Bitcoin Braces for Jobs Data Test as Tether Explores Gold Mining Ventures: Crypto Daybook Americas

Bitcoin's resilience faces its next major macroeconomic examination as employment data looms—while Tether makes surprising moves toward physical asset diversification.

Tether's Golden Gambit

The stablecoin giant dips its toes into gold mining operations, signaling a strategic pivot toward tangible asset backing. This isn't just diversification—it's a hedge against the very digital ecosystem they helped create.

Jobs Report: Crypto's Economic Litmus Test

Traditional employment metrics now serve as indirect indicators for digital asset performance. Strong numbers could trigger Fed hawkishness—weak data might fuel the decentralization narrative. Either way, Bitcoin becomes the thermometer for monetary policy temperature.

The irony? Wall Street still uses twentieth-century economic indicators to try predicting twenty-first-century assets—like using a sundial to time satellite launches.

What to Watch

- Crypto

- Sept. 10, 9:15 a.m.: Comptroller of the Currency Jonathan V. Gould will talk about digital assets at the CoinDesk: Policy & Regulation Conference in Washington.

- Macro

- Sept. 5, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July producer price inflation data.

- PPI MoM Prev. -1.25%

- PPI YoY Prev. 3.24%

- Sept. 5, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases August employment data.

- Nonfarm Payrolls Est. 75K vs. Prev. 73K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -10K

- Manufacturing Payrolls Est. -5K vs. Prev. -11K

- Sept. 5, 8:30 a.m.: Statistics Canada releases August employment data.

- Unemployment Rate Est. 7% vs. Prev. 6.9%

- Employment Change Est. 7.5K vs. Prev. -40.8K

- Sept. 5: S&P 500 Rebalance update released after market close. Strategy (MSTR) is one of the companies being considered for inclusion in the index.

- Sept. 5, 7 p.m.: Colombia’s National Administrative Department of Statistics releases August consumer price inflation data.

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.28%

- Inflation Rate YoY Est. 5.11% vs. Prev. 4.9%

- Sept. 5, 7 p.m.: El Salvador's Statistics and Census Office releases August consumer price inflation data.

- Inflation Rate MoM Prev. 0.33%

- Inflation Rate YoY Prev. -0.14%

- Sept. 5, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases July producer price inflation data.

- Earnings (Estimates based on FactSet data)

- Sept. 9: GameStop (GME), post-market, $0.19

Token Events

- Governance votes & calls

- Uniswap DAO is voting on deploying Uniswap v3 on Ronin with $1M in RON and $500K in UNI incentives to make it the chain’s primary decentralized exchange. Voting ends Sept. 6.

- Lido DAO is voting on a proposal to migrate Nethermind’s ~7,000 Ethereum validators to infrastructure operated by Twinstake, a staking provider co-founded by Nethermind. Voting ends Sept. 8.

- Uniswap DAO is voting to establish “DUNI,” a Wyoming DUNA as its legal entity, preserving decentralized governance while enabling off-chain operations and liability protections, with $16.5M in UNI for legal/tax budgets and $75K UNI for compliance. Voting ends Sept. 8.

- Uniswap DAO is voting on an updated Unichain-USDS Growth Plan to accelerate adoption through performance-based incentives and DAO-guided distribution. The proposal introduces minimum KPIs, a “no result, no reward” model. Voting ends Sept. 9.

- Unlocks

- Sept. 9: Sonic (S) to unlock 5.02% of its circulating supply worth $46.02 million.

- Sept. 11: Aptos (APT) to unlock 2.2% of its circulating supply worth $48.86 million.

- Sept. 15: Starknet (STRK) to unlock 5.98% of its circulating supply worth $15.66 million.

- Sept. 15: Sei (SEI) to unlock 1.18% of its circulating supply worth $16.01 million.

- Sept. 16: Arbitrum (ARB) to unlock 2.03% of its circulating supply worth $46.05 million.

- Token Launches

- Sept. 5: WORLDSHARDS (SHARDS) to be listed on Binance Alpha, MEXC, Gate.io and others.

- Sept. 5: Boost (BOOST) to be listed on Binance Alpha, Bitget, MEXC, BitMart, and others.

- Sept. 8: Openledger (OPEN) to be listed on Binance Alpha, MEXC and others.

- Sept. 8: OlaXBT (AIO) to be listed on Binance Alpha and others.

Conferences

The CoinDesk Policy & Regulation Conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB15 for 15% off your registration.

