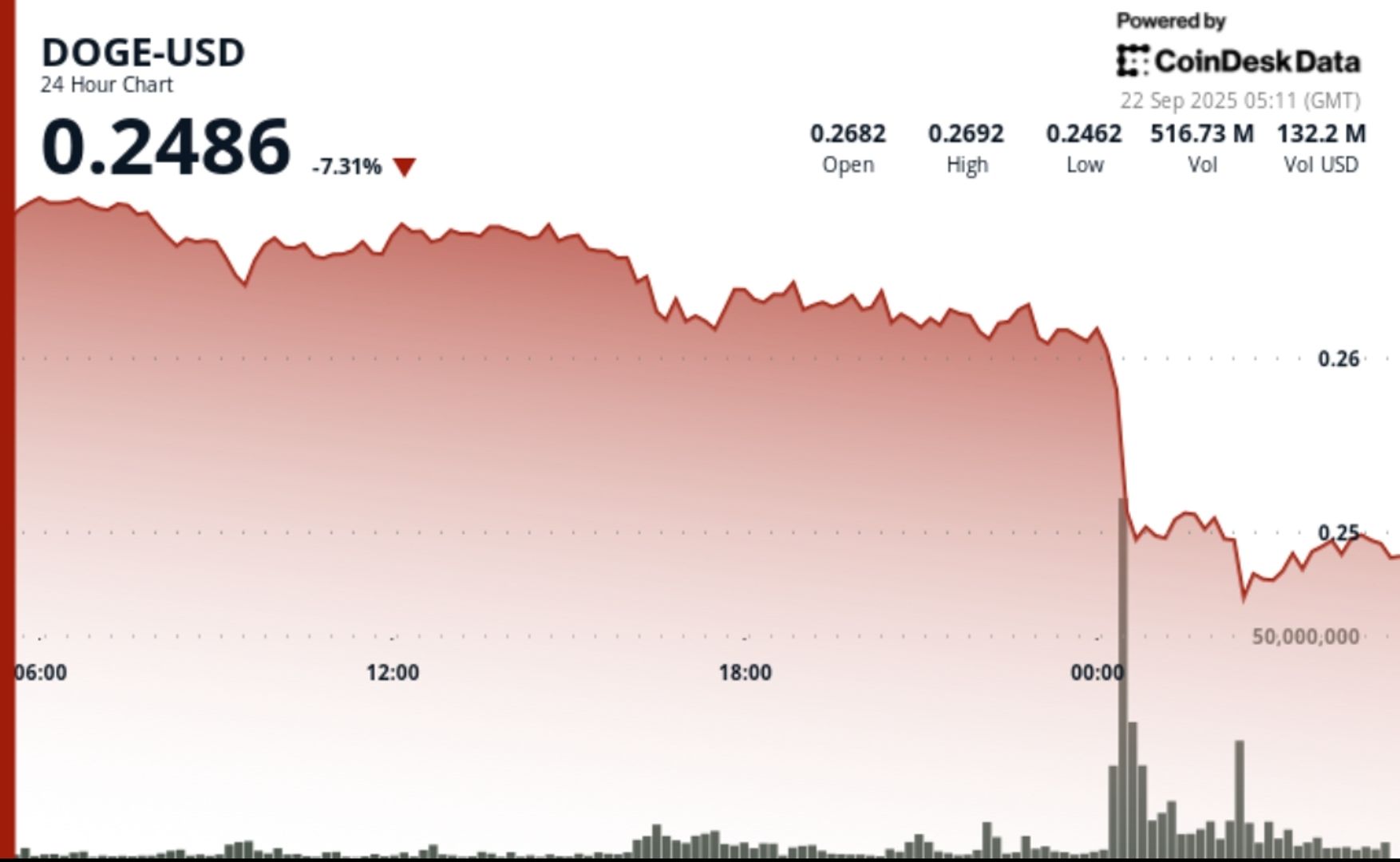

• DOGE fell 7% over the 24-hour period ending September 22 at 02:00, retreating from $0.27 to $0.25.

• Midnight trading saw a collapse from $0.26 to $0.25 on record 2.15 billion volume, dwarfing the 24-hour average of 344.8 million.

• Analysts flagged a “1-2 pattern” formation that has historically preceded DOGE breakouts above $0.28–$0.30.

Price Action Summary

• DOGE’s range spanned $0.02 (≈8%) between a $0.27 high and $0.25 low.

• Resistance solidified NEAR $0.27 following repeated rejections.

• Institutional support emerged around $0.25, with recovery attempts keeping DOGE anchored above this level.

• In the final hour (01:14–02:13), DOGE bounced within a narrow $0.25–$0.25 channel, showing accumulation patterns with spikes at 01:25 and 02:03.

Technical Analysis

• Record 2.15B tokens traded during the midnight dump confirms heavy institutional activity.

• Support confirmed at $0.25; failure here risks extending decline toward $0.23.

• Key resistance sits at $0.27, with next upside tests at $0.28–$0.30 should buying resume.

• Volume spikes during recovery attempts highlight potential bottoming interest.

• Pattern recognition: technicians identify a recurring “1-2 setup” consistent with prior rally structures.

What Traders Are Watching

• Whether $0.25 can hold as durable support after record liquidation flows.

• Institutional positioning around the $0.28–$0.30 resistance band if recovery gains traction.

• Follow-through volumes in upcoming sessions to confirm whether accumulation or further distribution dominates.

• Broader sentiment impact from ETF delays and ongoing regulatory uncertainty.