Chainlink’s $5.5M Reserve Move Fails to Stop 15% LINK Slide From August Peak

Chainlink just pulled $5.5 million worth of LINK from circulation—yet the token keeps bleeding value, down 15% from its August highs.

The Supply Shock That Wasn't

Traditional economics would suggest that reducing supply while demand holds steady should boost prices. But crypto markets dance to their own tune—often ignoring textbook logic in favor of herd sentiment and whale movements.

Reserve actions like these typically aim to signal strength or scarcity. This time, though, traders shrugged and kept selling. Maybe they’re focused on macro fears, maybe they’re just taking profits. Either way, the 'supply shock' narrative fell flat.

Where’s the Bottom?

With $5.5 million removed and still no bounce, the market’s asking: what will it take? More burns? Better fundamentals? Or just time? Chainlink’s tech remains solid—real-world asset tokenization and cross-chain interoperability are still megatrends. But in crypto, good tech doesn’t always equal green candles.

Sometimes, even smart money moves look dumb in a market that’s half speculation, half performance art.

Technical analysis

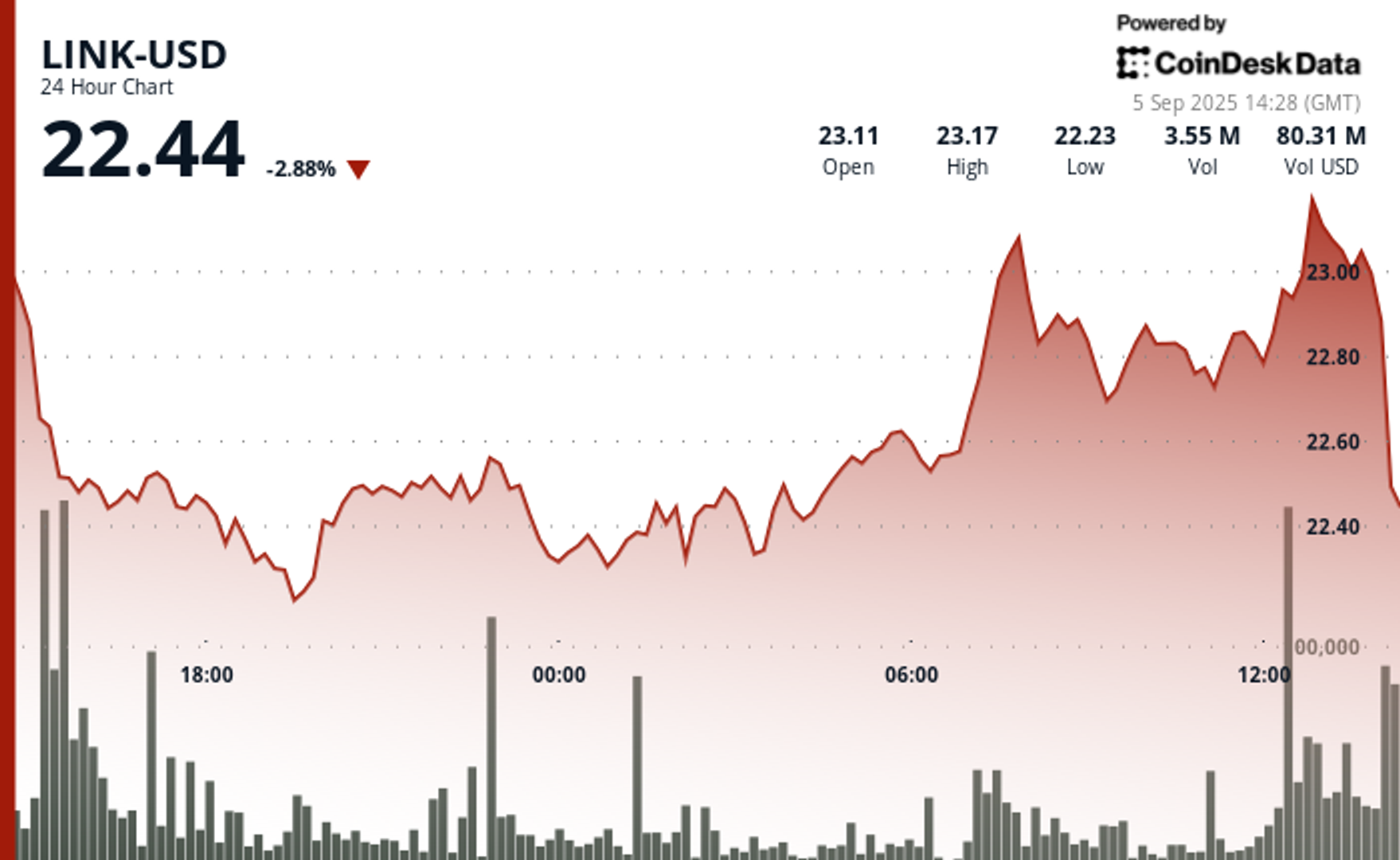

- LINK encountered persistent bearish pressure, forming lower highs and lower lows as the broader crypto market is in a consolidation period, CoinDesk Research's technical analysis model shows.

- Key technical support levels established around $22.28-$22.32.

- Strong volume-backed resistance formed around the $23.10-$23.16 level.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.