Why Asia’s Stablecoin Surge Is Outpacing the West – And What Advisors Must Know

Forget T-bills and money markets—Asia's crypto-savvy investors are voting with their wallets. Stablecoin adoption in the region now dwarfs Western markets, and the gap keeps widening.

Here’s what’s fueling the fire:

Regulatory arbitrage plays out in real-time

While US regulators sue stablecoin issuers, Asian financial hubs like Singapore and Hong Kong roll out clear licensing frameworks. Result? A flood of institutional capital seeking predictable rules.

The remittance revolution no one’s talking about

Cross-border payments between emerging markets now bypass correspondent banks entirely. Stablecoins cut settlement times from days to seconds—and workers sending wages home demand the efficiency.

DeFi’s dirty little secret

Yield-hungry investors park stablecoins in decentralized protocols offering double-digit APY. Try finding that at your private bank—unless you’re a billionaire with family office access.

The bottom line? Stablecoins aren’t just crypto’s killer app—they’re exposing traditional finance’s inefficiencies one transaction at a time. (And yes, that includes your precious 60/40 portfolio.)

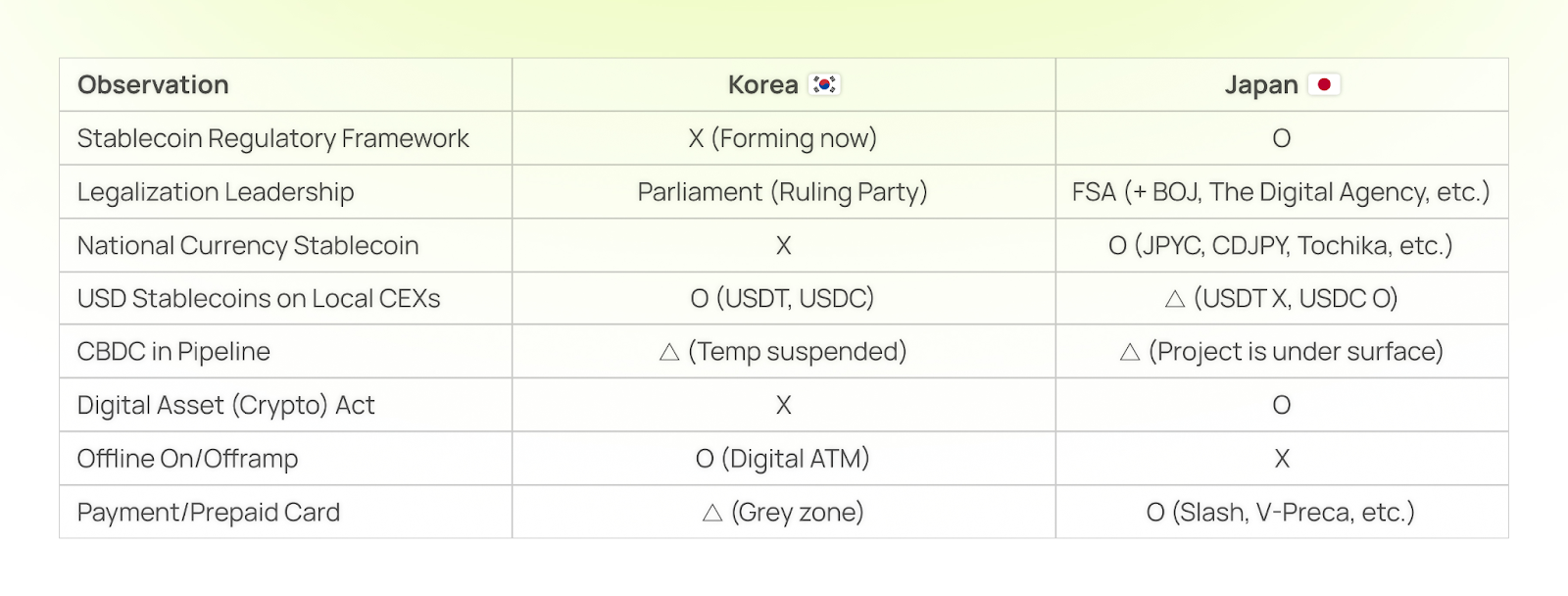

What Are the Approaches of South Korea and Japan Towards Stablecoins

After the passage of the GENIUS Act in the U.S., stablecoin projects, implementations and regulations are now a major subject of discussion around the world. South Korea and Japan are both having high-level and advanced discussions currently about how those stablecoins should operate. And how the private sector and governments should interact in regulating stablecoins.

- A CBDC, or a central bank-controlled digital currency, is a blockchain-powered digital currency controlled by a central bank pegged to a real-world currency denomination.

- A stablecoin is typically issued by private enterprises. They are usually designed to have a value identical to real-world currencies.

