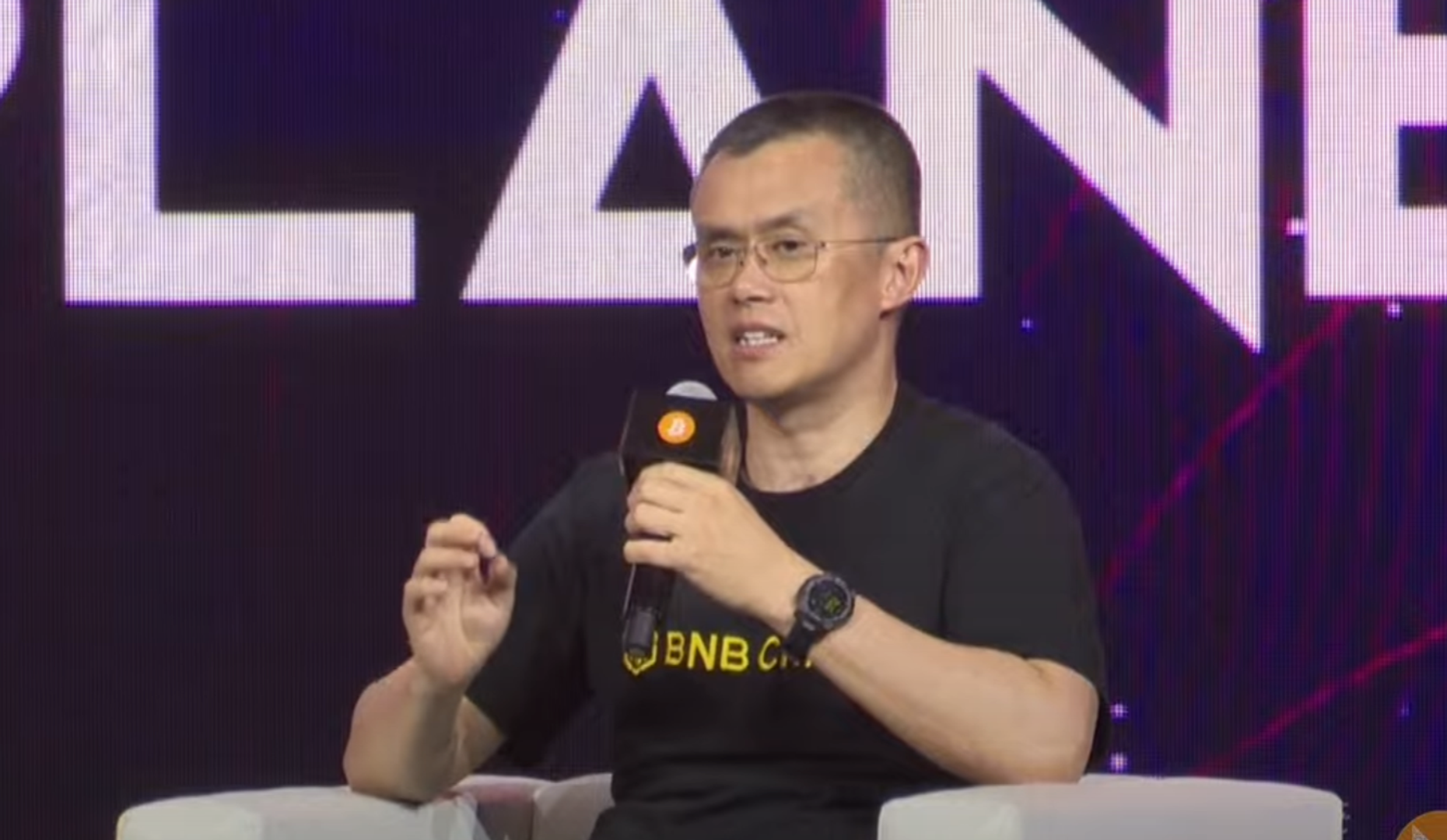

Public Token Treasuries and Tokenization are Fantastic for Crypto, But Risks Remain, Binance’s CZ Says

Token treasuries and asset tokenization are revolutionizing corporate finance—but Binance CEO Changpeng Zhao warns the explosive growth comes with serious caveats.

CZ's Bullish Vision

The Binance chief champions tokenized treasuries as crypto's gateway to mainstream legitimacy. Corporations holding digital assets? That's not speculation—it's strategic balance sheet optimization.

Hidden Pitfalls in Paradise

Regulatory gray zones threaten to derail progress. Volatility doesn't disappear just because assets go on-chain. And let's be honest—some treasurers still think 'DeFi' is a typo.

The Institutional Floodgates

Traditional finance giants are finally playing with digital legos. Tokenization bridges old money with new technology—creating efficiencies that make bankers blush and legacy systems weep.

Risk Management or Russian Roulette?

Smart contracts aren't foolproof. Oracle failures remain the silent killer of tokenized dreams. And nothing ruins a board meeting faster than explaining why your corporate treasury just got flash-loan attacked.

Future-Proof or Fashion Statement?

Tokenization isn't another crypto bubble—it's the plumbing for next-generation finance. But as every Wall Street veteran knows: even the best plumbing can leak when pressure builds.

Tokenization Push

Beyond bitcoin treasuries and ETFs, Zhao pointed to the surge in tokenization of real-world assets (RWAs) as another transformative trend. Stablecoins, treasury bills, commodities, real estate and even personal income streams are being tokenized, funneling “hundreds of millions and billions” into the crypto economy.

“We’re going both ways,” CZ said. “Equity markets now have access to crypto, and we’re bringing real-world assets into crypto. This is fantastic.”

Risks of Overreach

Despite his enthusiasm, CZ warned that not every company pursuing this strategy will succeed.

Some firms may use crypto treasuries as a way to “pump up their stock price,” while others lack the expertise to manage complex baskets of digital assets or investments in crypto startups. Failures are inevitable, he said, especially when markets turn.

“Right now we’re in a bull market,” Zhao said. “But eventually there will be a winter, there will be a bear market. Treasury companies will have to go through at least one cycle.”

MicroStrategy (MSTR), he noted, endured a painful first cycle but benefited later as its average bitcoin cost basis dropped.

Stability vs Speculation

CZ argued that in the long run, larger inflows of capital from institutional and equity markets should reduce volatility.

“Basically, the larger the market cap, the less volatility it has,” he said. “It’s just physics. A bigger ship is more stable.”

But he acknowledged that equity markets are full of speculative traders, meaning short-term volatility could increase even as the overall asset class stabilizes over time.

Beyond bitcoin

While bitcoin remains the centerpiece of most treasury strategies, CZ noted that other tokens are being adopted too — including a recently launched BNB treasury company.

For smaller and newer tokens, however, the risks are magnified. “The more mature the ecosystem, the less risk,” Zhao said. “Newer ones may have higher risk and higher returns, but the established ones are safer bets.”re

For CZ, the fusion of crypto with traditional markets — through bitcoin treasuries, ETFs and tokenized RWAs — is overwhelmingly positive. Still, he urged caution.

“Not every treasury company is going to multiply in value,” he said. “Investors need to evaluate them carefully, understand the risks, and be prepared for cycles.”