Corporate Bitcoin Demand Explodes: Businesses Gobble Up BTC at 4x Mining Rate

Wall Street's appetite for Bitcoin just hit hyperdrive—and the math doesn't lie.

River's latest research reveals corporations are absorbing Bitcoin at quadruple the rate it's being mined. That's right: for every new Bitcoin created, institutions are snapping up four.

Supply Shock Incoming

This isn't just growing interest—it's a full-scale supply squeeze. With fixed issuance and accelerating corporate adoption, available coins are vanishing faster than ever.

Traditional finance giants finally woke up to what crypto natives knew all along: digital gold beats printed paper. Though let's be honest—they're probably just trying to hedge against their own inflationary policies.

Get ready for the next leg up. When demand outpaces supply this dramatically, only one thing happens next.

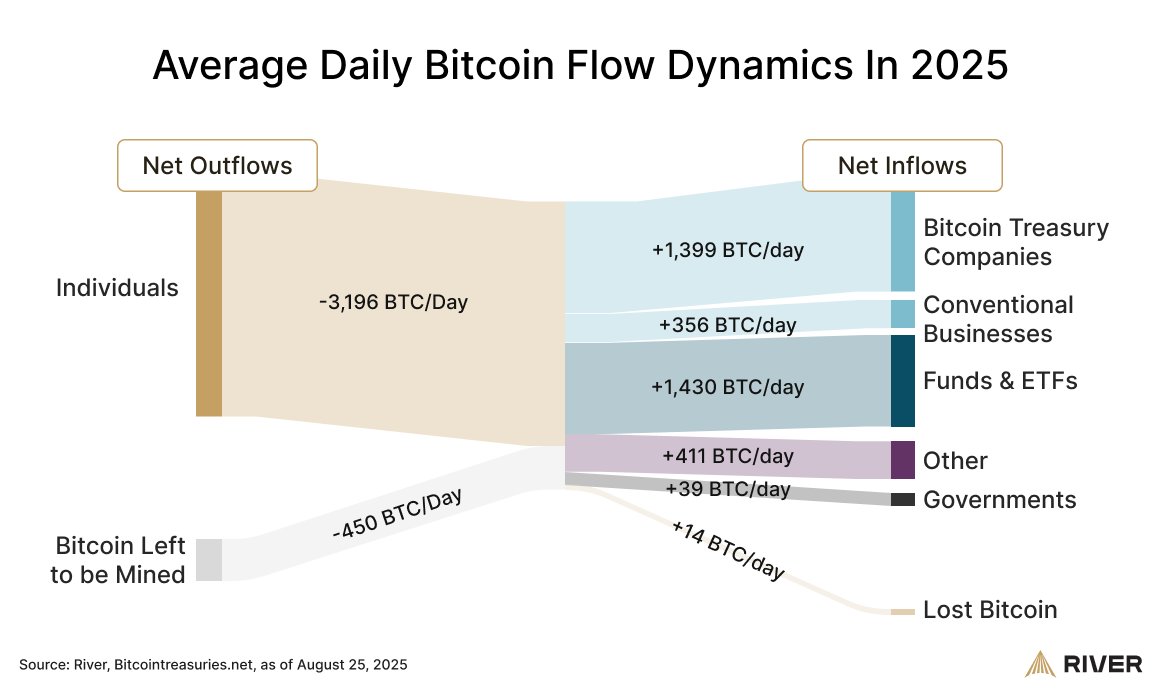

River defines “businesses” broadly. The category combines bitcoin treasury companies — firms such as Strategy that publicly hold BTC — with conventional companies that keep bitcoin on their balance sheets. Based on public filings, custodial address tagging and its own heuristics, River estimates that about 1,755 BTC per day FLOW into business-controlled wallets.

By comparison, River calculates new miner supply at about 450 BTC per day in 2025. That figure reflects the April 2024 halving, which cut the block subsidy to 3.125 BTC per block.

With bitcoin blocks averaging one every 10 minutes — about 144 per day — the result is roughly 450 BTC in new issuance daily, though the exact number fluctuates slightly as block times vary.

That math is the basis for River’s claim that companies are absorbing bitcoin at nearly four times the rate it is mined.

The infographic shows other large institutional inflows as well.

Funds and ETFs account for about 1,430 BTC/day in net inflows, which further boosts total absorption compared with new issuance. Smaller streams go to “other” entities (about 411 BTC/day) and governments (about 39 BTC/day).

River also records a small but steady Flow into “lost bitcoin” (about 14 BTC/day), representing coins that the firm judges to be permanently inaccessible, such as through key loss.

On the other side of the ledger, individuals appear as the largest net outflow at about –3,196 BTC/day. River stresses that this does not necessarily mean retail investors are dumping coins. Rather, it reflects bitcoin moving from addresses the firm classifies as individual-held into those it tags as institutional.

River says the takeaway is simple: when inflows to businesses and funds exceed new issuance from miners, available supply tightens. Still, the firm cautions that the infographic should be read carefully.

First, the figures are estimates, not an exact census of the blockchain.

River relies on a mix of wallet tagging, public disclosures and external databases, which may miss some holdings or misclassify certain addresses. Second, net inflows do not always equal direct spot buying. A business wallet showing +1,755 BTC per day could reflect OTC transactions, custodial transfers or treasury reshuffling, not just exchange purchases.

For readers unfamiliar with flow diagrams, the point is this: the lines show where coins are ending up on balance, not every trade or transfer in the system. If more coins consistently end up in business, fund and government wallets than miners are producing, River argues that institutions are tightening supply at the margin.

River’s snapshot is not a price forecast, but it illustrates how ownership patterns may be shifting. If businesses and funds continue to absorb more than miners produce, the firm argues, institutions could play a larger role in shaping bitcoin’s supply dynamics.