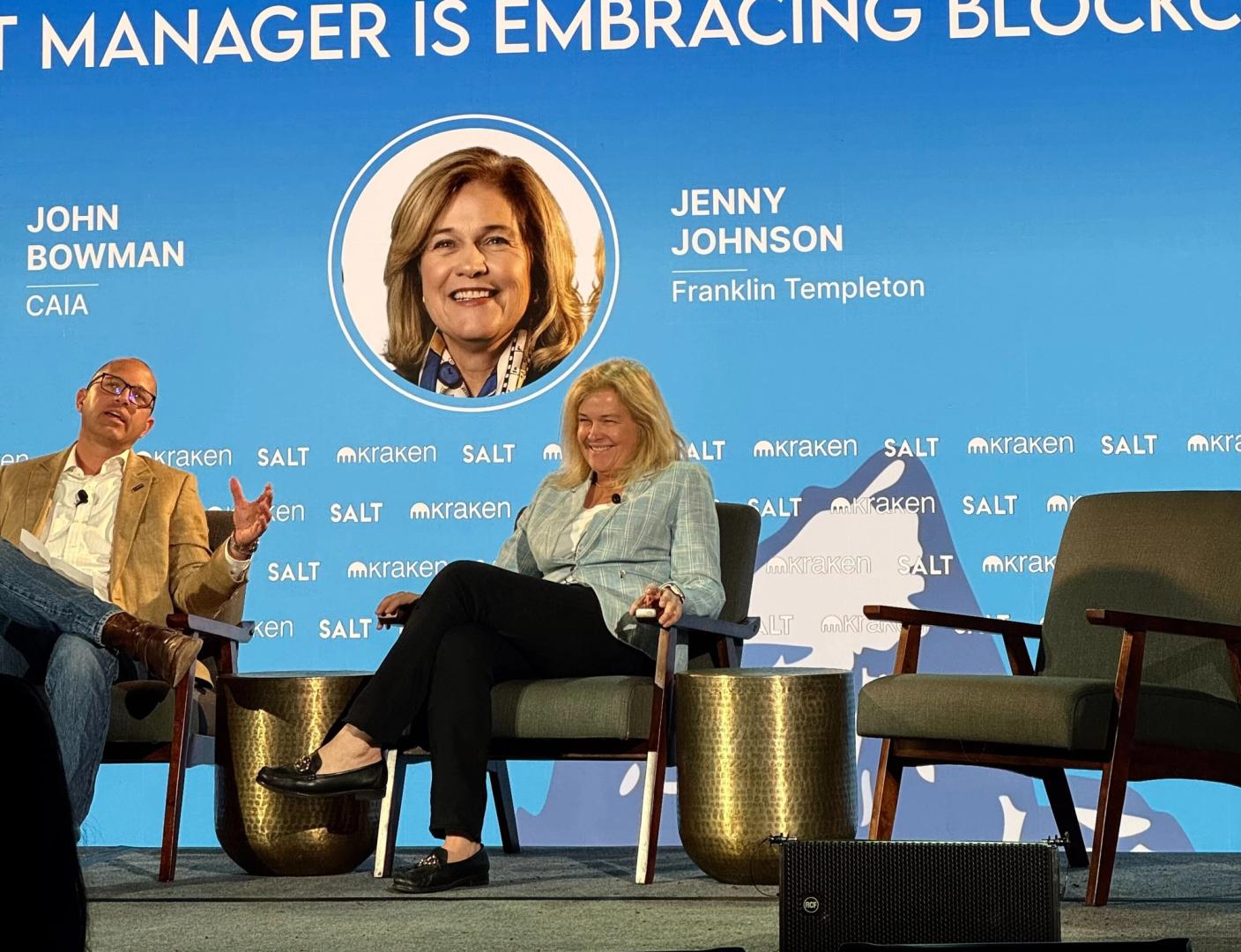

Franklin Templeton CEO Reveals Top Crypto Picks: Where to Park Your Funds in 2025

Franklin Templeton's CEO just dropped the playbook—and it's all digital assets. With $1.6 trillion in assets under management, this isn't some crypto bro's hot take; it's institutional money talking.

Where the Smart Money's Flowing

The firm's betting big on blockchain infrastructure—think layer-1 protocols and decentralized finance rails. Ethereum's ecosystem gets a nod, but so do emerging chains solving scalability without sacrificing security.

Stablecoins? They're not just for trading. Templeton sees them as the gateway for traditional finance to dive into crypto—earning yield while sidestepping volatility.

Tokenization's the sleeper hit. Real-world assets on-chain could unlock liquidity for everything from real estate to vintage wines—because nothing says 'disruption' like turning a Bordeaux into an NFT.

Of course, this comes from a firm that probably still charges 2% fees for active management while algorithms eat their lunch. But when a $1.6 trillion giant leans into crypto, even the skeptics start paying attention.