The Era of Real-World Assets DeFi Looping Has Arrived - Here’s What Changes Everything

BREAKING: Traditional finance's walls crumble as blockchain bridges physical assets to DeFi yield engines

THE NEW COLLATERAL STANDARD

Real estate, commodities, and institutional debt instruments now flow onto decentralized protocols—creating unprecedented liquidity loops that traditional banks can't replicate. Smart contracts automatically rehypothecate assets across lending markets, stacking yields while maintaining collateralization ratios that would make legacy financiers blush.

YIELD AGRESSION MEETS REAL ASSETS

Protocols now generate returns not from speculative tokens but from revenue-producing physical assets—apartment buildings paying rent, solar farms selling energy, and freight containers moving goods. The yields? Substantially higher than Treasury bonds, with transparency that audit firms can only dream of delivering.

REGULATORY ARBITRAGE OR PROGRESS?

While regulators scramble to classify these hybrid instruments, developers build faster—creating cross-chain bridges that bypass jurisdictional boundaries entirely. The result? A global capital market that operates 24/7 without intermediary approval. (Take that, slow-moving financial bureaucracies.)

Of course, Wall Street will eventually try to package these innovations into fee-laden ETFs—but for now, the real revolution belongs to those willing to deploy capital directly into the machines.

What is DeFi looping and how does it work?

DeFi looping is a yield amplification mechanism built on correlated collateral and debt. The essence of looping is yield-bearing assets — tokens that grow in value over time. Good examples include liquid staking tokens like Lido’s wstETH, synthetic dollars like Ethena’s sUSDe or tokenized private credit funds like Hamilton Lane’s SCOPE. The process begins by depositing such a yield-bearing asset, e.g. weETH, into a money market account, borrowing a closely related asset against it, e.g. ETH, allocating the borrowed amount back into the yield-bearing version, e.g. staking ETH on EtherFi and then redepositing it as collateral — that is one full loop. One of the most widely adopted looping structures is weETH (EtherFi’s wrapped staking ether) paired with ETH on lending platforms such as Spark.

