Digital Gold: A Story Still Being Written

Bitcoin's trillion-dollar question—digital gold or speculative gamble—remains unanswered as institutional adoption accelerates.

The Institutional Stampede

Corporate treasuries keep loading up on BTC, treating it like a non-correlated asset that just happens to moon every few years. BlackRock's ETF inflows hit record numbers while MicroStrategy's billion-dollar bet keeps paying off—until it doesn't.

Regulatory Whiplash

SEC approvals clash with crackdowns, creating a regulatory rollercoaster that would make any traditional finance exec reach for the Xanax. Meanwhile, El Salvador keeps stacking sats like there's no tomorrow.

The Ultimate Test

When the next crisis hits—and it always does—we'll see if Bitcoin actually behaves like gold or just another risk asset. Spoiler: Wall Street's probably wrong about both outcomes.

Finance's dirty little secret? They hate Bitcoin until they can't afford to ignore it—then they'll charge you 2% to manage it for you.

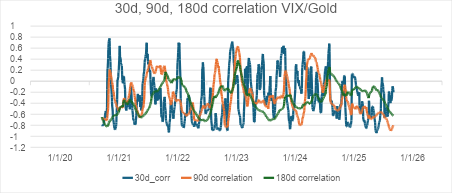

It is also worth remembering that gold itself has an imperfect track record as a macro and inflation hedge. It does not track consumer prices month by month, though over decades it has preserved purchasing power better than most assets. Research also shows that gold can serve as a SAFE haven during episodes of extreme equity stress, but not always, as its mixed relationship with the VIX illustrates.

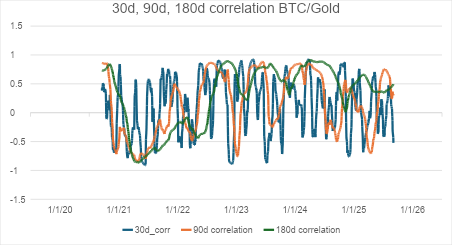

For bitcoin, the narrative is still in flux. Some investors view it as a technology play; others see it as an emerging macro hedge. We believe the latter will prove more durable over time. Unlike other blockchains, Bitcoin’s limited scalability, rigid governance and lack of Turing completeness mean it is unlikely to become a multi-application platform. Other protocols are far better suited to that role. Instead, bitcoin’s long-term value proposition rests on its scarcity and neutrality— features that echo gold’s monetary role.

Of course, such narratives take time to solidify. Gold required millennia to become widely accepted as a store of value. Bitcoin, by comparison, is only sixteen years old, yet it has already achieved remarkable levels of recognition and adoption. The “digital gold” analogy may not be fully supported by the data today, but it is far too early to dismiss it. If anything, history suggests that the story is still being written.

Legal Disclaimer

Information presented, displayed, or otherwise provided is for educational purposes only and should not be construed as investment, legal, or tax advice, or an offer to sell or a solicitation of an offer to buy any interests in a fund or other investment product. Access to the products and services of Lionsoul Global Advisors is subject to eligibility requirements and the definitive terms of documents between potential clients and Lionsoul Global Advisors, as they may be amended from time to time.