- Day 3 of 3: bitcoin++ (Istanbul)

- Day 2 of 2: ETHWarsaw 2025 (Warsaw)

- Day 2 of 3: Taipei Blockchain Week (Taiwan)

- Sept. 5: Bitcoin Indonesia Conference 2025 (Bali)

- Sept. 9-10: Fintech Week London 2025

- Sept. 9-10: WOW Summit Hong Kong 2025

- Sept. 9-13: Boston Blockchain Week (Quincy, Massachusetts)

- Sept. 10: CoinDesk Policy & Regulation Conference (New York)

- Sept. 12: Independent Investor Summit (New York)

Token Talk

By Oliver Knight

- The memecoin sector had shown signs of fading earlier this year, particularly after the short-lived hype cycles around tokens like TRUMP and MELANIA in January. Those launches briefly captured attention, but failed to sustain momentum, reinforcing the perception that the memecoin trade was exhausted after 2023’s frenzy.

- Both subsequently slumped. TRUMP is now 88% lower and and MELANIA is down 95% despite being touted by the U.S. president and first lady in January.

- However, there's a new kid on the block: MemeCore, a layer-1 blockchain solely focused on transitioning memecoins from speculative assets to something that has utility in decentralized finance (DeFi).

- The platform's native token, M, has risen by 261% in the past week despite a wider market pullback.

- The flurry of activity can also be tied to the MemeX liquidity festival, which offers $5.7 million in rewards to traders. It's worth noting that 85% of the trading volume has taken place on decentralized exchange PancakeSwap, indicating significant retail flows as opposed to on-chain utility.

- While some may argue this is just another flash in the pan, the surge demonstrates just how quickly memecoin sentiment can shift.

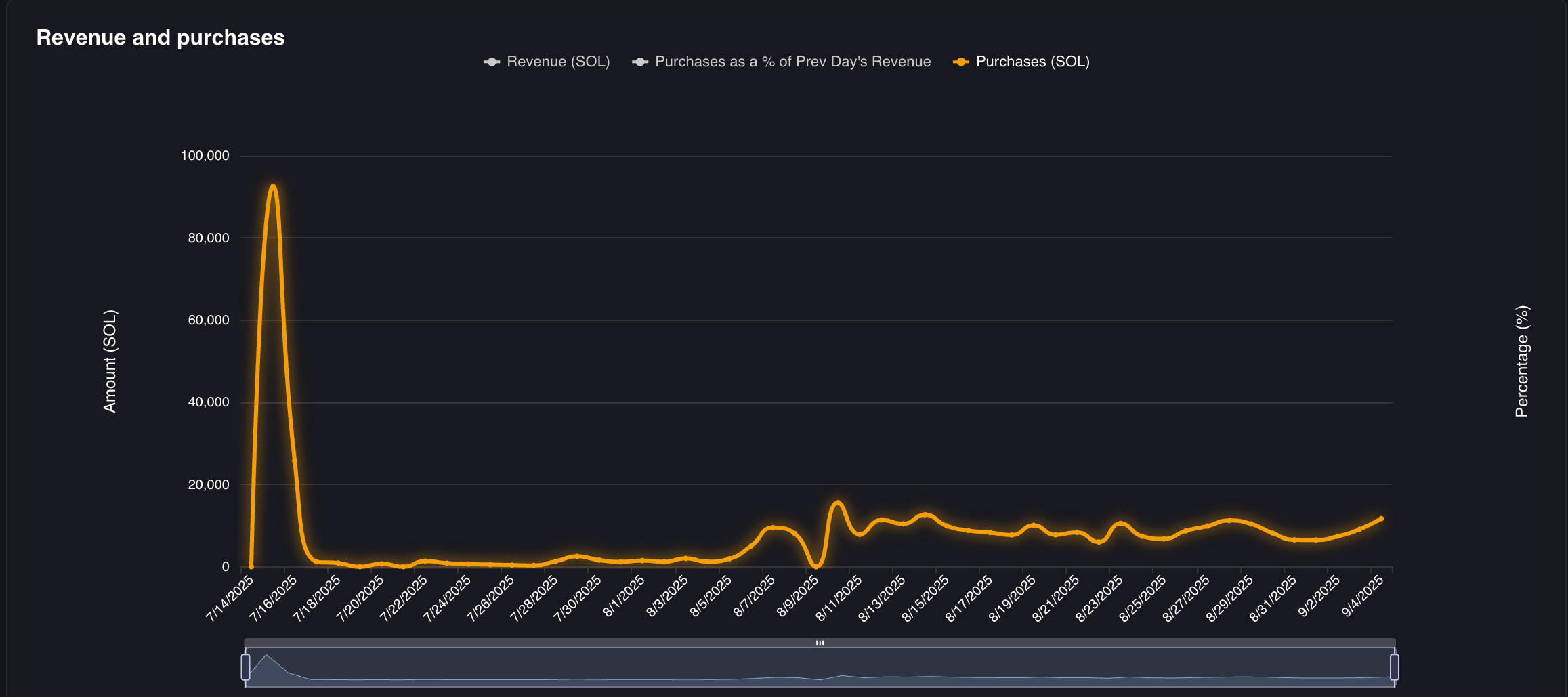

- The positive sentiment around MemeCore could find a way of moving back to Solana-based memecoin platform Pump.fun, whose $15.8 million in daily revenue in January has tumbled to between $1.5 million and $2.5 million this week.