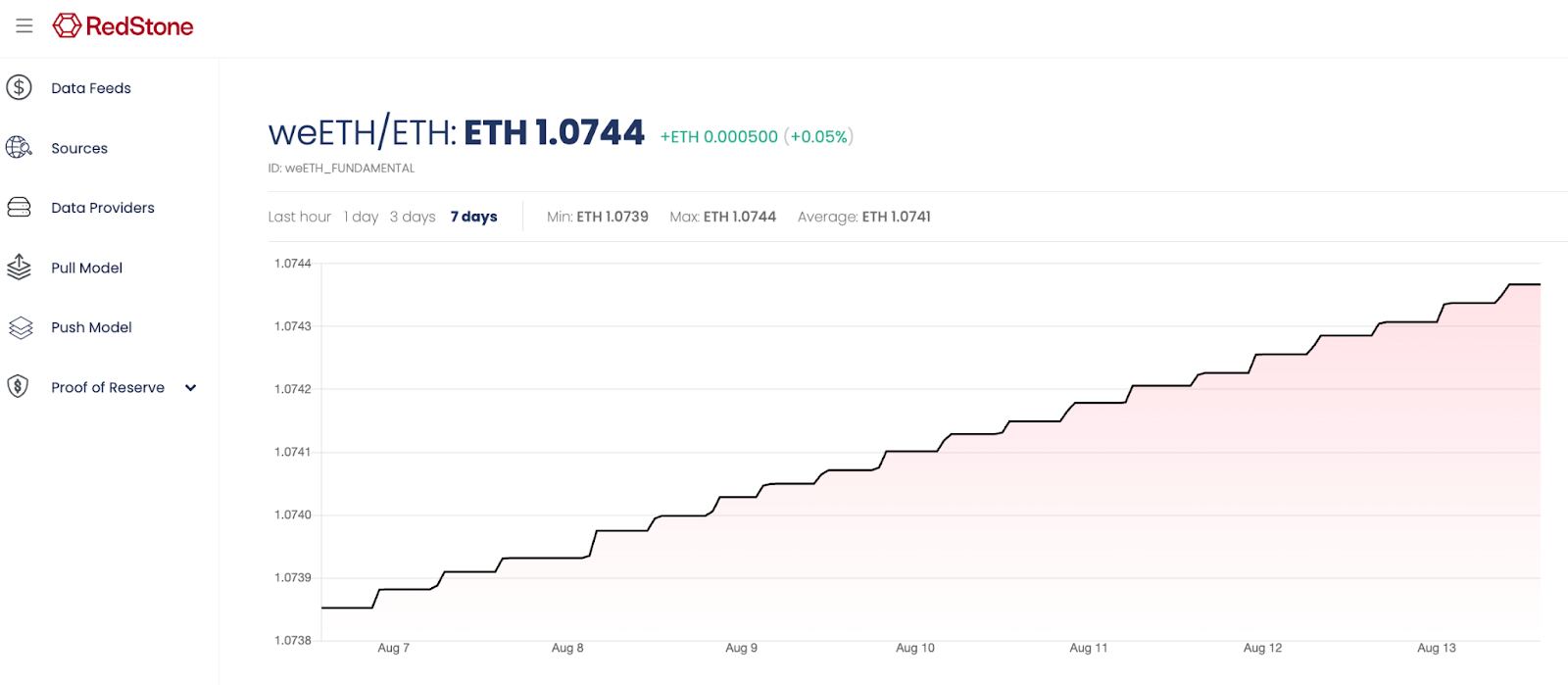

weETH accrues staking rewards, so one unit gradually becomes worth more ETH over time. Here, at EtherFi protocol launch 1 weETH equalled 1 ETH. Now, it equals 1.0744 ETH.

weETH / ETH price appreciation over time via liquid restaking yield accrual, Source: RedStone

If weETH yields ~3 percent annually and ETH borrow rates are 2.5 percent, each loop captures a 0.5 percent spread. With 90 percent loan-to-value ratio and 10 loops, that spread compounds, potentially increasing returns to roughly 7.5 percent annually.

Market size in 2025 and growth potential

Contango’s Q3 2024 estimates suggested that 20 to 30 percent of the $40 billion-plus locked in money markets and collateralized debt positions was attributable to looping strategies. This implied $12–15 billion in open interest, or roughly 2–3 percent of total DeFi TVL at the time.

Today, that scale is likely much larger: AAVE alone holds close to $60 billion in TVL. Given that trading volumes in leverage-based strategies typically exceed open interest by a factor of ten, annual transaction volume from looping may already surpass $100 billion.

