Gold’s Explosive Rally Unleashes Massive Catalyst - And Bitcoin Stands to Soar Alongside

Gold just triggered a seismic shift in macro sentiment - and Bitcoin's poised to ride the wave.

The Safe-Haven Surge

When traditional markets wobble, investors stampede toward proven stores of value. Gold's breakout rally signals deepening institutional anxiety about fiat systems and monetary policy experiments. That same fear fuels Bitcoin's flight-to-safety narrative.

The Inflation Hedge Playbook

Gold's momentum isn't happening in isolation. It's responding to the same macroeconomic pressures that drive crypto adoption - currency debasement, negative real yields, and institutional diversification demands. Smart money doesn't just buy gold; it builds balanced portfolios with uncorrelated assets.

The Digital Gold Narrative Accelerates

Bitcoin increasingly functions as gold 2.0 - portable, verifiable, and immune to central bank printing presses. When gold rallies on monetary uncertainty, Bitcoin catches the bid. It's the same trade with different technology.

Traditional finance finally understands what crypto natives knew for years: you can't print scarcity. Gold's rally proves the thesis, and Bitcoin executes it better. Sometimes the oldest stores of value pave the way for the newest - even if Wall Street still can't decide whether to call it an asset class or a revolution.

Meanwhile, the relative resilience of longer-duration yields is attributed to expectations of sticky inflation and other factors, which also support the bullish case in gold and BTC.

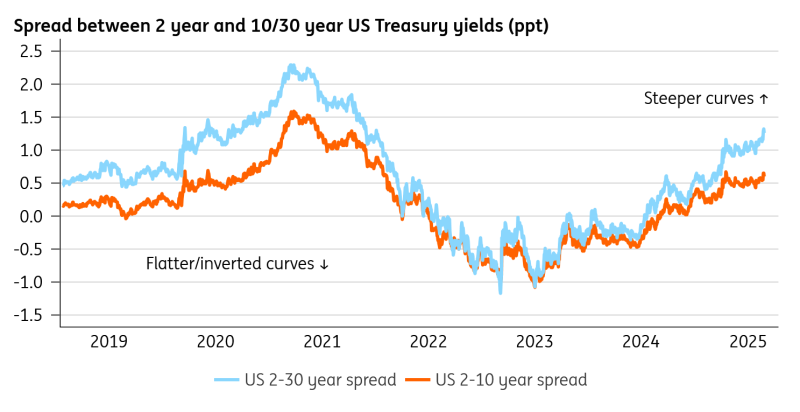

"The U.S. Treasury curve has unsurprisingly steepened: lower rates today risk inflaming inflation further ahead, which is bad news for bonds," analysts at ING said in a note to clients Friday.

Hansen explained that much of the relative resilience in the 10-year yield stems from inflation breakevens, currently at around 2.45%, and the rest represents the real yield.

"[It] signals that investors are demanding greater compensation for fiscal risks and potential political interference with monetary policy. This environment typically supports gold as both an inflation hedge and a safeguard against policy credibility concerns," Hansen noted.

The nominal yield is made up of two components: Firstly, the inflation breakeven, which reflects the market's expectation for average inflation over the bond's maturity. This portion of the yield compensates for the loss of purchasing power due to inflation. The second component is the real yield, which represents the additional compensation that purchasers demand above and beyond inflation.

Bull steepening is bearish for stocks

Historically, gold and gold miners have been among the best performers during prolonged periods of bull steepening in the yield curve, according to analysis by Advisor Perspectives. Conversely, stocks tend to underperform in these environments.

Overall, bitcoin finds itself in an intriguing position, given its dual nature as an emerging technology that often moves with the Nasdaq, while also sharing gold-like qualities as a store of value.