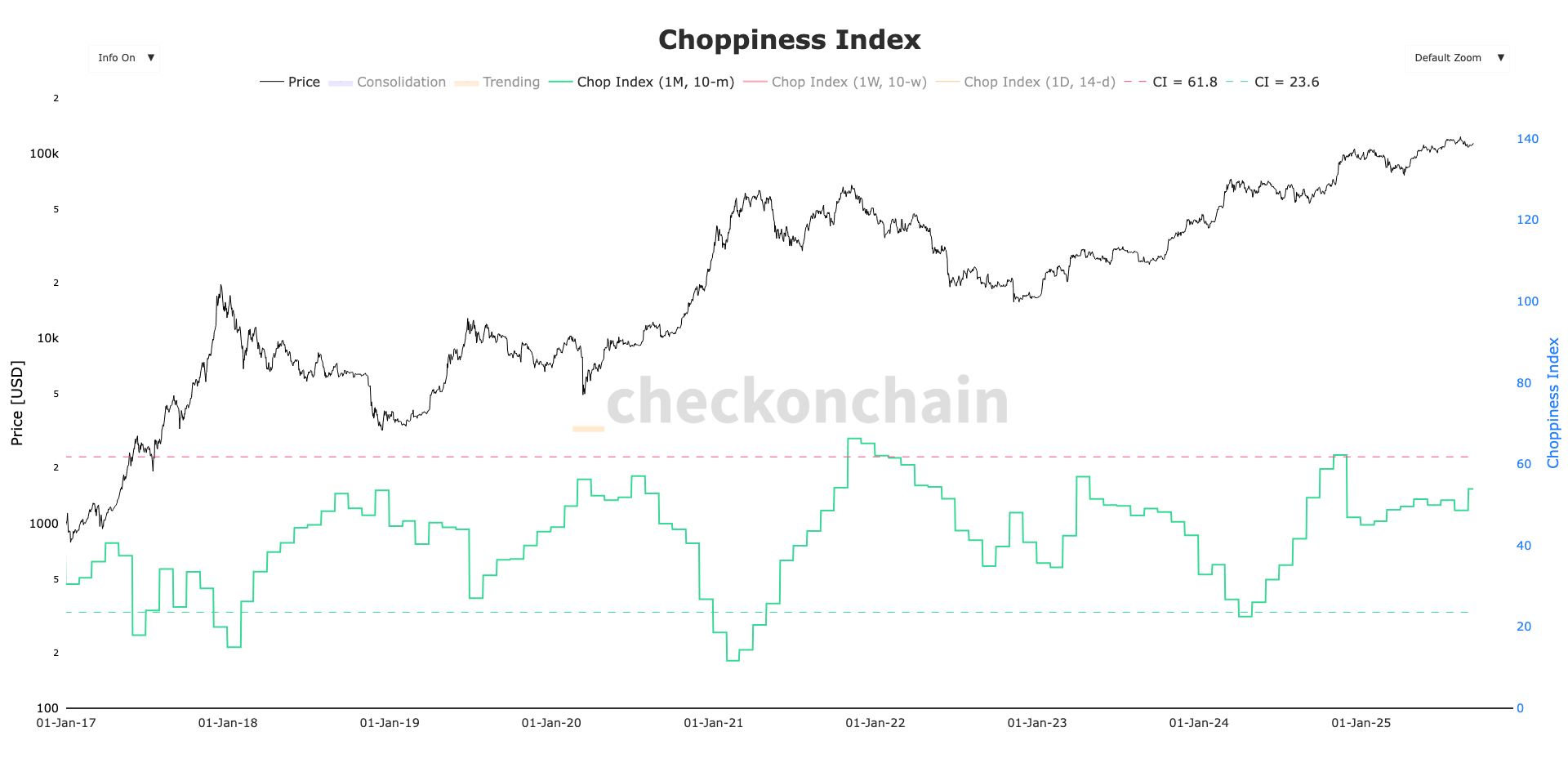

Bitcoin’s Choppiness Index Skyrockets: Is a Massive Breakout Imminent?

Bitcoin's market indecision hits fever pitch as the Choppiness Index climbs relentlessly—traders brace for what could be the most explosive move of the year.

Technical Tension Builds

The Choppiness Index doesn't lie—it measures market confusion, and right now, it's screaming uncertainty. Bitcoin's price action resembles a coiled spring, tightening with each passing day. Volatility compression typically precedes massive directional moves, and this setup looks textbook perfect.

Breakout Mechanics in Play

Market cycles follow patterns, and extended periods of consolidation often give way to powerful trend movements. The longer the chop persists, the more energy builds beneath the surface. Forget sideways action—this isn't boredom; it's potential energy waiting for a catalyst.

Traders on Edge

Everyone's watching the same charts, waiting for that decisive break above resistance or crash through support. The beauty of crypto? It never moves when expected—just when maximum pain gets distributed. Traditional finance types still call it speculative, meanwhile their bonds yield less than inflation.

Timing the Implosion—Or Explosion

Whether this breaks up or down, one thing's certain: it won't be subtle. Markets hate uncertainty more than they hate bad news, and this prolonged indecision practically guarantees a violent resolution. Buckle up—choppiness never lasts forever.