Alt Season Looms as Fed Cuts Spark Trader Frenzy: Crypto Daybook Americas

Federal Reserve signals trigger crypto market surge as altcoins prepare for massive rally.

Traders pivot from traditional assets to digital alternatives amid shifting monetary policy landscape.

Market analysts predict extended bull run for alternative cryptocurrencies as institutional money flows into the space.

Volatility spikes across major exchanges while retail investors scramble to position for potential Fed-induced liquidity wave.

Because nothing says 'sound monetary policy' like betting your retirement on meme coins when the central bank panics.

What to Watch

- Crypto

- Sept. 12: Gemini Space Station, the Winklevoss twins’ crypto exchange, begins trading on Nasdaq Global Select Market under ticker GEMI.

- Sept. 12: Rex-Osprey Dogecoin ETF begins trading on Cboe BZX Exchange under ticker DOJE.

- Macro

- Sept. 12: Uruguay Q2 GDP growth Est. N/A (Prev. 3.4%).

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Hyperliquid to vote on who issues its USDH stablecoin. Voting takes place Sept. 14.

- Curve DAO is voting to update donation-enabled Twocrypto contracts, refining donation vesting so unlocked portions persist after burns. Voting ends Sept. 16.

- Unlocks

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating supply worth $17.09 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating supply worth $18.06 million.

- Token Launches

- Sept. 12: Unibase (UB) to be listed on Binance Alpha, MEXC, and others.

Conferences

- Day 1 of 4: ETHTokyo 2025 (Tokyo, Japan)

Token Talk

By Oliver Knight

- One of the founders of Thorchain, a decentralized network that allows users to send assets across blockchains, was hacked this week after being duped by a deepfake video call on Zoom.

- "Ok so this attack finally manifested itself. Had an old metamask cleaned out," JPThor wrote on X.

- Peckshield noted that $1.2 million was stolen from a Thorchain user, with ZachXBT adding that the perpetrator is linked to North Korean hackers.

- Thorchain emerged as one of North Korea's most popular laundering tools earlier this year; researchers estimated that 80% of the proceeds from a $1.4 billion hack on Bybit had been siphoned through Thorchain and protocols like Vultisig.

- The thorchain token (RUNE) is trading around $1.28, having lost 14% of its value in the past month and more than 90% since hitting its March 2024 high of $12.95.

- The hack involved a mixture of social engineering and phishing, two techniques that contributed to the $2.5 billion stolen by hackers in the first half of 2025.

Derivatives Positioning

- Open interest in futures tied to the top 10 cryptocurrencies increased 3%-5% in the past 24 hours as strengthening expectations of Fed rate cuts prompt traders to take more risk.

- Still, the market does not appear overheated, with annualized perpetual funding rates for major coins continuing to hover around 10%. Positive funding rates indicate a bullish bias among traders. Extremely high values typically signal market froth.

- OI in PENGU, one of the best-performing tokens of the past seven days, hit a record high 7.78 billion coins, validating the price rise. Funding rates for the coin are slightly elevated at around 15%.

- Smaller tokens, like SKY and PYTH, have deeply negative funding rates, a sign of bias towards bearish, short positions.

- CME's bitcoin futures are finally seeing an uptick in OI, ending a multiweek decline while ether OI has pulled back to a one-month low of 1.78 million ETH. These diverging trends could be a sign of renewed trader focus on BTC. Options OI in BTC and ETH remains elevated at multimonth highs.

- On Deribit, BTC and ETH options continue to show a bias toward puts up to the December expiry, despite traders pricing roughly five U.S. interest-rate cuts by July next year.

Market Movements

- BTC is up 0.53% from 4 p.m. ET Thursday at $115,049.85 (24hrs: +0.79%)

- ETH is up 2.21% at $4,515.82 (24hrs: +1.89%)