Derivatives Positioning

- Ether's open interest in USDT and dollar-denominated perpetual contracts on major exchanges declined to 1.93 million ETH, a four-week low. This capital outflow raises questions about the sustainability of ETH's nearly 18% gain over the period.

- Except for LINK and BTC, open interest declined across the top 10 tokens. OI in major Solana perpetuals slipped below 11 million SOL, threatening to invalidate the four-week uptrend.

- BTC futures activity on the CME remains subdued, but options are heating up, with open interest rising to 47.23K BTC, the highest since April. The notional OI has risen to $5.21 billion, the most since November. Some traders have been buying cheap out-of-the-money puts, prepping for a potential hotter-than-expected U.S. nonfarm payrolls (NFP) report.

- Consistent with trends on offshore exchanges, Ether’s futures open interest on the CME slipped below 2 million ETH, while the three-month annualized premium rose from 5% to 7%.

- On Deribit, BTC puts continue to trade at a premium to calls across all tenors, pointing to downside concerns.

- The seven-day volatility risk premium has retraced nearly to zero, suggesting that the implied volatility for seven days is now roughly equal to the realized volatility. In other words, investors aren't expecting a premium to hedge against future volatility spikes, despite the U.S. jobs data due later today.

- In ETH's case, puts are trading at a premium to calls out to the end-November expiry.

- Block flows on the OTC desk at Paradigm have been mixed, with a BTC $116K call lifted alongside an ether $4K put.

Market Movements

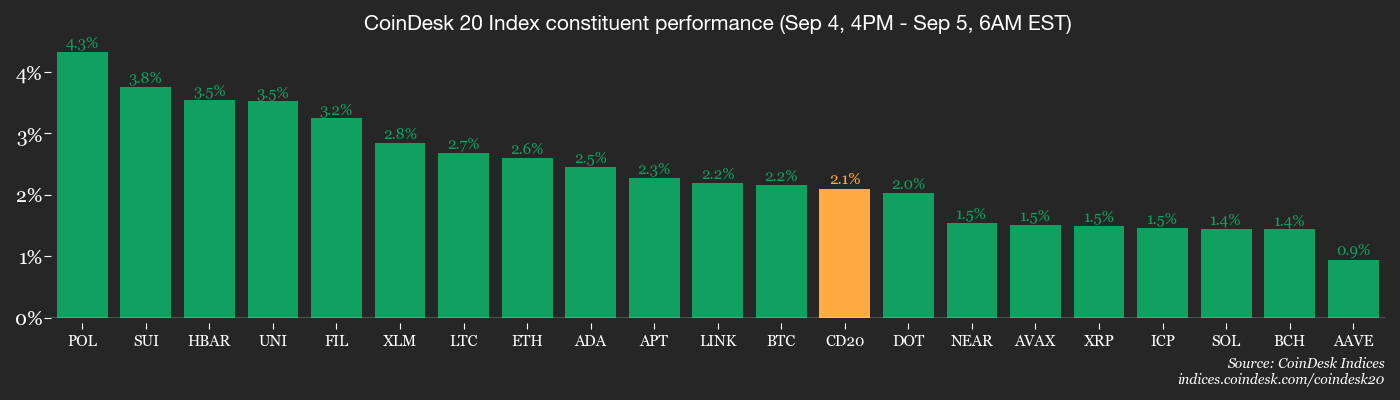

- BTC is up 1.71% from 4 p.m. ET Thursday at $112,306.62 (24hrs: +1.4%)

- ETH is up 2.14 at $4,398.33 (24hrs: -0.19%)

- CoinDesk 20 is up 1.85% at 4,050.32 (24hrs: +0.28%)

- Ether CESR Composite Staking Rate is up 1 bps at 2.88%

- BTC funding rate is at 0.0015% (1.6425% annualized) on KuCoin

- DXY is down 0.35% at 98.00

- Gold futures are unchanged at $3,609.80

- Silver futures are unchanged at $41.42

- Nikkei 225 closed up 1.03% at 43,018.75

- Hang Seng closed up 1.43% at 25,417.98

- FTSE is up 0.26% at 9,241.13

- Euro Stoxx 50 is up 0.18% at 5,356.16

- DJIA closed on Thursday up 0.77% at 45,621.29

- S&P 500 closed up 0.83% at 6,502.08

- Nasdaq Composite closed up 0.98% at 21,707.69

- S&P/TSX Composite closed up 0.57% at 28,915.89

- S&P 40 Latin America closed up 0.49% at 2,770.29

- U.S. 10-Year Treasury rate is down 1.5 bps at 4.161%

- E-mini S&P 500 futures are up 0.21% at 6,524.25

- E-mini Nasdaq-100 futures are up 0.5% at 23,787.25

- E-mini Dow Jones Industrial Average Index are unchanged at 45,664.00

Bitcoin Stats

- BTC Dominance: 58.73% (unchanged)

