XRP Rockets to $3.33 on Double-Average Volume—Then Crashes Back to Reality

XRP just gave traders a masterclass in crypto volatility—surging to $3.33 on twice the usual volume before face-planting faster than a Wall Street analyst backpedaling on a bad call.

The Pump: Riding the Wave

Double the trading volume? Check. A blistering rally to $3.33? Of course. For a hot minute, it looked like XRP might actually defy gravity—or at least the SEC’s skepticism.

The Crunch: Gravity Always Wins

Then came the sell-off. No slow bleed here—just a hairpin reversal that left overleveraged longs scrambling. Classic crypto: euphoria to panic in 60 seconds flat.

Bonus jab: At least it’s not as embarrassing as watching traditional finance try to explain ‘blockchain’ at a shareholder meeting.

Technical Analysis Overview

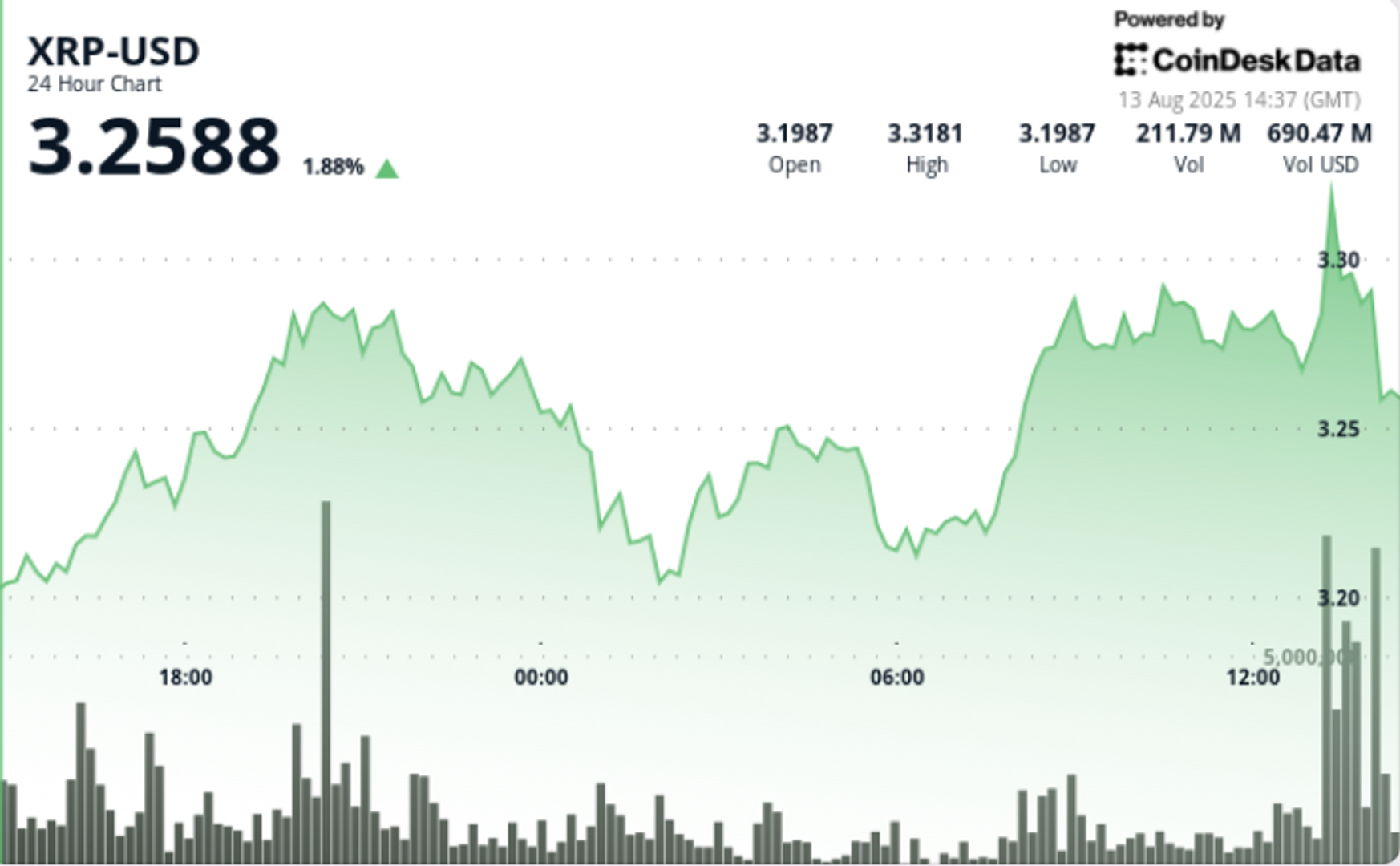

XRP gains 2.81% in the 24-hour period ending August 13 14:00, moving from $3.20 to $3.29 within a $0.13 range (3.89% volatility). The advance peaks at $3.33 at 13:00 on 193.90M volume — more than double the daily average of 81.50M — marking heavy institutional participation.

The late-session window from 13:07–14:06 sees aggressive two-way trade: price rallies from $3.27 to $3.32 on 11.30M volume before dropping to $3.26 on 14.00M as large holders take profits. Price closes the session at $3.28, holding above $3.20 support.

News Background

Ripple’s settlement with the U.S. Securities and Exchange Commission has removed a multi-year compliance overhang, unlocking greater corporate treasury flexibility. The ruling has triggered short-term positioning from existing stakeholders, though on-chain data shows limited new wallet growth despite price strength.

Price Action Summary

• XRP gains 3% from $3.20 to $3.29 in August 12 15:00–August 13 14:00 window

• Session high of $3.33 on 193.90M volume confirms institutional flow

• Support holds at $3.20; resistance locked at $3.32-$3.33

• Profit-taking drop from $3.32 to $3.26 highlights supply zone selling

Market Analysis and Economic Factors

The rally reflects ongoing large-holder accumulation after the regulatory resolution, with flows concentrated between $3.20-$3.30. However, resistance at $3.33 has capped advances, prompting quick reversals on heavy volume as profit targets are hit. Market sentiment remains constructive while price holds above $3.20.

Technical Indicators Analysis

• Support: $3.20 (volume-backed buying)

• Resistance: $3.32-$3.33 (institutional profit-taking zone)

• Intraday range: $0.13 (3.89% volatility)

• Volume spikes above 193.90M show peak institutional participation

• Sharp reversal patterns signal tactical rebalancing by large holders

What Traders Are Watching

• Breakout attempts above $3.33 toward $3.40

• Durability of $3.20 support in next profit-taking cycle

• Impact of sustained corporate treasury flows post-settlement

• On-chain signs of fresh institutional entry