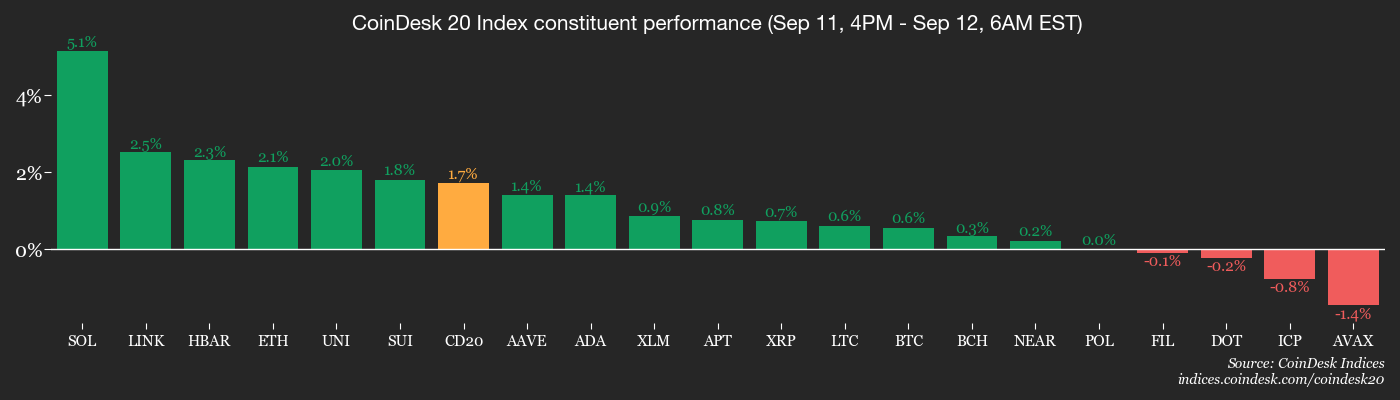

- CoinDesk 20 is up 1.82% at 4,289.35 (24hrs: +1.72%)

- Ether CESR Composite Staking Rate is up 6 bps at 2.86%

- BTC funding rate is at 0.0085% (9.2549% annualized) on Binance

- DXY is up 0.22% at 97.75

- Gold futures are up 0.23% at $3,682.20

- Silver futures are up 1.68% at $42.85

- Nikkei 225 closed up 0.89% at 44,768.12

- Hang Seng closed up 1.16% at 26,388.16

- FTSE is up 0.32% at 9,327.33

- Euro Stoxx 50 is down 0.3% at 5,370.54

- DJIA closed on Thursday up 1.36% at 46,108.00

- S&P 500 closed up 0.85% at 6,587.47

- Nasdaq Composite closed up 0.72% at 22,043.07

- S&P/TSX Composite closed up 0.78% at 29,407.89

- S&P 40 Latin America closed up 1.31% at 2,859.93

- U.S. 10-Year Treasury rate is up 2.5 bps at 4.036%

- E-mini S&P 500 futures are down 0.12% at 6,584.75

- E-mini Nasdaq-100 futures are unchanged at 24,013.25

- E-mini Dow Jones Industrial Average Index are down 0.2% at 46,049.00

Bitcoin Stats

- BTC Dominance: 57.95% (-0.55%)

- Ether to bitcoin ratio: 0.03930 (1.75%)

- Hashrate (seven-day moving average): 1,046 EH/s

- Hashprice (spot): $53.67

- Total Fees: 3.96 BTC / $453,051

- CME Futures Open Interest: 139,355 BTC

- BTC priced in gold: 31.6 oz

- BTC vs gold market cap: 8.94%

Technical Analysis

- XRP's price is looking to establish a foothold above the upper end of a monthslong descending triangle consolidation pattern.

- Should it succeed, momentum chasers will likely join the market, accelerating the rise toward record highs.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $323.95 (+2.73%), +0.66% at $326.10 in pre-market

- Circle (CRCL): closed at $133.7 (+17.6%), +0.88% at $134.88

- Galaxy Digital (GLXY): closed at $28.87 (+10.7%), +1.7% at $29.36

- Bullish (BLSH): closed at $53.99 (+2.6%), +2.2% at $55.18

- MARA Holdings (MARA): closed at $15.71 (-0.95%), +0.57% at $15.80

- Riot Platforms (RIOT): closed at $15.65 (-4.57%), +0.58% at $15.74

- Core Scientific (CORZ): closed at $15.55 (-2.75%), +0.64% at $15.65

- CleanSpark (CLSK): closed at $10.2 (+1.69%), +0.1% at $10.21

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $35.67 (+0.51%)

- Exodus Movement (EXOD): closed at $28.86 (+4.98%), -1.18% at $28.52

- Strategy (MSTR): closed at $326.02 (-0.13%), +0.81% at $328.65

- Semler Scientific (SMLR): closed at $28.54 (+1.86%), +1.51% at $28.97

- SharpLink Gaming (SBET): closed at $16.36 (+1.68%), +3.06% at $16.86

- Upexi (UPXI): closed at $5.68 (+4.03%), +13.73% at $6.46

- Lite Strategy (LITS) (formerly Mei Pharma): closed at $3.07 (+10.43%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $552.7 million

