OKX Ignites Market Frenzy: 50% OKB Supply Burn Sends Token Soaring After $7.6B Purge

Talk about a supply shock—OKX just turned deflationary economics into a rocket booster.

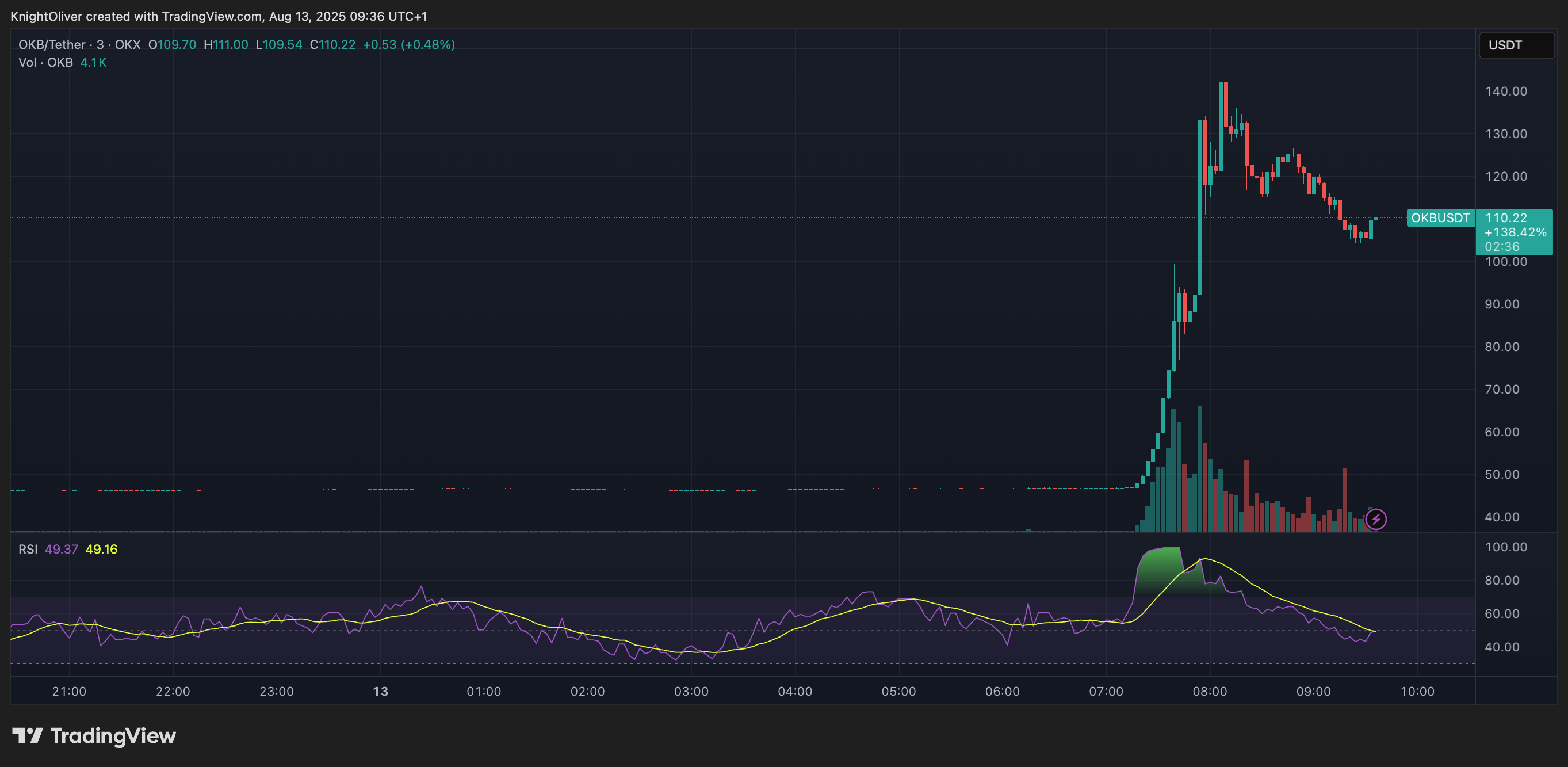

In a move that sent traders scrambling, the exchange incinerated half of OKB's circulating supply—torching a eye-watering $7.6 billion worth of tokens. The market's response? A vertical price surge that'd make even Bitcoin maximalists glance sideways.

Tokenomics 101: When you vaporize supply while demand holds steady, price charts start looking like a heart rate monitor during a bull run. Though let's be real—in crypto, 'demand' often means 'speculators chasing the next shiny thing.'

This isn't just a burn—it's a strategic nuke on sell pressure. By permanently removing 50% of OKB from circulation, OKX effectively doubled the scarcity premium overnight. Cue the inevitable trading frenzy as FOMO meets artificial scarcity.

The real test? Whether this engineered pump outlasts the typical crypto news cycle. After all, even the most aggressive token burns can't defy gravity forever—just ask all those 'deflationary' tokens now gathering dust below their ATHs.

The strategy mirrors that of BNB, the token of BNB Chain, which is associated with rival exchange Binance. That undergoes quarterly burns that often precede short-term rallies.

Supporting that narrative, OKB’s turnover ratio, a measure of trading activity relative to supply, spiked from 0.03 pre-announcement to 0.093, signaling heightened speculative and strategic positioning.

Sustained price momentum will depend on whether OKX can continue to drive adoption of its X LAYER blockchain, of which OKB is the native token. To that end, the exchange plans to increase transaction speed and reduce gas prices, according to a blog post. It will also be phasing out Ethereum-based OKB tokens, which can now be redeemed for X Layer versions.