- Ether to bitcoin ratio: 0.03914 (0.82%)

- Hashrate (seven-day moving average): 973 EH/s

- Hashprice (spot): $52.48

- Total Fees: 4.86 BTC / $537,022

- CME Futures Open Interest: 133,775 BTC

- BTC priced in gold: 31.6 oz

- BTC vs gold market cap: 8.92%

Technical Analysis

- The ether-bitcoin (ETH) ratio is looking to top the Ichimoku cloud on the weekly chart. Crossovers above the cloud are said to confirm a bullish shift in momentum.

- The pair has already topped the descending trendline, characterizing the three-year-long downward trend.

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $306.80 (+1.49%), +1.53% at $311.49 in pre-market

- Circle (CRCL): closed at $117.49 (-0.82%), +0.54%% at $118.12

- Galaxy Digital (GLXY): closed at $22.91 (-6.07%), +1.27% at $23.20

- Bullish (BLSH): closed at $49.01 (-9.68%), +1.27%% at $49.63

- MARA Holdings (MARA): closed at $15.11 (-4.91%), +1.52% at $15.34

- Riot Platforms (RIOT): closed at $13.16 (-2.16%), +1.98% at $13.42

- Core Scientific (CORZ): closed at $113.62 (+0.29%)

- CleanSpark (CLSK): closed at $9.08 (-3.81%), +1.1% at $9.18

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.17 (-4.98%)

- Exodus Movement (EXOD): closed at $29.17 (-0.08%), +2.84% at $25.00

- Strategy (MSTR): closed at $327.59 (-0.81%), +2.2% at $334.86

- Semler Scientific (SMLR): closed at $13.62 (+0.29%)

- SharpLink Gaming (SBET): closed at $15.43 (-8.26%), +2.53% at $15.82

- Upexi (UPXI): closed at $6.33 (-4.52%), +2.69% at $6.50

- Mei Pharma (MEIP): closed at $4.27 (-5.74%), +1.87% at $4.35

ETF Flows

Spot BTC ETFs

- Daily net flows: -$222.9 million

- Cumulative net flows: $54.63 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: -$167.3 million

- Cumulative net flows: $13.19 billion

- Total ETH holdings ~6.52 million

Source: Farside Investors

Chart of the Day

- The chart shows the Solana memecoin launchpad Pump.fun's purchases of its native token, PUMP.

- The platform snapped up $12,192,383 in PUMP tokens last week, offsetting the total circulating supply by over 5%.

While You Were Sleeping

- Stablecoin Group Tether Holds Talks to Invest in Gold Miners (Financial Times): Tether, which already holds $8.7 billion in gold bars, is considering investments across the gold supply chain, with its CEO saying the metal is a complement to bitcoin.

- Bitcoin Bulls Should Keep an Eye Out for Spike In Key Bond Market Index (CoinDesk): The recent sharp rise in the MOVE index, a key gauge of volatility in U.S. Treasuries, often signals tighter liquidity, which curbs demand for risk assets such as bitcoin.

- Bitcoin Hits $113K as BTC Dominance Approaches Two-Week High of 59% (CoinDesk): Bitcoin’s move came as $3.28 billion in options expired at 08:00 UTC on Deribit near Friday’s $112,000 “max pain” point, where options buyers face the biggest losses.

- Hong Kong’s Digital Bond Market Gains Steam With Fresh Offerings (Bloomberg): Digital bonds, debt securities that use the blockchain for issuance, trading and settlement, are gaining traction in Hong Kong, with the government offering subsidies of up to HK$2.5 million ($320,500) per offering.

- Venezuelan Military Aircraft Fly Near U.S. Warship in ‘Provocative Move’, Pentagon Says (Reuters): Venezuela’s action followed two days after a U.S. strike on a Venezuelan boat allegedly carrying narcotics killed 11, an act criticized by some legal scholars and one Democratic congresswoman.

- Bitcoin Crash Brewing? Trader Plans Bids at $94K, $82K for Potential Market Freakout (CoinDesk): The president of Spectra Markets sees bitcoin at an inflection point, citing fading bullish drivers, a bearish double top and halving cycle history as reasons for placing bids at $94,000 and $82,000.

In the Ether