- Cumulative net flows: $56.15 billion

- Total BTC holdings ~ 1.30 million

Spot ETH ETFs

- Daily net flow: $113.1 million

- Cumulative net flows: $12.97 billion

- Total ETH holdings ~ 6.42 million

Source: Farside Investors

Chart of the Day

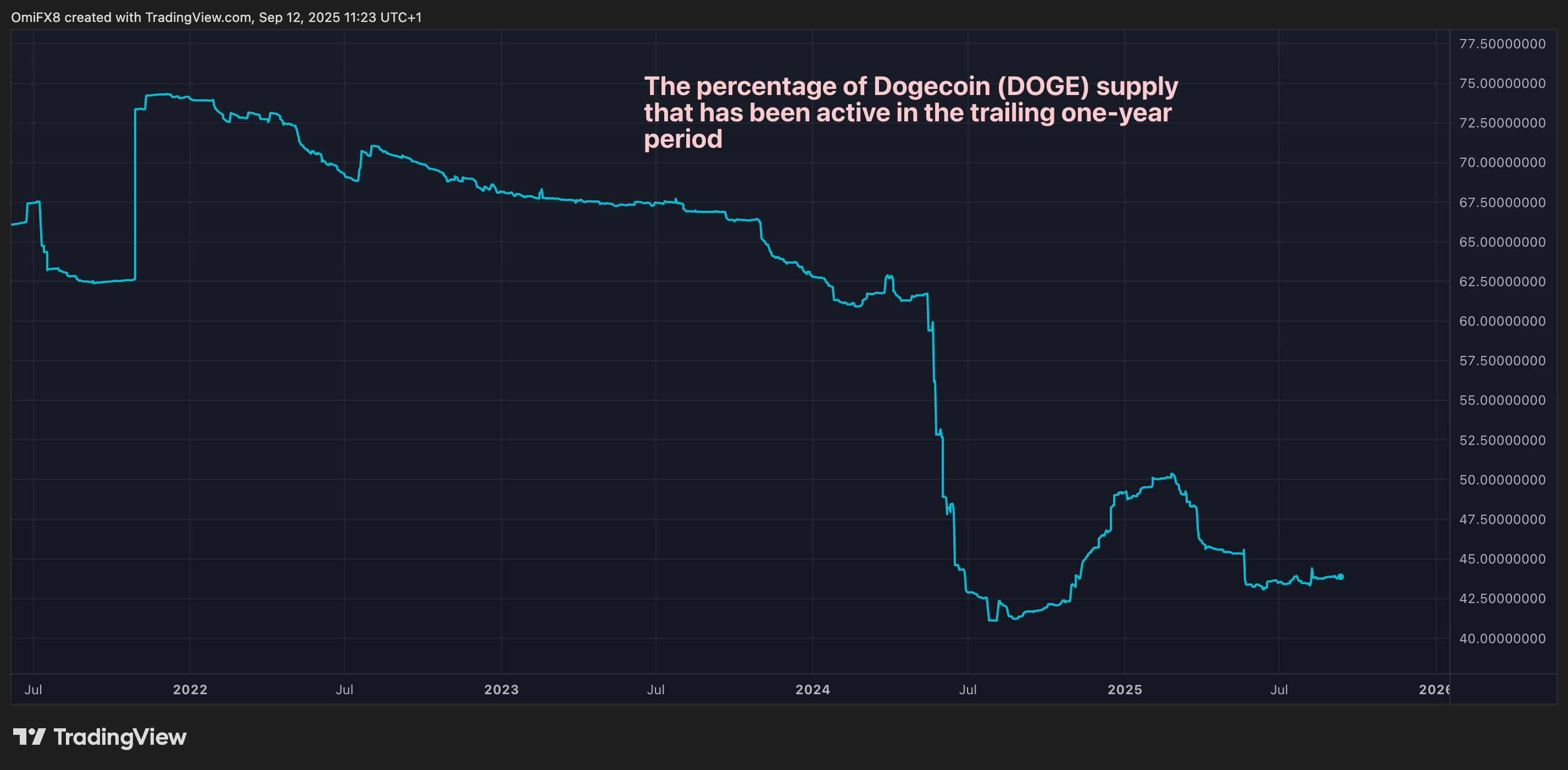

- The chart shows the the percentage of dogecoin's (DOGE) circulating supply that has been active in the trailing one-year period.

- The number of coins that have moved or been transacted within the past year remains at multimonth lows near 43%. The tally peaked at nearly 75% in November 2021 and has been dropping ever since.

- The decline indicates an investor shift to holding strategy and reduced speculative trading.

While You Were Sleeping

- BofA Says Investors Back Fed’s Credibility With Rate-Cut Timing (Bloomberg): Bank of America strategist Michael Hartnett said rising bank stocks and narrowing credit spreads show investors trust the Fed’s timing on rate cuts as growth momentum picks up.

- Crypto Pundits Retain Bullish Bitcoin Outlook as Fed Rate Cut Hopes Clash With Stagflation Fears (CoinDesk): Despite rising inflation and labor market weakness in the U.S., optimism persists with crypto gaining traction as a hedge against fiat debasement and traders expecting Fed cuts to start on Sept. 17.

- World Liberty Financial Token Holds Steady as Community Backs Buyback-and-Burn Plan (CoinDesk): WLFI holders voted nearly unanimously to use all liquidity fees for buybacks and burns across Ethereum, BNB Chain and Solana, establishing a scarcity model for the Trump-linked token.