XRP Volatility Explodes While Defending $2.77 Support—What’s Next for the Crypto?

XRP's price swings widen dramatically as it clings to a critical support level—traders brace for the next big move.

Testing the Floor

XRP bulls dig in at $2.77, turning the level into a battleground. Hold that line, and momentum could surge. Break it, and things get messy fast.

Market Mood Swings

Volatility isn’t just noise—it’s opportunity. Or panic, depending which side of the trade you’re on. Sharp moves trigger liquidations, fuel speculation, and keep everyone glued to charts.

What’s Next?

Watch for a decisive close above or below support. A bounce could target previous highs; a breakdown might invite a deeper correction. Either way, expect fireworks—because when has crypto ever done anything quietly? (Besides, what’s a little chaos between friends who enjoy leveraged bets?)

News Background

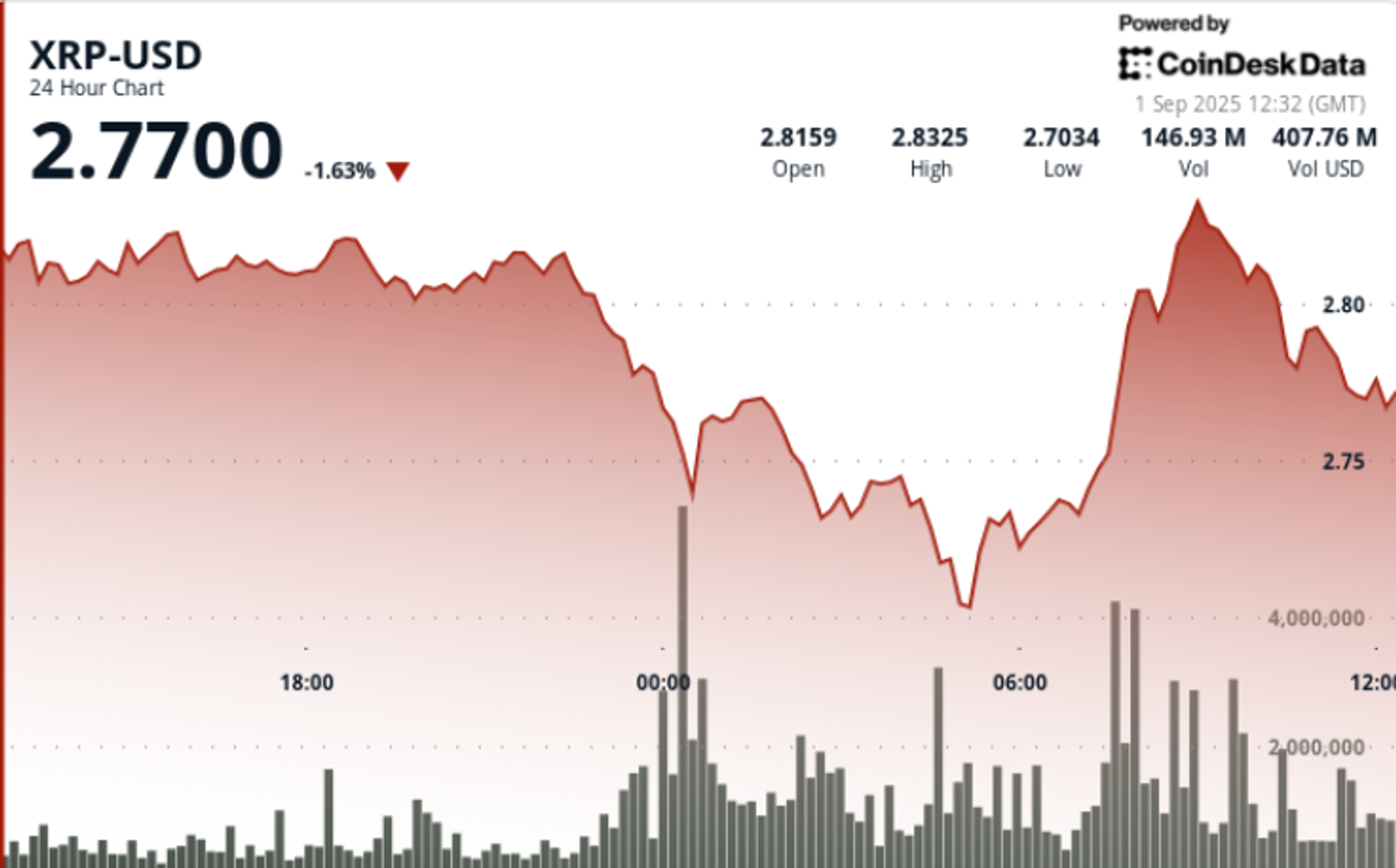

- XRP fell from $2.80 to $2.70 during late Aug. 31–early Sept. 1 before rebounding to $2.82 on heavy volumes.

- Whales accumulated 340M XRP over two weeks, a signal of institutional conviction despite short-term bearish pressure.

- On-chain activity spiked with 164M tokens traded during the Sept. 1 morning rebound, more than double session averages.

- September remains a historically weak month for crypto, but whale accumulation is viewed as a counterbalance to retail liquidation flows.

Price Action Summary

- Trading range spanned $0.14 (≈4.9%) between $2.70 low and $2.84 high.

- The steepest decline came at 23:00 GMT on Aug. 31, as price slid from $2.80 to $2.77 on 76.87M volume, nearly 3x daily averages.

- At 07:00 GMT Sept. 1, bullish flows drove a rebound from $2.73 to $2.82 on 164M volume, cementing $2.70–$2.73 as near-term support.

- Final hour consolidation (10:20–11:19 GMT) saw price slip 0.71% from $2.81 to $2.79, with heavy selling between 10:31–10:39 on 3.3M volume per minute, confirming resistance at $2.80–$2.81.

Technical Analysis

- Support: $2.70–$2.73 floor repeatedly defended, reinforced by whale buying.

- Resistance: $2.80–$2.84 remains the rejection zone, with $2.87–$3.02 as the next upside threshold.

- Momentum: RSI near mid-40s after rebound, showing neutral-to-bearish bias.

- MACD: Compression phase continues; potential crossover if accumulation persists.

- Patterns: Symmetrical triangle forming with volatility compression; breakout path remains open toward $3.30 if resistance clears.

What Traders Are Watching

- If $2.70–$2.73 holds, short-term traders will treat it as a springboard for $2.84 retests.

- A close above $2.84 would put $3.00–$3.30 back in play.

- Downside scenario: breach of $2.70 exposes $2.50 as next structural support.

- Whale accumulation vs. institutional selling — the push-pull dynamic that could dictate September direction.