Chinese Stock Margin Debt Hits Record High - Fueling Global Risk-On Rally and Bitcoin Surge

Margin debt on Chinese exchanges just smashed through all-time highs—and that's sending shockwaves across global markets.

The Leverage Effect

When traders borrow big to buy stocks, it screams confidence—or sheer recklessness. This surge in Chinese margin funding isn't just a local story. It's lighting a fire under risk assets worldwide.

Bitcoin's Riding the Wave

Digital gold's catching bids as speculation heats up. No surprise—when leverage flows, crypto often goes. Bitcoin's acting like the ultimate risk-on proxy, again.

Global Dominoes

From Hong Kong to Wall Street, traders are watching Shanghai's margin numbers like hawks. High leverage there usually means higher volatility everywhere. And volatility? That's just opportunity with a different haircut.

Because nothing says 'healthy market' like borrowed money chasing overpriced assets—classic finance, just with more zeros.

Moderate risk-on in crypto

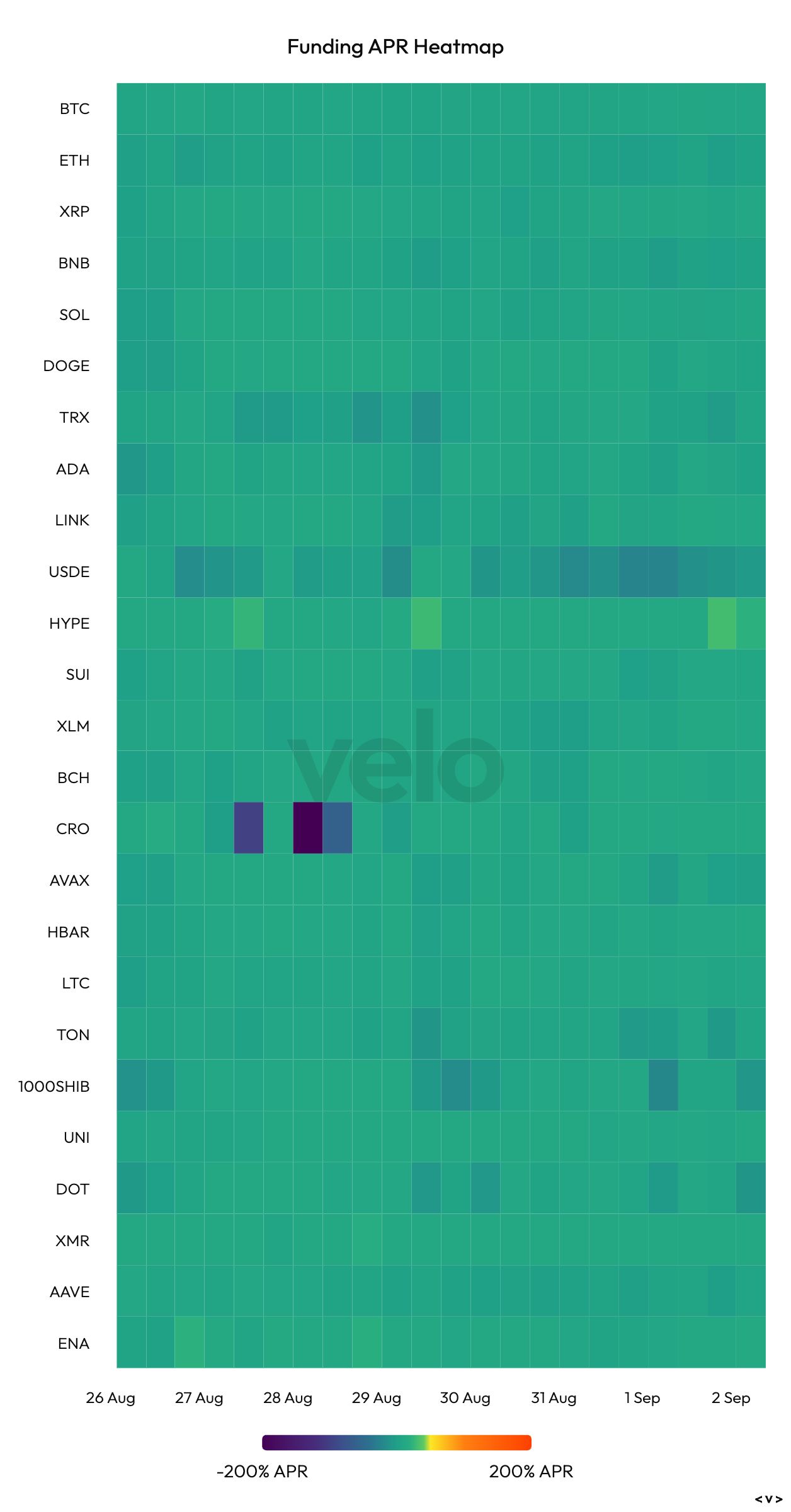

While there is no standardized metric to measure margin debt across the entire crypto industry, traders often use perpetual funding rates as a proxy to gauge overall demand for leverage. These rates indicate the cost of holding Leveraged positions and reflect market sentiment toward risk.

Currently, funding rates for the top 25 cryptocurrencies are hovering between 5% and 10%, signaling a moderate level of bullish leverage among traders. This suggests that while there is demand for leveraged long positions, market participants remain cautious, striking a balance between Optimism and risk management.