Risk-On Positions Undermined by 1M U.S. Jobs Revision: Crypto Daybook Americas

Risk-on sentiment takes a direct hit as U.S. jobs data gets slashed by one million positions—just another day in macroeconomic whiplash.

Jobs Data Shockwaves

That massive revision rips through trader confidence like a hot knife through butter. Suddenly, those leveraged long positions don't look so clever when the foundational data gets rewritten overnight.

Crypto Market Reaction

Digital assets wobble as traditional finance flinches. Bitcoin tests key support levels while altcoins bleed—proving once again that crypto hasn't quite decoupled from legacy market tremors.

Institutional Whiplash

Hedge funds scramble to reposition portfolios that were betting on continued economic strength. Another reminder that Wall Street's crystal ball works about as well as a Magic 8-Ball.

The Silver Lining Playbook

Weak jobs data might just push the Fed toward earlier rate cuts—because nothing says 'healthy economy' like needing emergency monetary stimulus every few years.

Bottom Line: Traders who thought they could outsmart the market just learned the oldest lesson in finance—the only free lunch is the one you bring yourself.

What to Watch

- Crypto

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould will talk about digital assets at the CoinDesk: Policy & Regulation Conference in Washington.

- Sept. 11: REX Shares and Osprey Funds’ Dogecoin ETF shares to start trading on Cboe BZX Exchange under ticker DOJE.

- Macro

- Sept. 10, 8 a.m.: Brazil August CPI. Inflation rate YoY Est. 5.1%, MoM Est. -0.15%.

- Sept. 10, 8:30 a.m.: U.S. August PPI YoY Est. 3.3%, MoM Est. 0.3%. Core YoY Est. 3.5%, MoM Est. 0.3%.

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Goldfinch DAO is voting on the Goldfinch Foundation’s annual budget of $400,000 and 200,000 GFI. Voting ends Sept. 10.

- Compound DAO is voting on extending its COMP yield strategy. Voting ends Sept. 11.

- Hyperliquid to vote on who issues its USDH stablecoin. Voting takes place Sept. 14.

- Unlocks

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating supply worth $50.89 million.

- Token Launches

- Sept. 10: Linea (LINEA) to be listed on Binance Alpha, KuCoin, MEXC, KuCoin, Bitget OKX, CoinW, and others.

- Sept. 10: Kong (KONG) to be listed on KuCoin.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB15 for 15% off your registration.

- Day 4 of 4: Future Proof Festival (Huntington Beach, California)

- Day 2 of 2: Fintech Week London 2025

- Day 2 of 2: WOW Summit Hong Kong 2025

- Day 2 of 5: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 10: Future of Finance (New York)

Token Talk

By Oliver Knight

- The crypto market has entered "altcoin season" despite sentiment remaining in bearish territory.

- CoinMarketCap's altcoin season index has ticked up to 59/100, topping August's high of 57 as capital continues to rotate into the more speculative tokens.

- Market intelligence platform Santiment noted that while prices are moving to the upside, sentiment is becoming more negative.

- "Traders have changed their tunes, swinging more and more negative with expectations of bitcoin falling back below $100K, Ethereum back below $3.5K, and altcoins going through a retrace period," Santiment wrote on X.

- Altcoins remain unperturbed with mantle (MNT) and pyth (PYTH) leading the way, gaining 15% and 10%, respectively, over the past 24 hours.

- Bitcoin (BTC), the largest cryptocurrency in terms of market cap, continues to languish around $112,500.

- Previous altcoin seasons have occurred when bitcoin consolidates as traders rotated capital to speculative assets without the risk of missing out on a major BTC move.

- Bitcoin has been trading between $107,000 and $113,000 for more than two weeks after failing to break beyond $124,000.

Derivatives Positioning

By Omkar Godbole

- BTC's futures open interest (OI) has remained steady over the past 24 hours as traders sit on the sidelines ahead of tomorrow's U.S. CPI release.