The Bank of Japan maintains a firm stance that CBDCs should only be used for interbank settlements. Private banks' issued stablecoins can be used for business-to-business (B2B) and business-to-consumer (B2C) transactions. The Bank of Japan and the Financial Services Agency have devised a stablecoin regulatory framework with a positive stance on the use of privately regulated stablecoins.

While the Bank of Japan acknowledges the “the potential of stablecoins as an efficient means of payment,” it also envisions co-existence with CBDCs and views the digital Yen as a complementary, rather than competitive, FORM of cash, with traditional finance.

The Governor of the Bank of Japan, Kazuo Ueda, recently said, “Stablecoins increase small international remittances, leading to risk diversification. With more high-frequency micropayments, it will be interesting to explore how CBDCs can play a complementary role.” Suggesting that private stablecoins could provide learnings for a CBDC design in terms of its payment efficiency.

This contrasts with the Bank of Korea's current ambivalent stance as to whether or not private stablecoins should be controlled by central banks, considering that they will potentially cause instability in domestic currency value or capital flight. It is crucial to understand that Korea has very tight capital controls on the currency system.

However, South Korea’s National Assembly has led the pro-stablecoin discussions by proposing three different Digital Asset bills to legalize KRW stablecoins. These bills came after President Jae Myung Lee pledged to create domestic stablecoins during the recent election campaign that concluded successfully in June. It is noteworthy that Korea’s CBDC project was halted on 29 June 2025, following these stablecoin discussions.

Image: Kaia

As a result, many competing consortia from Web3, fintech, and the banks are all scrambling for a position to be part of any future stablecoin designs. Kakao and Naver, the largest IT enterprises in South Korea, have begun their stablecoin research task forces, filed trademarks, or formed an alliance group seeking potential partners.

Circle, the USDC issuer, signed an MOU with Hana Bank, one of Korea’s main banks, to lay the groundwork for a future stablecoin business alliance. Private South Korean banks have already begun positioning themselves as stablecoin businesses; the CBDC project was frozen in June.

Nevertheless, South Korea has maintained a “one bank for one centralized crypto exchange" regulation, blocking new market entrants. Therefore, many in the industry are keenly awaiting to see which of the three bills is adopted.

Rather than benefiting the South Korean economy, the Bank of Korea and others argue that a Korean-won (KRW) backed stablecoin will not prevent capital flights from South Korea, as those stablecoins will not be widely used in global digital asset transactions like USD stablecoins.

Despite these statements, the private sector could well have a prominent role in the creation of a South Korean stablecoin, especially as South Korea has the second-biggest retail crypto market.

The interaction between the private sector and governments in regulating stablecoins, as well as how South Korea and Japan address these issues, particularly in balancing the mass adoption of stablecoins with adherence to Web3 principles, has implications beyond their borders.

Unknown block type "divider", specify a component for it in the `components.types` optionAsk an Expert

Asia's embrace of blockchain is a strategic pivot, moving beyond the speculative aspects of cryptocurrency to its potential as a foundational technology. Policy leaders across the region see that regulatory clarity is essential for sustainable innovation; examples such as Hong Kong's licensing regime for Virtual Asset Service Providers (VASPs) and Singapore's regulated DeFi and cross‑border payment pilots show this in action. This proactive approach creates the regulatory clarity and robust infrastructure necessary to facilitate secure on-chain transactions and more efficient cross-border payments, ultimately modernizing financial systems.

South Korea's new framework, formalized in the Digital Asset Basic Act (DABA), represents a major step toward institutional acceptance. Its key features, including comprehensive guidelines for stablecoins and the introduction of crypto exchange-traded funds (ETFs), are designed to create a more secure and defined environment for digital assets. Furthermore, the launch of a state-supported blockchain network underscores a strategic focus on building institutional-grade infrastructure. These developments collectively signal that South Korea views digital assets not just as a retail product, but as a legitimate part of the financial ecosystem, paving the way for greater institutional participation.

The developments in Asia, particularly in countries like South Korea, provide a clear roadmap for the future of global finance. Advisors should recognize that this trend signals a MOVE toward institutional acceptance and the potential for new, regulated financial products. It is crucial to monitor developments in tokenized securities, which could fundamentally change how assets are issued, traded, and settled. Additionally, keeping an eye on new stablecoin regulations and digital Know Your Customer (KYC) frameworks is essential, as these trends could very well be a preview of the next evolution of capital markets globally.

Unknown block type "divider", specify a component for it in the `components.types` optionKeep Reading

- A recent working paper from the Central Bank of Malaysia (CBM) has identified XRP and bitcoin as potential “alternatives to the current monetary and payment instruments”.

- The United Arab Emirates prepares for the rollout of the Digital Dirham CBDC.

- The European Central Bank aims to finish its digital euro testing phase by October 2025