XRP Plunges 4% After Hitting $2.88 Wall—ETF Hype Fails to Sustain Momentum

XRP just got slapped back to reality after a brutal rejection at the $2.88 resistance level. The token nosedived 4% as speculative ETF chatter collided with cold, hard selling pressure.

Market Rollercoaster

Traders watched gains evaporate in minutes—proof that even hot ETF rumors can’t outrun a stiff technical ceiling. The drop echoes a familiar crypto theme: hype hits a wall, and gravity does the rest.

Finance’s Ironic Twist

Wall Street’s latest ‘crypto revolution’ looks more like a rerun—big promises, swift corrections, and another round of bag-holding for the over-leveraged crowd. Because nothing says innovation like watching digital assets mimic traditional market follies.

What’s next? If history holds, a volatile bounce—or another leg down. Either way, keep your seatbelt fastened.

News Background

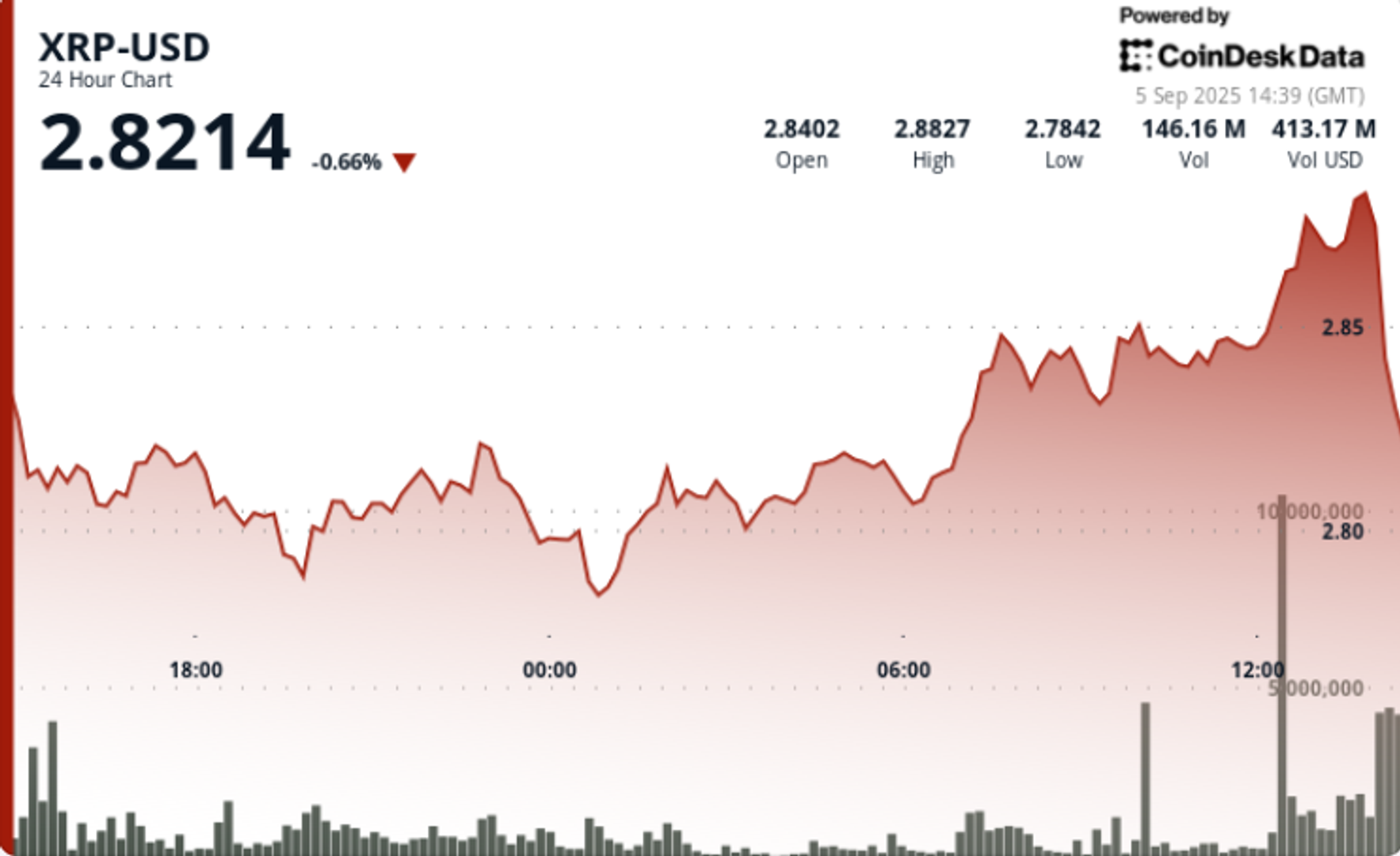

• XRP fell 4% from $2.88 to $2.84 on September 5 after hitting an intraday high of $2.89, as institutional selling pressure emerged.

• Trading volume exploded to 227.75 million during the 12:00 hour, nearly 4x the 24-hour average of 58.40 million.

• Six asset managers, including Grayscale and Bitwise, have filed for spot XRP ETFs, with SEC decisions expected in October.

• Ripple’s legal settlement with the SEC has improved regulatory clarity, boosting industry estimates to an 87% probability of ETF approval.

• Technical strategists are comparing the current 47-day consolidation range to XRP’s 2017 structure, which preceded a parabolic rally.

Price Action Summary

• XRP traded in a $0.10 range (3.47%) between $2.78 and $2.89 during the 24-hour session from Sept. 4 15:00 to Sept. 5 14:00.

• The asset advanced from $2.84 to $2.89 on massive volume at 12:00 and 13:00 before rejecting resistance.

• A concentrated 60-minute move from 13:26 to 14:25 saw a 4% slide from $2.88 to $2.84 on 10.6M volume, breaching intraday supports at $2.86 and $2.85.

• XRP closed the session at $2.84, just above primary support levels NEAR $2.77.

Technical Analysis

• Resistance: $2.88–$2.89 zone validated after multiple failed breakouts.

• Support: Immediate levels at $2.84–$2.85, with stronger backing at $2.77.

• Pattern: 47-day consolidation suggests potential breakout setup; $4.63–$13 targets flagged if structure resolves higher.

• Momentum: RSI in mid-50s, showing neutral bias; MACD histogram converging toward bullish crossover.

• Volume: 227.75M at peak vs 58.40M average confirms institutional distribution.

What Traders Are Watching

• Whether $2.77 holds as decisive support into September.

• SEC’s October spot XRP ETF rulings — seen as a potential bullish trigger.

• Continuation of whale accumulation (340M tokens recently added) despite short-term distribution pressure.

• Signs of breakout above $3.30, which analysts argue could open pathways toward $4+.