Aave Labs Launches Horizon: Institutions Can Now Borrow Stablecoins Against Tokenized Assets

Aave Labs just flipped the institutional lending game on its head—Horizon lets big players use tokenized real-world assets as collateral for stablecoin loans.

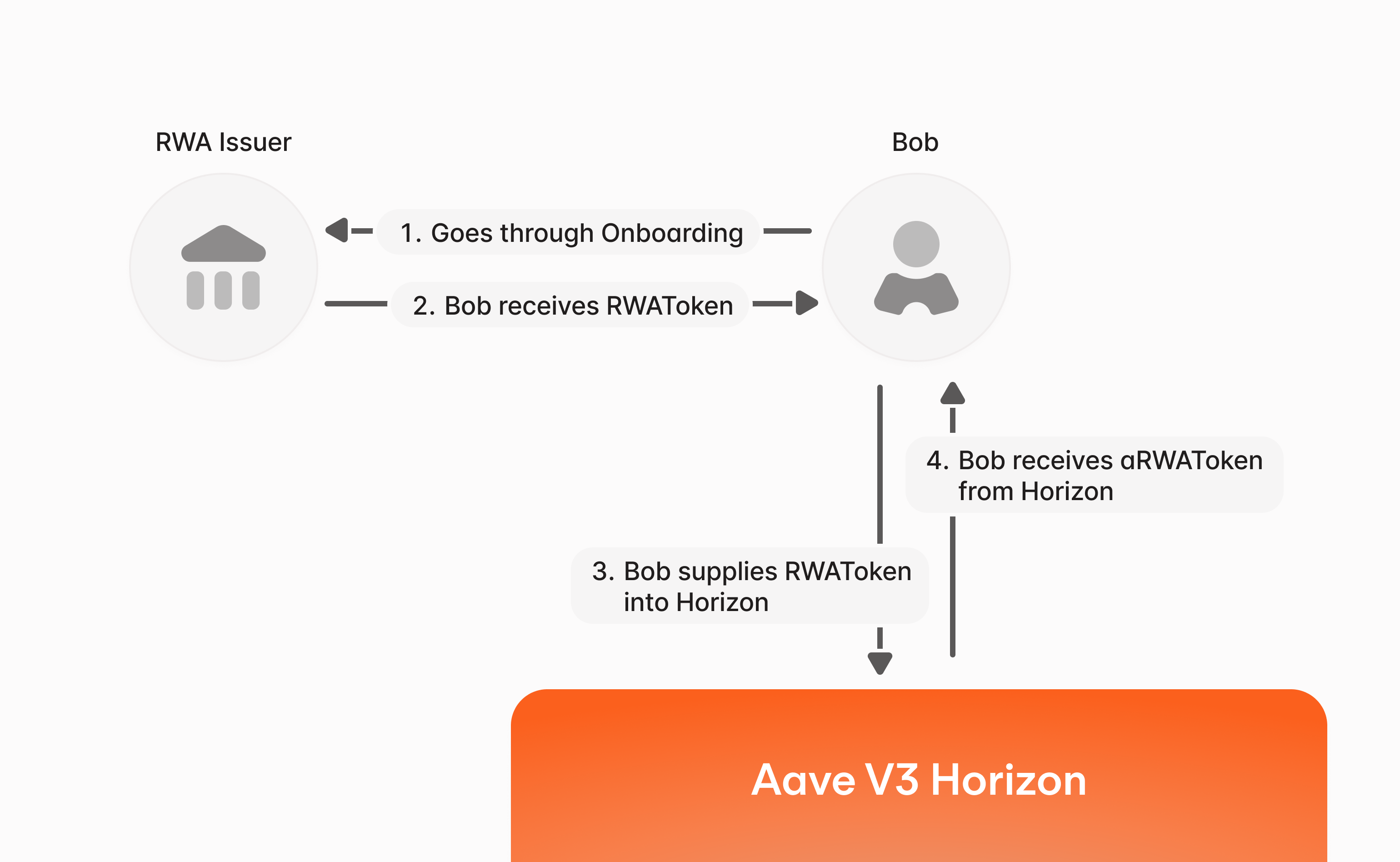

How It Works

Forget traditional finance's slow-moving machinery. Horizon connects tokenized assets—think real estate, commodities, or even fine art—to DeFi liquidity. Institutions lock up tokenized holdings and draw immediate USDC or DAI loans. No banks. No waiting.

Why It Shakes Things Up

This isn’t just another DeFi feature—it’s a bridge between TradFi and crypto. By accepting tokenized RWAs, Aave taps into trillion-dollar markets while giving institutions on-ramps to decentralized liquidity. Suddenly, illiquid assets become working capital.

Fine Print & Finance Jab

Of course, there’s risk. Volatility, oracle dependencies, and the classic 'what-if-the-protocol-gets-a-haircut' scenario. But hey—if banks can lend against overvalued commercial real estate for decades, why not let crypto have a turn?

Chainlink’s oracle services supply real-time pricing data, starting with NAVLink, delivering net asset values of tokenized funds directly on-chain to ensure the loans are appropriately collateralized.

Launch partners include a range of asset issuers including Ethena, OpenEden, Securitize, VanEck, Hamilton Lane and WisdomTree, with plans to expand collateral selection to more tokenized assets.