Ether Under $4.2K? Buckle Up—Volatility Ahead

Ethereum's price teeters below $4,200—and traders are licking their chops. Here's why the next move could be explosive.

Liquidity Hunt

Market makers smell blood. A drop under this key level triggers algorithmic feeding frenzies—liquidity pools get drained faster than a hedge fund's moral compass.

Gamma Squeeze Playground

Options desks reload short gamma exposure below $4.2K. The result? Wilder swings than a crypto VC's investment thesis.

Institutional FOMO Fuel

Traditional finance still treats ETH like a 'risky asset'—until it isn't. Watch pension fund memos suddenly discover 'blockchain exposure' if prices rip higher.

Bottom line: ETH's price discovery gets messy here. Perfect for degenerates, terrifying for accountants. (Bonus jab: At least the volatility's real—unlike half the 'yield' products Wall Street peddles.)

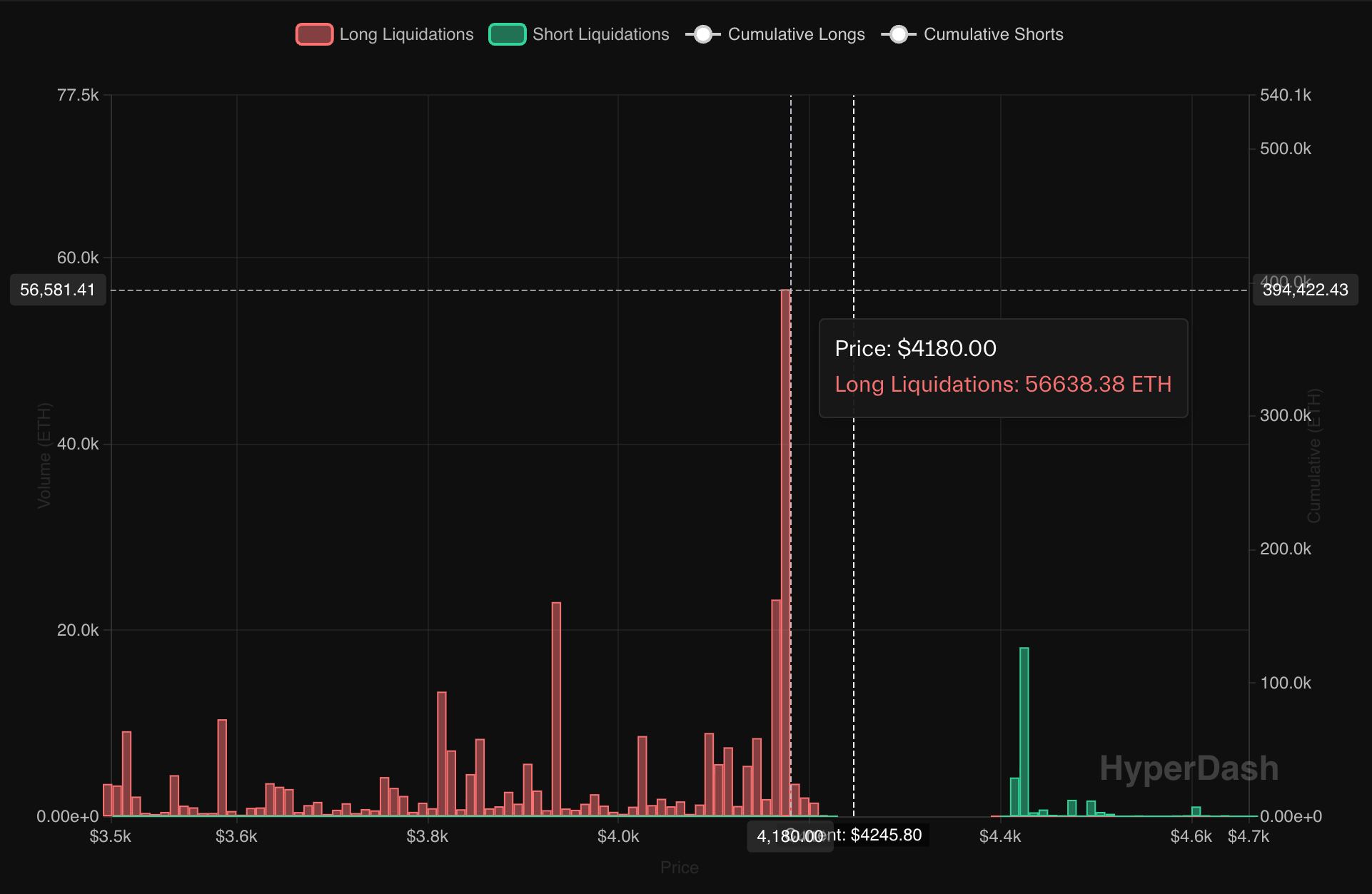

Liquidations, or the forced closure of Leveraged bets, happen when a trader's position falls short of the margin requirements set by the exchange.

The margin shortage typically occurs when the market moves against the trader's position, causing their account equity to fall below the minimum maintenance margin. This prompts the exchange to automatically close the position to prevent further losses and ensure borrowed funds are recovered.

Largely long liquidations cause a sudden surge in selling pressure, which pushes prices even lower, creating a cascading effect that can trigger additional liquidations. This negative feedback loop tends to amplify market volatility.