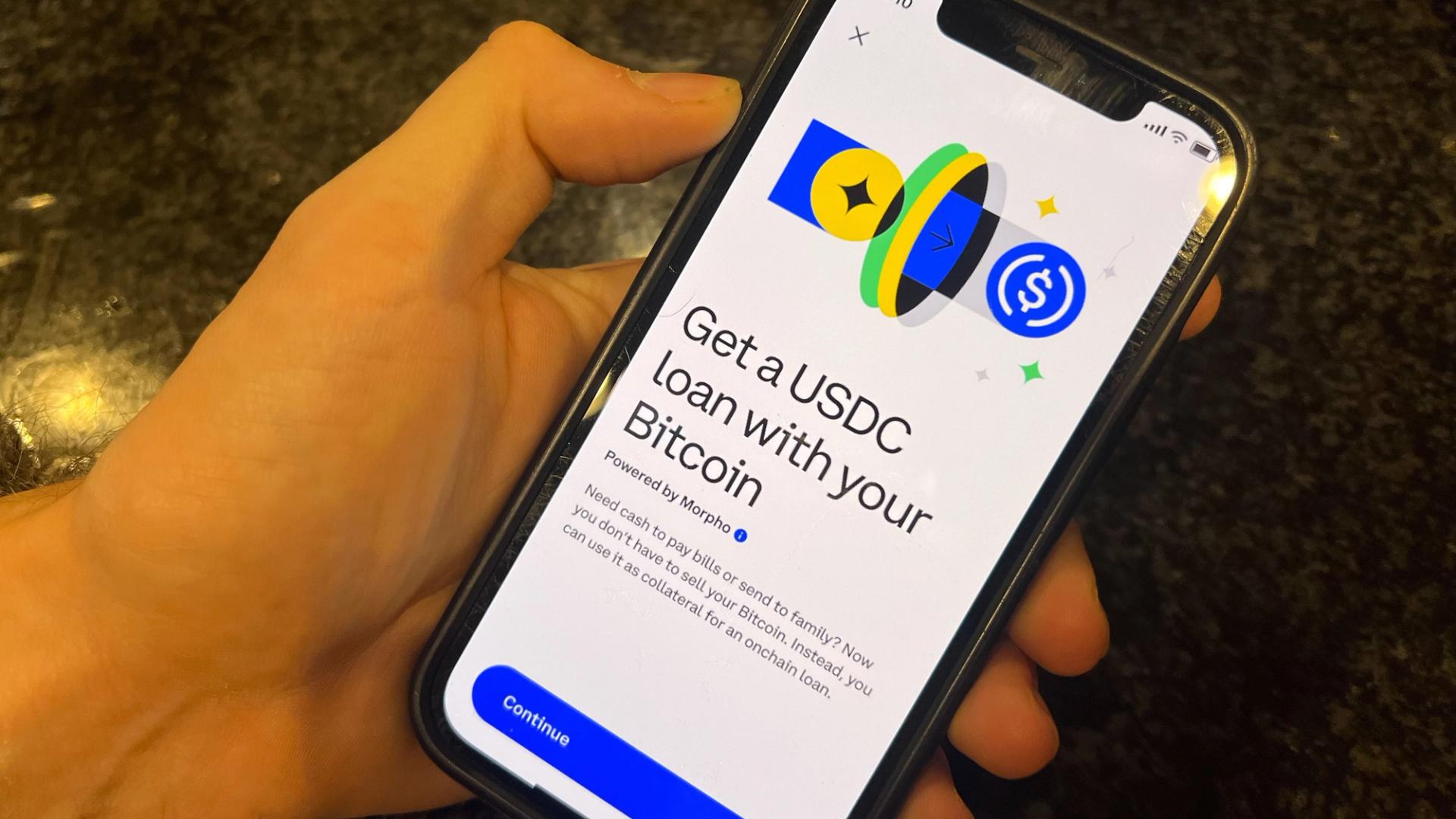

Coinbase Unleashes USDC Lending Revolution with Morpho and Steakhouse Financial

Coinbase just dropped a bombshell—partnering with Morpho and Steakhouse Financial to launch institutional-grade USDC lending services. Finally, someone's giving traditional finance a run for its money—literally.

The DeFi Power Play

Morpho's cutting-edge lending protocols meet Steakhouse's risk management expertise, creating a trifecta that bypasses legacy banking bottlenecks. No more waiting for wire transfers—just instant, borderless yield opportunities.

Institutional Adoption Accelerates

This move signals crypto's maturation from speculative asset to functional financial infrastructure. Wall Street might still be debating digital assets, but Coinbase just built the highway they'll eventually have to drive on.

Yield hunters rejoice—while traditional banks offer savings rates that barely beat inflation, this partnership delivers real yield in real time. Because let's be honest: 0.01% APY is just institutional-grade insulting.