Whale Accumulation Sparks Dogecoin’s Stunning V-Shaped Rebound From $0.21 Lows

Big money moves trigger meme coin's dramatic reversal

Whale Watching Pays Off

Major holders snapped up DOGE at bargain prices, fueling a textbook V-shaped recovery that left retail traders scrambling to catch up. The pattern emerged after Dogecoin briefly touched $0.21—a level that apparently screamed 'buy' to deep-pocketed investors.

Market Mechanics Exposed

Whale accumulation doesn't just move prices—it reveals where smart money places its bets. This rally demonstrates yet again that crypto markets remain playgrounds for the wealthy, where fundamentals take a backseat to coordinated buying power. The 'people's currency' narrative gets another reality check as institutional-sized wallets call the shots.

Recovery Mode Activated

The bounce from lows showcases crypto's signature volatility, where double-digit swings become just another Tuesday. While traders celebrate the green candles, skeptics note this is the same pattern that's burned retail investors countless times before. Another day, another pump—but who really gets left holding the bag?

News Background

- DOGE has faced pressure this month after reports tied to Qubic’s potential 51% attack spooked retail traders and drove selling.

- Despite those risks, on-chain data shows whale cohorts accumulated more than 680 million DOGE in August, offsetting retail outflows.

- Broader market sentiment has been mixed, with Bitcoin and Ethereum consolidating near highs, leaving memecoins trading with outsized volatility.

Price Action Summary

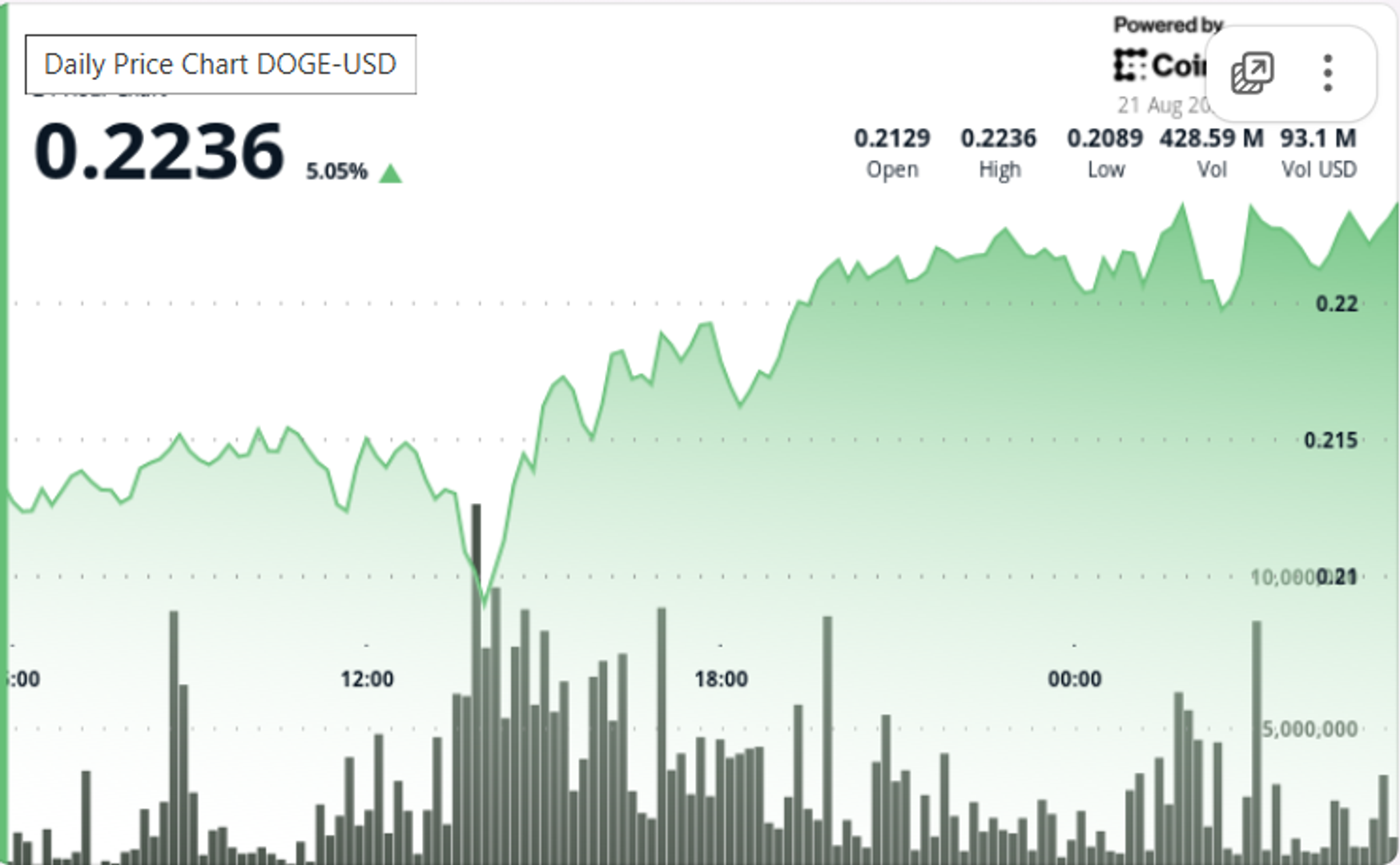

- DOGE advanced 5% in the 24 hours ending Aug. 21, 04:00, recovering from an intraday bottom of $0.21 to close at $0.22.

- The token hit its session low around 13:00 UTC on Aug. 20 before reversing course in a V-shaped recovery.

- Trading volume spiked to 9.29 million in the final hour, adding 0.45% in the last stretch and confirming institutional-sized flows.

- Whales accumulated 680 million DOGE through August, positioning despite ongoing concerns around Qubic’s potential 51% attack.

Technical Analysis

- Key support held at $0.21, tested at mid-session before high-volume reversal.

- Resistance emerged at $0.22, setting a $0.01 trading range for the session.

- A breakout was triggered at 04:31 UTC with the 9.29 million volume spike marking the session pivot.

- Sustained turnover at 6.8 million per minute during the final hour points to larger buyers driving momentum.

What Traders Are Watching

- Whether $0.22 can flip from resistance into support, opening path toward $0.23–$0.24.

- Continued whale positioning trends against the backdrop of Qubic security concerns.

- Strength of follow-through buying after the late-session volume burst, which will confirm if the V-shaped recovery has legs.