XRP Futures Explode: CME Open Interest Shatters Records as $3.70 Target Looms

XRP futures just hit unprecedented levels at the CME—traders are piling in as momentum builds toward that crucial $3.70 mark.

Market Pulse: Bulls Take Control

Open interest surges as institutional players position for what could be the next major leg up. No fluff, no filler—just pure speculative energy driving the action.

Price Watch: Eyes on the Prize

Everyone’s watching that $3.70 level like hawks. Break through, and things could get seriously interesting. Hold back, and well… welcome to crypto.

Final Take: Greed or Genius?

Another day, another record—because nothing says 'healthy market' like leveraged bets stacked to the moon. Onward and upward, until the music stops.

News Background

- CME Group said its crypto futures suite has surpassed $30 billion in notional open interest for the first time, with SOL and XRP futures each crossing $1 billion. XRP became the fastest contract to hit the milestone, doing so in just over three months.

- The development is viewed as a signal of market maturity and new institutional capital entering derivatives.

- Broader crypto markets remained firm into late August, though regulatory overhang in the U.S. has continued to pressure XRP relative to peers.

- Corporate adoption trends and pilot remittance programs keep XRP in focus for treasury desks, even as volatility spikes test investor conviction.

Price Action Summary

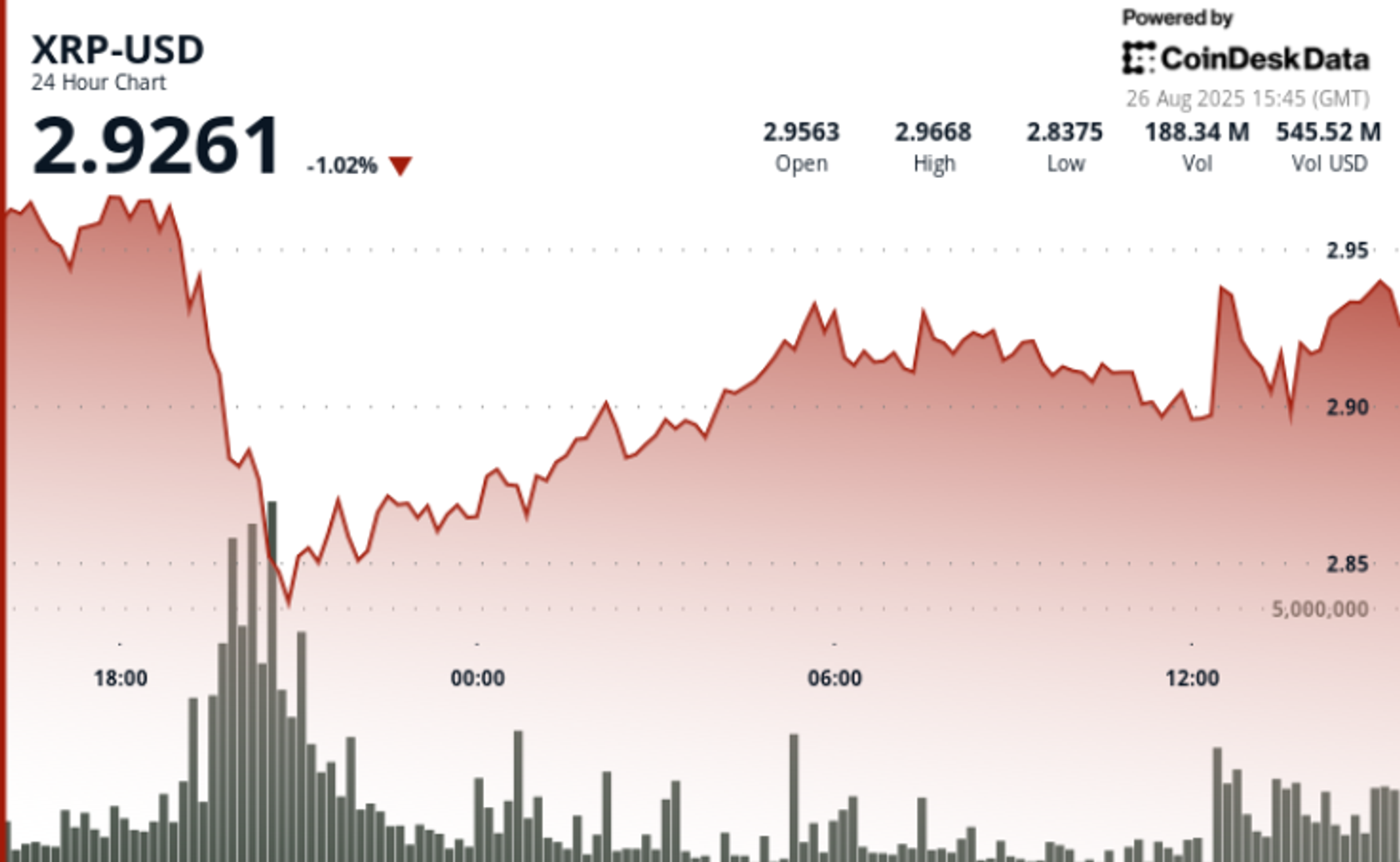

- XRP traded through a 5% range between $2.98 and $2.84 in the 24-hour session ending August 26 at 14:00.

- The steepest move occurred on August 25 during evening hours, when XRP dropped from $2.96 to $2.84 on 217.58 million tokens — triple its 72.45 million daily average.

- The token rebounded to $2.92, with the $2.84 level emerging as critical support as institutional flows stepped in.

- In the final hour of trading, XRP rose 0.7% from $2.90 to $2.92 on more than 5.7 million volume, signaling fresh corporate and fund participation.

Technical Analysis

- Support confirmed at $2.84 with high-volume absorption of sell pressure.

- Resistance remains at $2.94–$2.95, with repeated profit-taking capping upside attempts.

- RSI climbed from oversold 42 back into mid-50s, suggesting stabilizing momentum.

- MACD histogram tightening, indicative of potential bullish crossover in coming sessions.

- Weekly momentum divergence patterns point to compressed volatility, setting up for a directional breakout.

- Order books show concentrated institutional bids above $3.60, signaling strategic positioning ahead of regulatory catalysts.

What Traders Are Watching

- Bulls see $3.70 as the next upside target if $2.90–$2.92 base holds.

- Bears flag $2.80 as the downside trigger, with a break below support likely to accelerate losses.

- Derivatives flows now dominate the backdrop: CME’s $1B open interest in XRP futures will be a key barometer of institutional conviction.