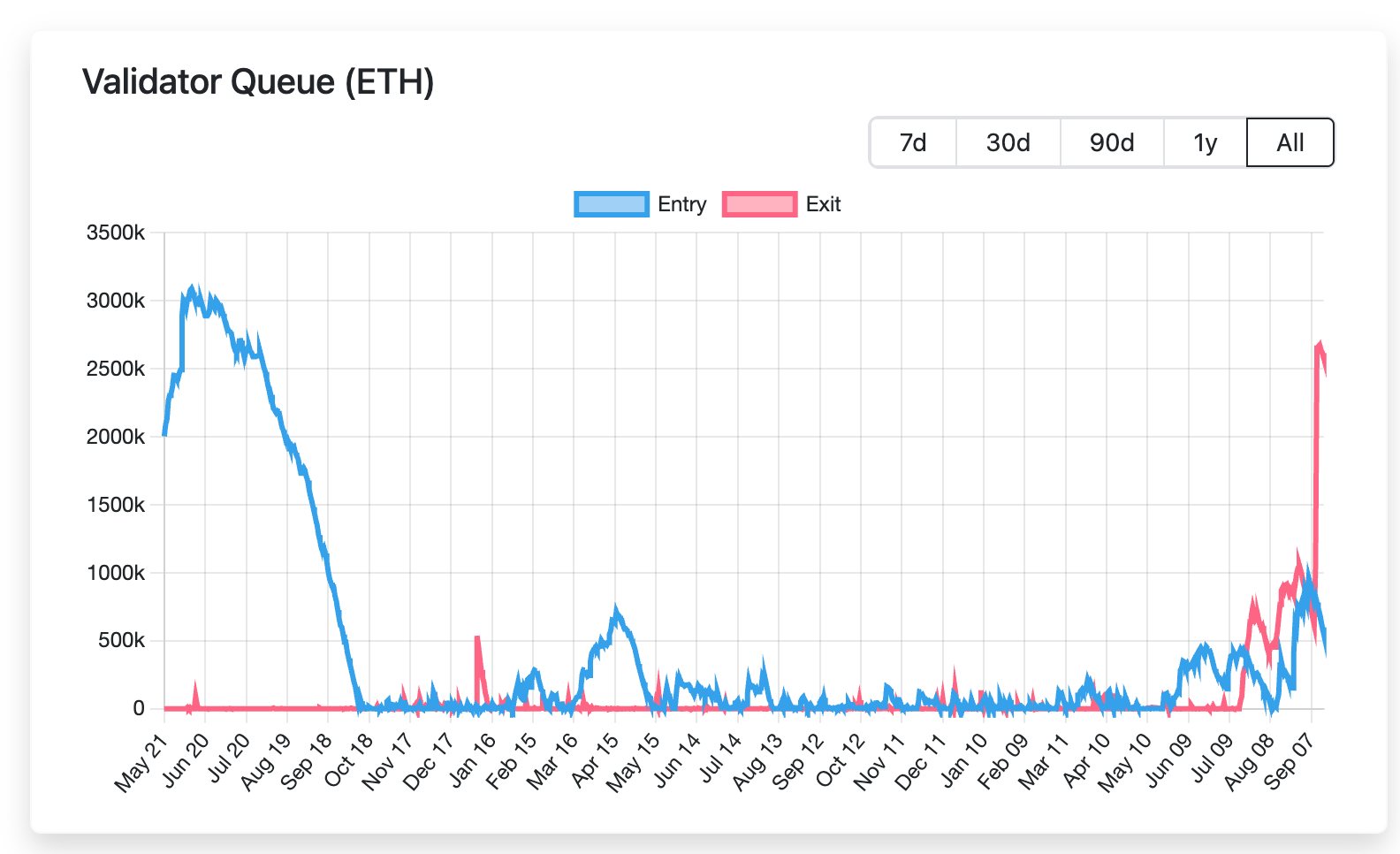

Ethereum’s 2.5M ETH Validator Exit Bottleneck Sparks Network Concerns

Ethereum's staking ecosystem hits critical congestion as 2.5 million ETH stacks up in validator exit queues—raising questions about network liquidity and operational efficiency.

The Great Unstaking Logjam

Validator exits aren't just slowing down—they're creating a traffic jam that would make Wall Street's quarterly report season look efficient. With 2.5 million ETH waiting to unbond, we're witnessing the blockchain equivalent of airport security lines during holiday travel.

Network Mechanics Under Pressure

Ethereum's carefully designed exit mechanism works perfectly—until it doesn't. The protocol's built-in rate limiting, meant to prevent mass exodus, now ironically creates the very bottleneck it was designed to avoid. Validators wanting out face waiting periods that make traditional bank transfers look instantaneous.

Liquidity Implications

While the crypto-sphere panics about locked funds, seasoned traders see opportunity. This isn't a bug—it's a feature working as intended, even if it's working painfully slowly. The queue manages systemic risk while giving the market time to adjust without catastrophic sell pressure.

Finance's Ironic Parallel

Traditional finance types will chuckle at 'blockchain inefficiency' while their settlement systems still require three business days and a fax machine confirmation—but at least Ethereum's delays are transparent and predictable, unlike your broker's excuse about 'market conditions' preventing withdrawals.

Ethereum’s churn limit, which is a protocol safeguard that caps how many validators can enter or exit over a certain time period, is currently capped at 256 ETH per epoch (about 6.4 minutes), restricting how quickly validators can join or leave the network, and is meant to keep the network stable.

With more than 2.5M ETH lined up, stakers on Wednesday face 44 days before even reaching the cooldown step.

Thalman believes that much of the ETH existing will simply be restaked under new validators, meaning that if even 75% of the current queue is re-deposited, nearly 2 million ETH will flood the activation queue, bringing delays for new ETH staking, and a backlog on both sides of the validator queue.

“The activation queue is currently 13 days, to this add the ~2M ETH from those currently exiting (35 days) and 4.7M from ETFs (81 days), and the total is 129 days. This assumes that there are no other ETH holders that choose to stake and enter the queue, like corporate treasuries,” Thalman wrote in the blog.

The swelling queue underscores a paradox: Ethereum is working "as intended” Thalman notes, and the demand to both exit and re-enter highlights staking’s central role in the ecosystem. The network is thus experiencing the growing pains of a maturing, institutionalized system where infrastructure scares, profit cycles, and regulatory shifts all collide in real time.