Beyond ETH: stable-yield assets

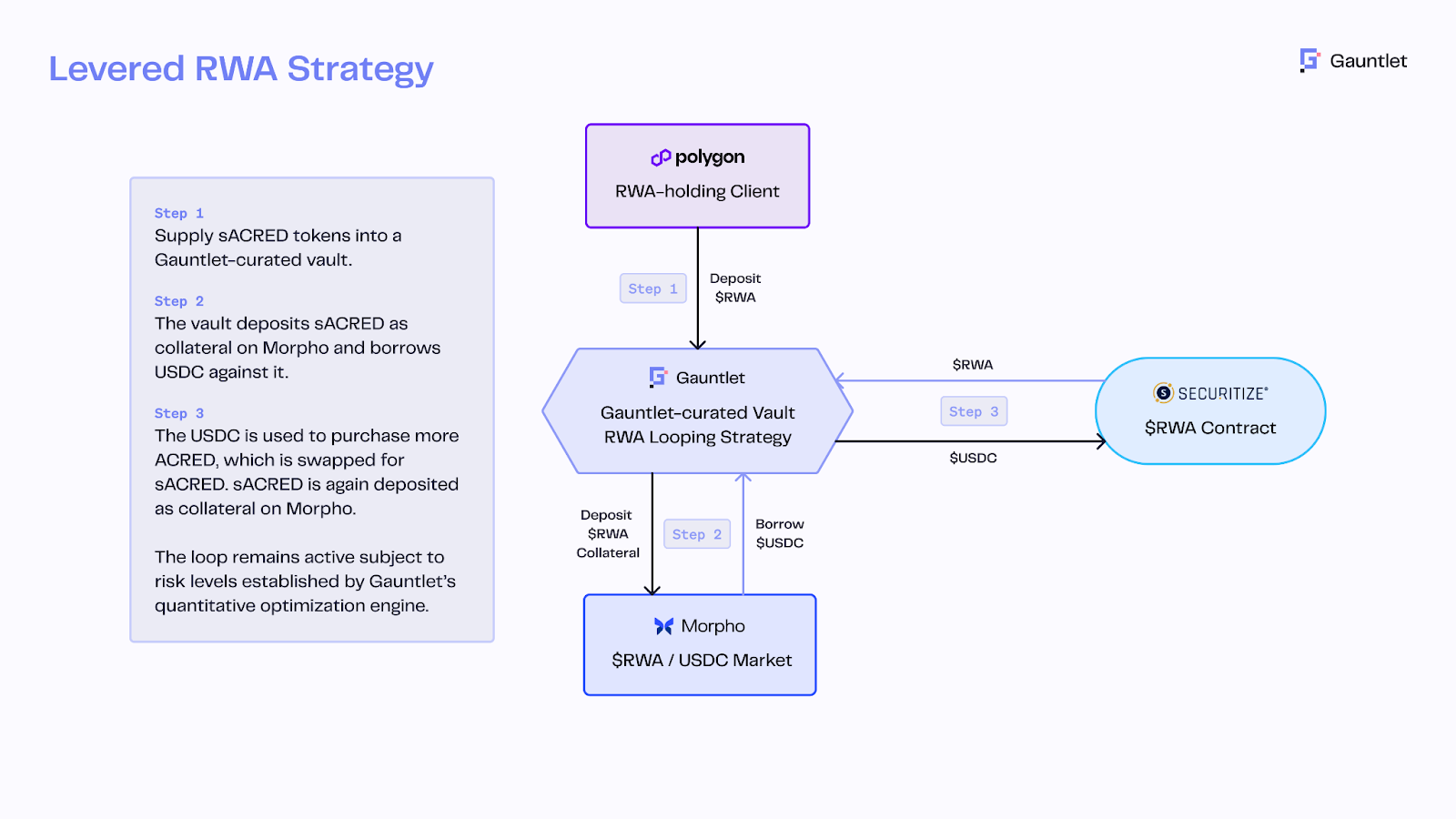

Looping can also be applied to asset pairs that are not necessarily crypto native. A practical example is sACRED / USDC looping on Morpho. Here, a token representing a tokenized private credit fund (Apollo’s ACRED via sACRED vault) is deposited to borrow USDC, which is then converted into sACRED and redeposited. While the yield profile is designed to be predictable, it depends on the performance of the underlying private credit portfolio and is not as inherently stable as ETH staking rewards.

RWA looping strategy on Morpho secured by RedStone price feeds, Source: Gauntlet.

Future directions: tokenized funds as loop collateral

Institutions are bringing RWAs on-chain partly because looping can amplify returns with transparent, modelable risks and auditable parameters. Likely growth lanes include:

- Private credit vehicles, e.g., Hamilton Lane’s SCOPE, made available via Securitize with daily on-chain NAV delivered by RedStone, and on-demand redemptions, positioned for steady monthly yield per issuer materials.

- Cash-and-carry strategies like Spiko C&C, capturing predictable term premia.

- Reinsurance-linked securities, like MembersCap MCM Fund I, historically have been associated with low default rates and consistent payouts.

Why this matters for institutions

Looping enables more efficient use of capital by turning yield-generating positions into repeatable, collateralizable instruments. The risk–return profile is similar to traditional fixed-income and money market desks, but here it is delivered with 24/7 liquidity, transparent collateralization metrics and automated position management.

It is one of DeFi’s most battle-tested strategies, with clear appeal for traditional finance: higher yields within a framework of transparent, well-defined and actively monitored risks. As tokenized RWAs scale, looping is poised to become a foundational building block in on-chain portfolio construction, further narrowing the gap between traditional and decentralized finance.