XRP Nears $3 Breakout as RSI and MACD Flash Bullish Signals

XRP coils beneath the $3 resistance level—technical indicators suggest an explosive move approaches.

RSI and MACD Alignment

The Relative Strength Index hovers near overbought territory while MACD shows strengthening bullish momentum. Traders watch for convergence patterns that typically precede major price movements.

Market Psychology at Play

Consolidation at these levels indicates accumulation—smart money positioning before the next leg up. Retail hesitation creates the perfect setup for a violent breakout that leaves latecomers chasing.

Because nothing says 'financial revolution' like watching traders stare at colored lines on screens while hoping the SEC doesn't tweet something mean.

News Background

- Whales accumulated about 340M XRP (~$960M) over the last two weeks. This offsets broader selling pressure and shows longer-horizon conviction.

- September is often a weak month for crypto. Macro uncertainty around central bank policy and growth outlook continues to pressure risk assets.

- On-chain and trading activity stayed elevated. Early in the session volumes ran well above normal, then cooled as the day progressed. The pattern matches institutional-led buying in the open and retail-driven trading into the close.

Price Action

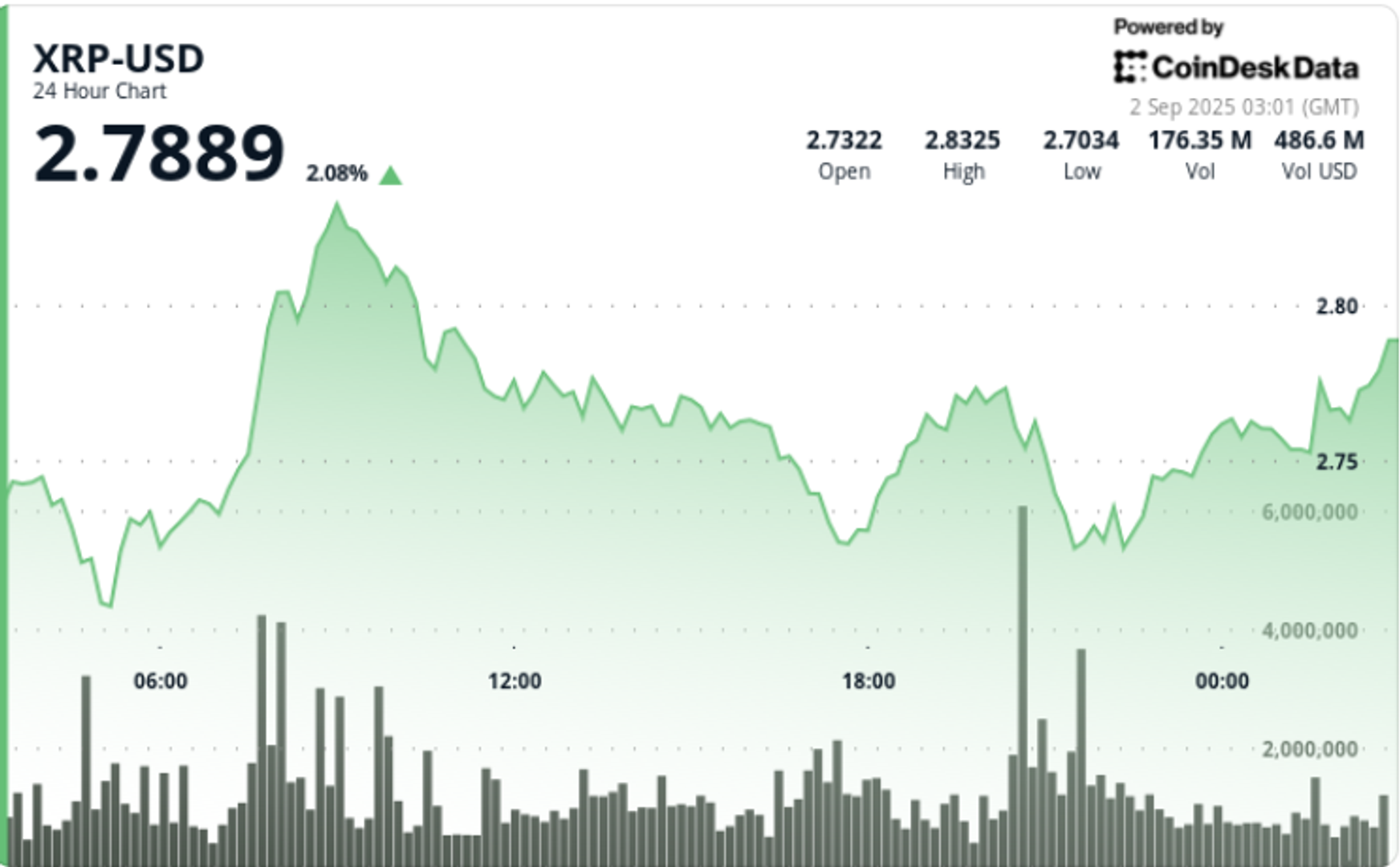

- Window: Sept. 1, 14:00 → Sept. 2, 13:00 (24h).

- Range: $2.70–$2.83, about a 4% swing. Price tagged $2.71 around 21:00 before rebounding to highs near $2.83.

- Volume: Surged to 101.36M and 93.66M in bursts, compared with a 24h average of 65.49M. Weekly pace was about 19% higher than average.

- Levels: A base formed at $2.70–$2.72. Repeated rejection near $2.83 capped the upside. The session ended consolidating just under resistance.

Technical Analysis

- Support: $2.70–$2.72 with volume-backed demand. Secondary levels at $2.65 and $2.50 if stress builds.

- Resistance: $2.83 near term. Above that, $3.00 psychological and $3.30 structural breakout levels.

- Momentum: RSI in the mid-50s, showing neutral-to-bullish conditions.

- MACD: Histogram is converging toward a bullish crossover. This would confirm constructive momentum if volumes remain high.

- Patterns: A symmetrical triangle is forming under $3.00. A sustained move above $3.30 could target $4.00 and beyond. Intraday higher lows point to continued accumulation.

- Flows: Early heavy prints suggest institutional buying. Later fades show retail profit-taking under resistance.

What Traders Are Watching

- A breakout above $2.83 and then $3.00. A clean close through $3.30 is needed for upside extension.

- Whether $2.70–$2.72 support holds. A close below this range shifts focus to $2.50.

- Confirmation from RSI moving above 60 with a MACD cross on rising volume.

- Ongoing whale accumulation and whether it can absorb further September weakness.