Corporate America Dumps Recession Panic—Even as Tariffs Hit 1910s-Level Highs

Wall Street shrugs off economic doom—again.

While Main Street braces for impact, Corporate America’s recession fears have nosedived. The irony? This confidence surge comes as average tariff rates hit their highest level since Woodrow Wilson’s presidency.

Tariffs at 1910 levels? No problem.

CEOs are betting big on resilience (or maybe just hoping the Fed will bail them out—again). Supply chains? Reinvented. Consumer demand? ‘Unshakable.’ Meanwhile, economists eye the numbers like a ticking time bomb.

One hedge fund manager quipped: ‘They’re not afraid of recessions—just afraid of missing the next bubble.’

Trump recently unveiled sweeping tariffs in addition to those announced in April in a MOVE aimed at sparking a manufacturing boom. That has lifted the average U.S. tariff rate to 20.1%, the highest sustained level since the 1910s, according to estimates released by the World Trade Organization and the International Monetary Fund.

Markets, too, have largely looked past tariff-induced recession fears, with the S&P 500 rising 28% since the early April dip. Bitcoin, the leading cryptocurrency by market value, has risen to $122,000 from roughly $75,000, a 62% surge in four months, CoinDesk data show.

According to JPMorgan, traders have been focusing on resilient corporate earnings and the expected economic recovery following the interim slowdown.

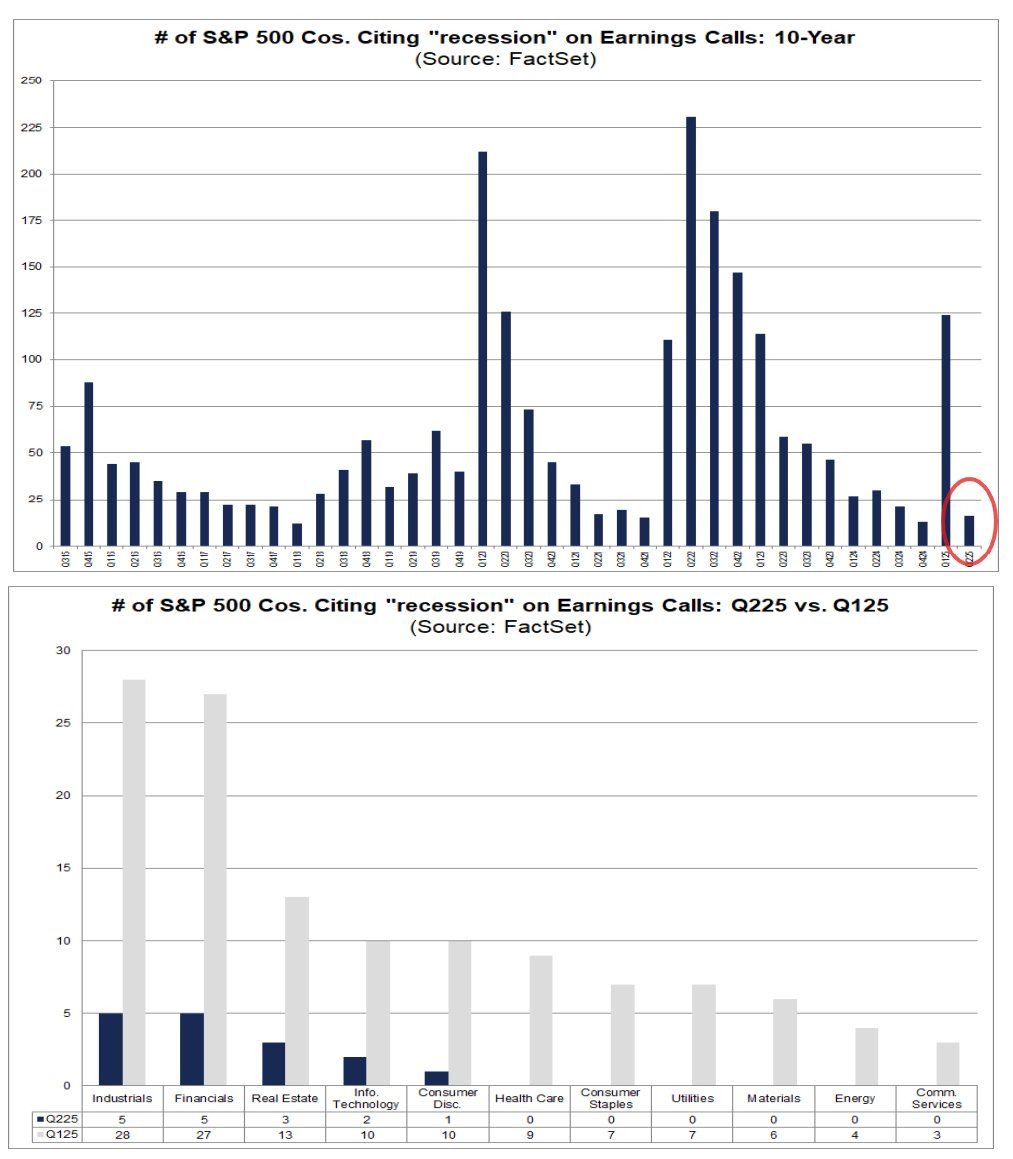

More than 80% of S&P 500 companies have recently reported their second-quarter earnings, with over 80% beating earnings expectations and 79% surpassing revenue forecasts. That's the strongest performance in four years.