XRP Symmetrical Triangle Tightens Under $3.00 - $3.30 Breakout Imminent

XRP coils beneath key resistance as symmetrical triangle pattern signals major move ahead.

Technical Tension Builds

The pattern's converging trendlines squeeze price action between support and resistance—classic consolidation before explosive volatility. Traders eye the $3.30 level as the definitive breakout threshold.

Market Psychology at Play

Every symmetrical triangle whispers the same question: breakout or breakdown? With XRP trading under $3.00, the bulls need volume to confirm the upside—because in crypto, patterns either print profits or become hindsight excuses for bad trades.

Breakout or Fakeout?

Watch for sustained closes above $3.30 to validate the bullish scenario. Fail here, and it's just another chart pattern doomed by the crypto market's addiction to disappointing over-leveraged speculators.

News Background

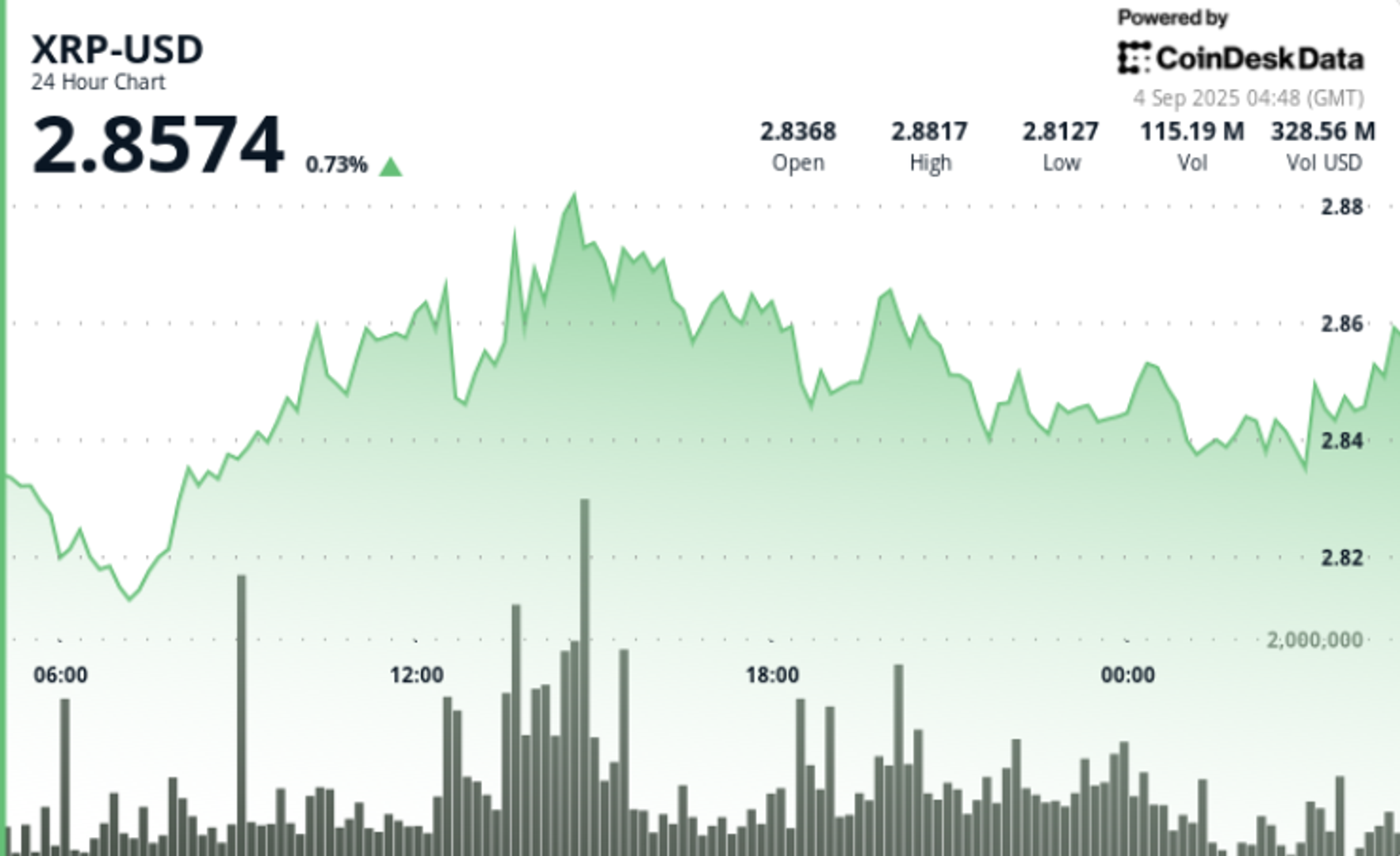

- XRP traded in a narrow 2% range from $2.81 to $2.87 during the 24h session from Sept. 2 at 14:00 to Sept. 3 at 13:00.

- Large wallets accumulated roughly 340M XRP (~$960M) over the past two weeks even as institutions liquidated ~$1.9B since July.

- Total transaction volume across the XRP Ledger reached 2.15B XRP on Sept. 1, more than double typical daily activity.

- Analysts remain split: some highlight long-term bullish structures (symmetrical triangles, Elliott Wave counts) with upside toward $7–$13, while others warn of fading momentum below multi-year resistance trendlines.

Price Action

- XRP opened near $2.84 and closed at $2.85, up slightly despite intraday volatility.

- Price dipped early from $2.84 → $2.79, then rebounded to $2.87 by midday on Sept. 3.

- Support developed at $2.82, repeatedly attracting bids.

- Resistance capped upside near $2.86, where distribution pressure intensified.

- Final-hour trading saw a reversal: a spike to $2.873 (12:38 GMT) on 5.38M volume was rejected, pushing price back under $2.85.

Technical Analysis

- Support: $2.82 zone remains the key demand area. Below that, $2.70 and $2.50 are next.

- Resistance: $2.86–$2.88 continues to act as overhead supply. $3.00 is the psychological hurdle, with $3.30 as breakout confirmation.

- Momentum: RSI steady in mid-50s, showing neutral bias with slight bullish lean.

- MACD: Histogram converging toward bullish crossover, signaling momentum could strengthen if volume persists.

- Patterns: Symmetrical triangle consolidation under $3.00 intact. Break above $3.30 unlocks higher targets.

- Volume: Session surges (93M–95M vs 44M avg) point to active institutional flows.

What Traders Are Watching

- Whether $2.82 support holds under renewed pressure.

- A decisive close above $2.86–$2.88, then $3.00 and $3.30 for a breakout setup.

- Whale flows: continued accumulation versus ongoing institutional selling.

- Regulatory and macro catalysts, including Fed policy and pending SEC clarity, which could shift sentiment quickly.