- OI in ETH, SOL and HYPE has increased by over 2%, while XRP, SUI, ADA, and ENA have seen capital outflows.

- Annualized funding rates for top coins except TRX and XLM are hovering at or above 10%, indicating a bullish bias but nothing out of ordinary. In other words, there are no signs of excess leverage buildup or overheating.

- On the CME, notional open interest in BTC options has climbed to a record $5.6 billion, while activity in futures remains subdued.

- On Deribit, BTC and ETH puts out to December expiry continue to trade at a premium to calls, indicating lingering downside concerns.

- Block flows at OTC desk Paradigm featured a long position in the ether $4,000 put expiring on Sept. 26.

Market Movements

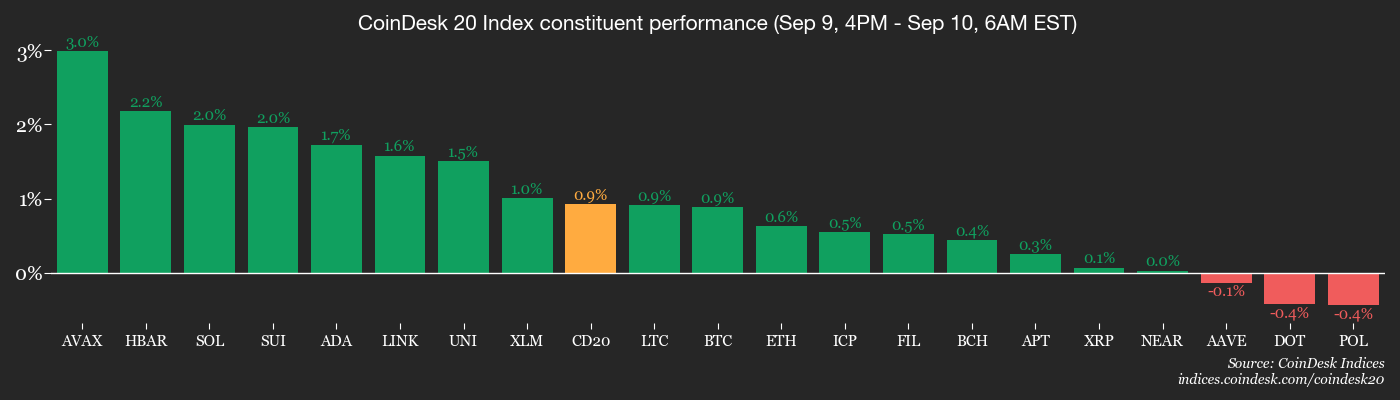

- BTC is up 0.68% from 4 p.m. ET Tuesday at $112,296.28 (24hrs: -0.35%)

- ETH is up 0.47% at $4,325.02 (24hrs: -0.54%)

- CoinDesk 20 is up 0.87% at 4,128.56 (24hrs: -0.59%)

- Ether CESR Composite Staking Rate is up 3 bps at 2.87%

- BTC funding rate is at 0.0103% (11.2785% annualized) on KuCoin

- DXY is unchanged at 97.76

- Gold futures are up 0.1% at $3,686.00

- Silver futures are up 0.65% at $41.61

- Nikkei 225 closed up 0.87% at 43,837.67

- Hang Seng closed up 1.01% at 26,200.26

- FTSE is up 0.25% at 9,265.34

- Euro Stoxx 50 is up 0.25% at 5,382.08

- DJIA closed on Tuesday up 0.43% at 45,711.34

- S&P 500 closed up 0.27% at 6,512.61

- Nasdaq Composite closed up 0.37% at 21,879.49

- S&P/TSX Composite closed up 0.12% at 29,063.01

- S&P 40 Latin America closed unchanged at 2,800.26

- U.S. 10-Year Treasury rate is up 1.3 bps at 4.087%

- E-mini S&P 500 futures are up 0.14% at 6,530.75

- E-mini Nasdaq-100 futures are unchanged at 23,886.50

- E-mini Dow Jones Industrial Average Index are down 0.26% at 45,640.00

Bitcoin Stats

- BTC Dominance: 58.19% (unchanged)

