Bitcoin Under Siege: Critical Support Levels Tested as Pressure Mounts Below Key Cost Bases

Bitcoin's foundation cracks as it struggles beneath crucial price floors—traders watch nervously while institutions recalculate their exposure.

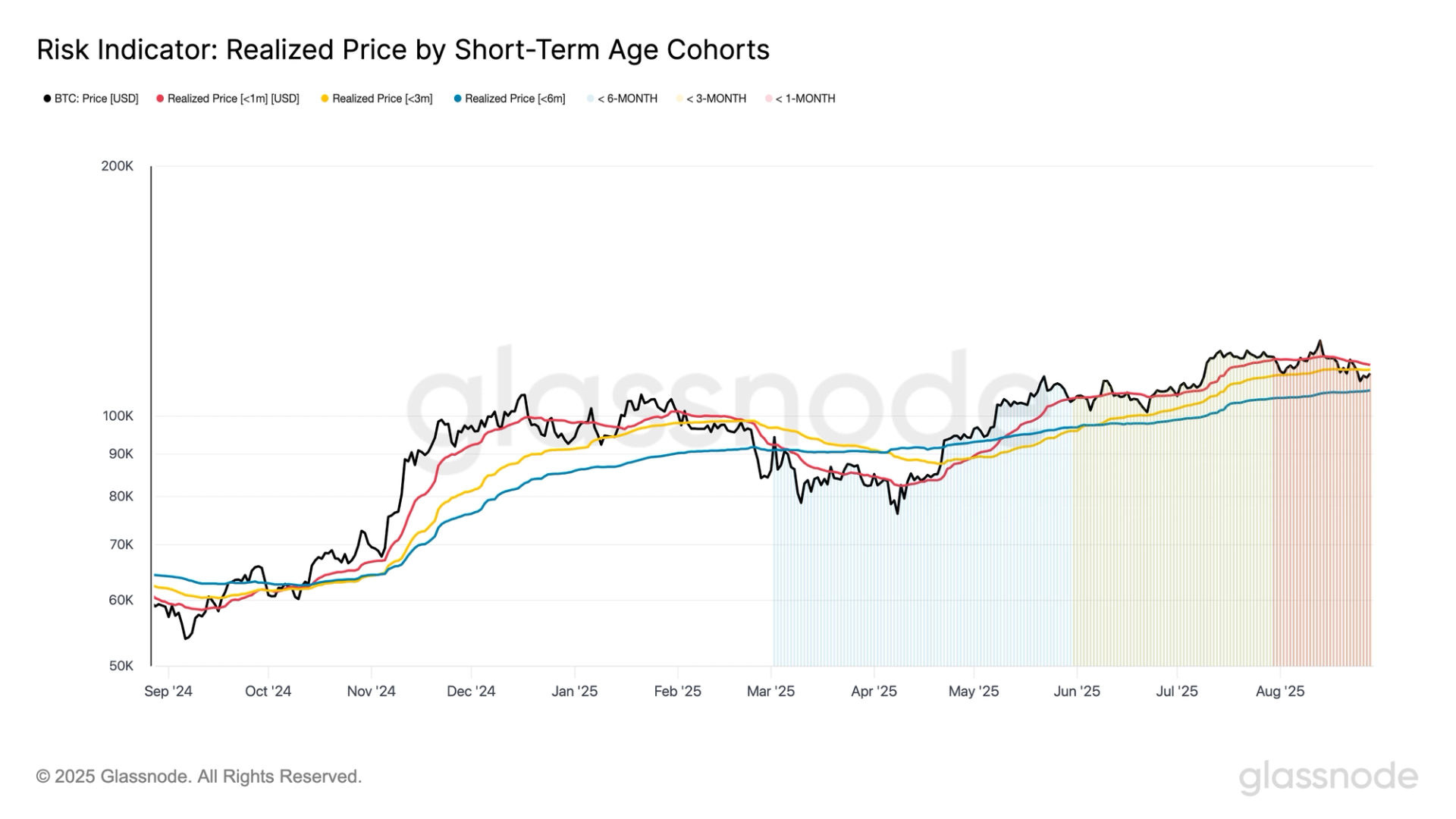

The Gravity of Support Levels

When Bitcoin dips below its key cost bases, it doesn't just spook retail—it sends quakes through mining operations and ETF flows alike. These levels aren't just numbers on a chart; they're psychological battlegrounds where hodlers make their stand or cut their losses.

Market Mechanics Under Stress

Liquidity thins out, leverage gets unwound, and suddenly everyone remembers that crypto doesn't sleep—it just bleeds across time zones. Trading desks increase hedging activity while long-term holders reassess their conviction against worsening technical structures.

The Institutional Dilemma

Even Wall Street's finest can't spin this as 'accumulation opportunity' when their own cost basis models flash red. Nothing brings traditional finance players back to reality quite like underperforming their own vault fees—talk about adding insult to injury.