Qubic’s 51% Attack Threat Sparks DOGE Meltdown: Futures Open Interest Plummets 8%

DOGE holders hit panic buttons as Qubic's rumored 51% attack plans trigger market chaos.

Futures bloodbath: Open interest nosedives 8% as leveraged positions get liquidated en masse. The meme coin's infrastructure shows alarming vulnerability to coordinated attacks.

Traders scramble: Risk management teams work overtime while retail investors face another 'learning opportunity' about crypto's wild west nature.

Market psychology shattered: The 8% drop in open interest reveals how quickly confidence evaporates when network security gets questioned. Another reminder that in crypto, your gains are only as secure as the weakest validator.

Wall Street bankers probably sipping champagne—nothing makes traditional finance happier than watching crypto's 'decentralized' promises crash into centralized reality.

News Background

• Qubic’s governance forum approved a proposal to direct hashpower toward Dogecoin, raising the possibility of a coordinated 51% attack. The group recently executed a similar move against Monero, successfully disrupting block validation.

• The news fueled jitters across the Dogecoin community, with traders pricing in heightened security risks.

• At the same time, whales accumulated 680 million DOGE in August, showing long-term interest despite the threat.

• Derivatives positioning weakened, with DOGE futures open interest sliding 8%, signaling declining confidence in near-term upside.

Price Action Summary

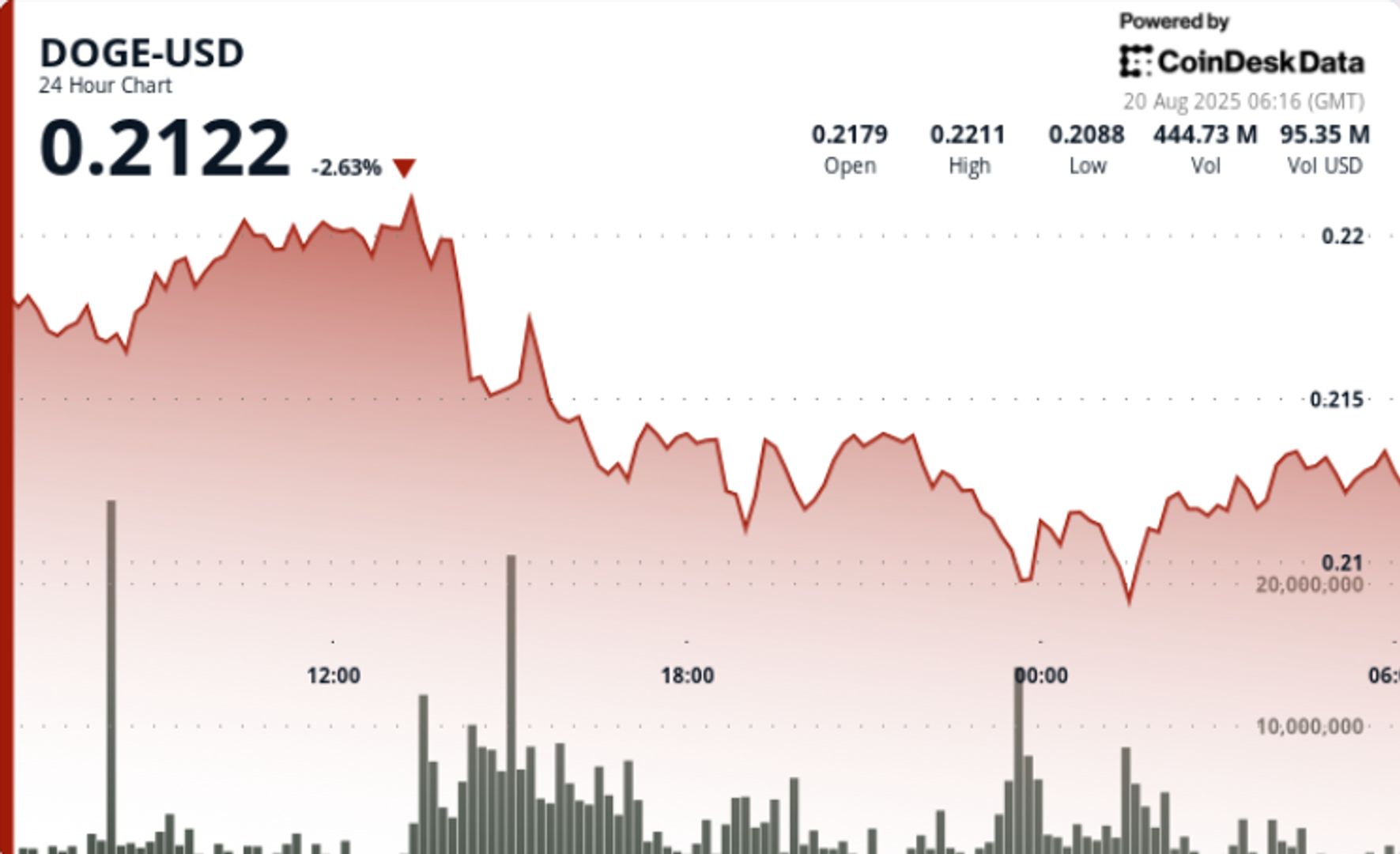

• Doge dropped 5% in the 24-hour period from August 19 06:00 to August 20 05:00, falling from $0.22 to $0.21.

• The heaviest selling occurred between 13:00-15:00 UTC on August 19, when DOGE crashed from $0.22 to $0.21 amid 916 million tokens traded — double the 24-hour average.

• $0.22 emerged as a strong resistance zone after repeated rejections, while $0.21 acted as a key support level into the close.

• Overnight action was range-bound, with DOGE oscillating between $0.2120-$0.2130 before closing at $0.2124.

Technical Analysis

• Resistance: $0.22 confirmed as heavy supply zone with high-volume rejection.

• Support: $0.21 holding as a psychological floor, with risk of a $0.208 retest if selling persists.

• Volume: 916 million traded, up 100% over baseline, reflecting panic selling.

• Structure: Range-bound consolidation between $0.2120-$0.2130 in late hours shows uncertainty rather than recovery momentum.

• Futures: Open interest fell 8%, suggesting leverage longs are unwinding.

What Traders Are Watching

• Whether Qubic follows through on its DOGE attack plan after Monero disruption.

• Whale accumulation versus retail capitulation — will large players defend $0.21 support?

• Market reaction to continued declines in derivatives open interest.

• A decisive move above $0.22 or below $0.21 to set next directional bias.