- Ether-bitcoin ratio: 0.03848 (-0.38%)

- Hashrate (seven-day moving average): 992 EH/s

- Hashprice (spot): $52.47

- Total fees: 4.61 BTC / $517,036

- CME Futures Open Interest: 134,650 BTC

- BTC priced in gold: 30.7 oz

- BTC vs gold market cap: 8.68%

Technical Analysis

- Dogecoin printed a Doji candle Tuesday, which indicates lack of willingness among bulls and bears to lead the price action.

- The emergence of Doji has neutralized the bullish outlook stemming from the descending trendline breakout confirmed Sunday.

- Tuesday's high of 25 cents is the new level to beat for the bulls.

Crypto Equities

- Coinbase Global (COIN): closed on Tuesday at $318.78 (+5.49%), +0.56% at $320.57 in pre-market

- Circle (CRCL): closed at $117.99 (+4.92%), +1.07% at $119.25

- Galaxy Digital (GLXY): closed at $26.58 (+9.74%), +1.35% at $26.94

- Bullish (BLSH): closed at $53.81 (+7.36%), unchanged in pre-market

- MARA Holdings (MARA): closed at $15.93 (+4.8%), +0.75% at $16.05

- Riot Platforms (RIOT): closed at $15.21 (+13.17%), +0.85% at $15.34

- Core Scientific (CORZ): closed at $14.53 (+4.31%), +2.96% at $14.96

- CleanSpark (CLSK): closed at $9.67 (+5.45%), +1.03% at $9.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $33.13 (+11.59%)

- Exodus Movement (EXOD): closed at $26.75 (+1.71%), unchanged in pre-market

- Strategy (MSTR): closed at $328.53 (-0.42%), +0.69% at $330.80

- Semler Scientific (SMLR): closed at $28.07 (-0.78%)

- SharpLink Gaming (SBET): closed at $16.69 (+6.51%), +0.48% at $16.77

- Upexi (UPXI): closed at $5.5 (-2.83%), +3.45% at $5.69

- Mei Pharma (MEIP): closed at $2.78 (-7.33%), +4.32% at $2.90

ETF Flows

Spot BTC ETFs

- Daily net flows: $23 million

- Cumulative net flows: $54.85 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $44.2 million

