Fed’s Sept. 17 Rate Cut: Short-Term Volatility, Long-Term Rocket Fuel for Bitcoin, Gold & Stocks

Markets brace for turbulence as the Federal Reserve prepares to slash rates on September 17—but savvy investors already see the storm clouds parting.

Why This Cut Changes Everything

The Fed's move isn't just another policy tweak—it's a full-scale liquidity injection that could redefine risk assets for years. Bitcoin doesn't just benefit from lower rates; it thrives in environments where traditional finance looks shaky.

Gold's Moment in the Spotlight

While Wall Street frets about short-term jitters, gold's ancient store-of-value narrative gets a modern upgrade. Negative real yields? Meet positive historical returns.

Stocks: The Unlikely Winners

Equity markets might dip initially, but cheap money eventually finds its way into growth assets. Tech stocks especially stand to gain—because when money's free, speculation isn't just encouraged; it's practically mandated.

Remember: The Fed isn't cutting rates because the economy's booming—they're cutting because something's broken. But broken systems create opportunities for those willing to bet against conventional wisdom.

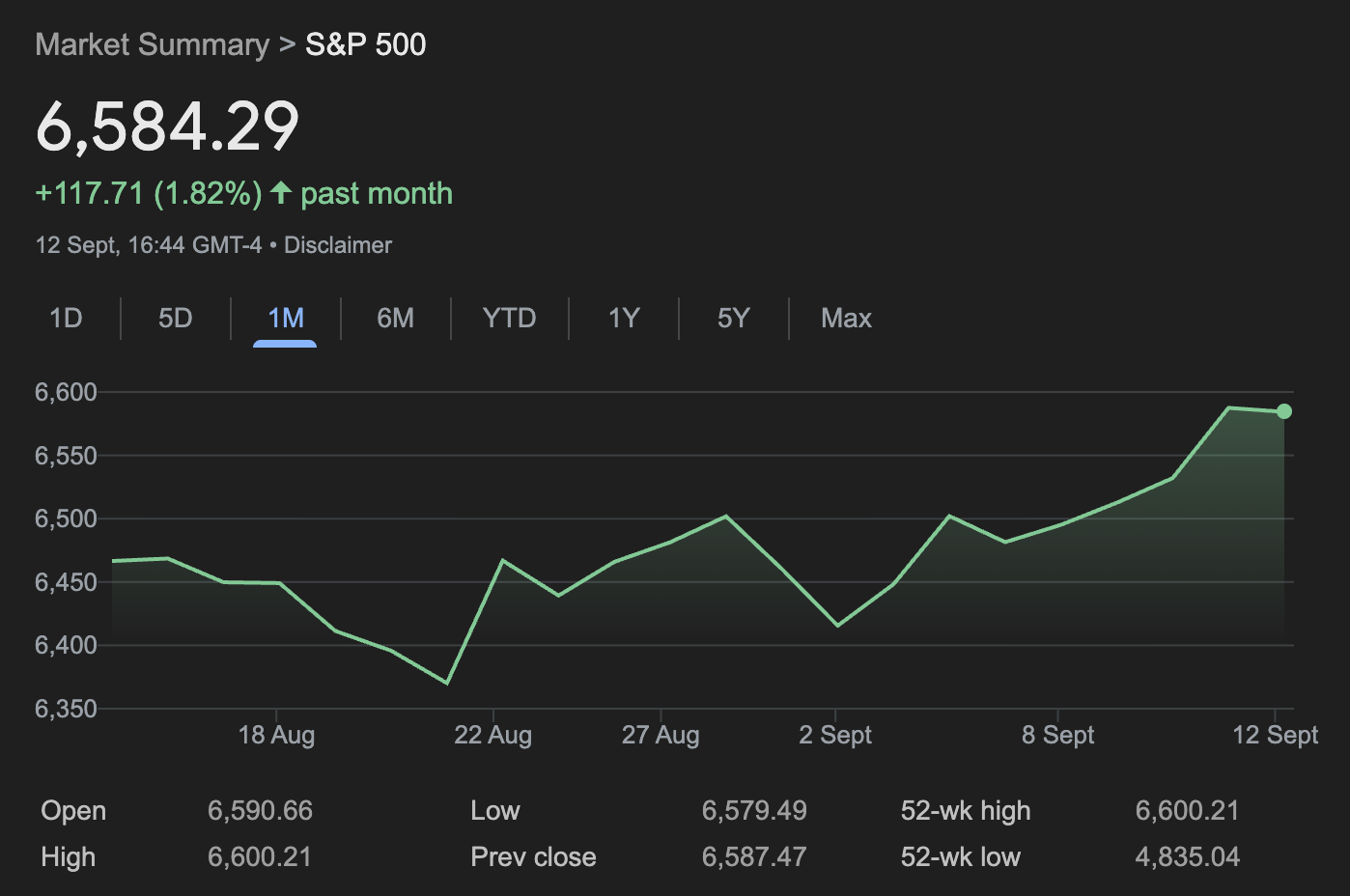

The Nasdaq Composite also notched five straight record highs, ending at 22,141, powered by gains in megacap tech stocks, while the Dow slipped below 46,000 but still booked a weekly advance.

Crypto and commodities have rallied alongside.

Bitcoin is trading at $115,234, below its Aug. 14 all-time high near $124,000 but still firmly higher in 2025, with the global crypto market cap now $4.14 trillion.

Gold has surged to $3,643 per ounce, NEAR record highs, with its one-month chart showing a steady upward trajectory as investors price in lower real yields and seek inflation hedges.

Historical precedent supports the cautious optimism.

Analysis from the Kobeissi Letter — reported in an X thread posted Saturday — citing Carson Research, shows that in 20 of 20 prior cases since 1980 where the Fed cut rates within 2% of S&P 500 all-time highs, the index was higher one year later, averaging gains of nearly 14%.

The shorter term is less predictable: in 11 of those 22 instances, stocks fell in the month following the cut. Kobeissi argues this time could follow a similar pattern — initial turbulence followed by longer-term gains as rate relief amplifies the momentum behind assets like equities, Bitcoin and gold.

The broader setup explains why traders are watching the Sept. 17 announcement closely.

Cutting rates while inflation edges higher and stocks hover at records risks denting credibility, yet staying on hold could spook markets that have already priced in easing. Either way, the Fed’s message on growth, inflation, and its policy outlook will likely shape the trajectory of markets for months to come.