- Cumulative net flows: $12.69 billion

- Total ETH holdings ~6.36 million

Source: Farside Investors

Chart of the Day

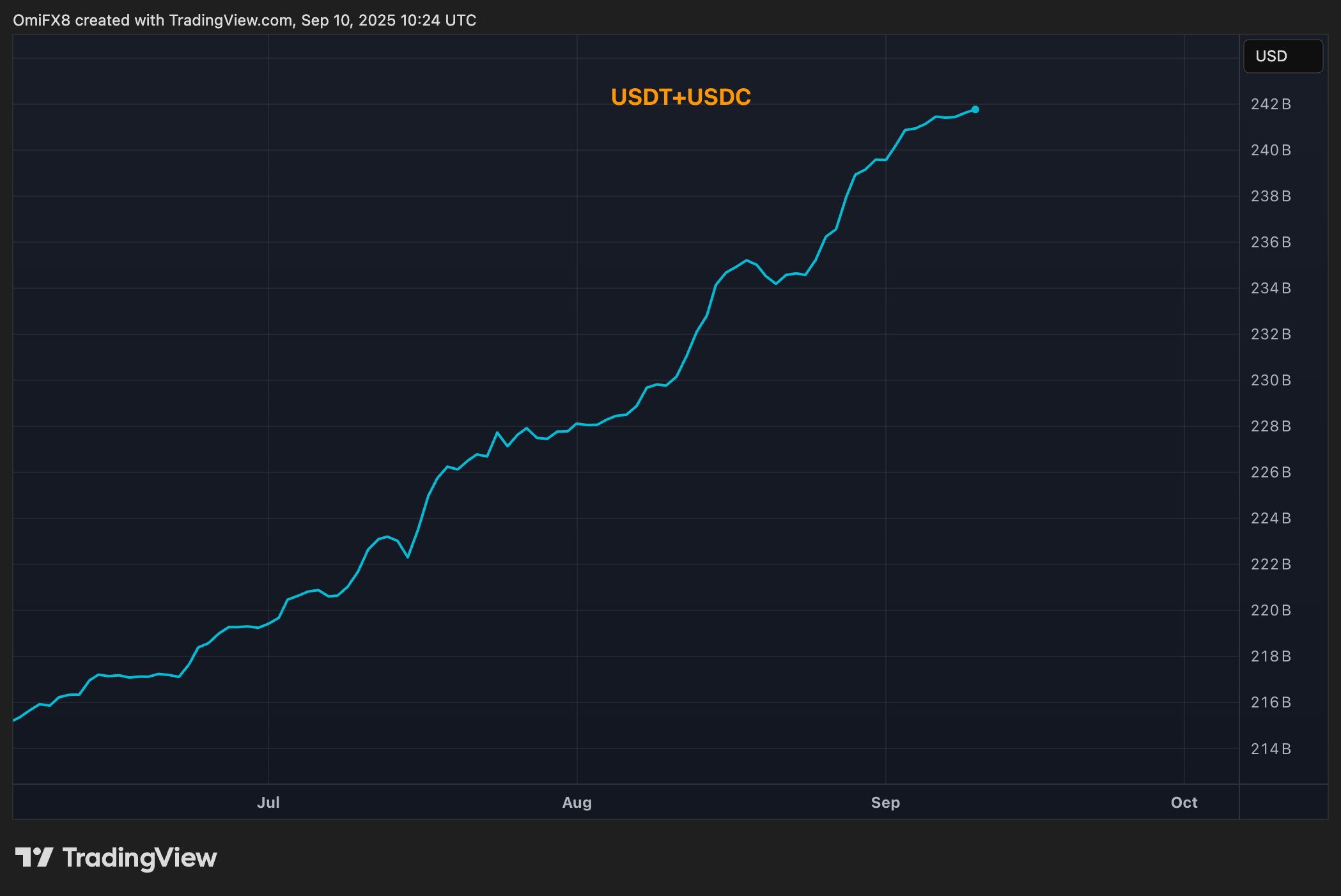

- The combined market cap of the two largest stablecoins, Tether's USDT and Circle Internet's USDC, continues to set new highs, indicating persistent demand for dollar-linked assets despite Fed rate cut bets.

- The Fed is expected to cut rates at its Sept. 17 meeting.

While You Were Sleeping

- Bitcoin Retakes $112K, SOL hits 7-Month High as Economists Downplay Recession Fears (CoinDesk): The U.S. cut 911,000 jobs from payroll estimates for the year ended March 2025, unsettling markets, but economists said the revision signaled slower labor force growth rather than recession or stagflation.

- Gold Pushes Toward Record as Traders Wait for Inflation Prints (Bloomberg): Gold rose, fueled by rate-cut expectations, central bank buying, ETF inflows, Israel’s strike in Doha and President Trump urging the EU to join him in new tariffs on India and China.

- Judge Blocks Trump From Removing Fed Governor Lisa Cook (The Wall Street Journal): Judge Jia Cobb said Cook was likely to prevail since removals must be based only on a Fed governor’s conduct while in office, rather than unproven, pre-appointment allegations.

- Metaplanet to Raise $1.4B in International Share Sale, Stock Jumps 16% (CoinDesk): Metaplanet is selling the shares at 553 yen each, with NAKA committing to buy $30 million worth.

- Poland Says It Shot Down Russian Drones That Entered Its Airspace (The New York Times): Poland’s military said Russian drones crossed its airspace during strikes on Ukraine, prompting Poland and NATO air forces to deploy warplanes and close skies over Warsaw.