Zora Skyrockets 50% Overnight – Perps Listings and Base Ecosystem Fuel Meteoric Rise

Zora's native token just pulled off a jaw-dropping 50% rally—proving once again that crypto moves faster than a hedge fund manager chasing performance fees.

Perps go brrr: Futures listings on major exchanges lit the fuse, while Base's surging ecosystem provided the rocket fuel. Suddenly, everyone's scrambling to explain why they didn't buy the dip.

DeFi's latest darling: The breakout showcases how infrastructure plays can still trigger violent upside when liquidity meets narrative—no VC unlock drama required.

Traders are now watching whether Zora can hold these levels, or if this is just another 'buy the rumor, sell the news' circus. Either way, the charts don't lie—for now.

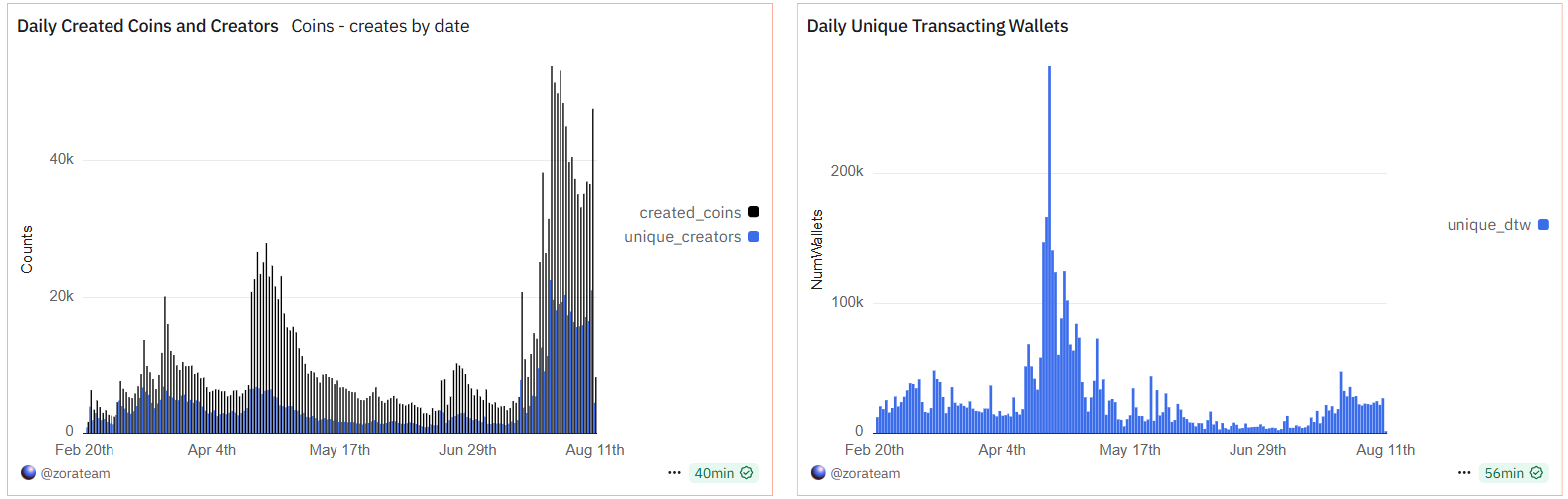

Trading volume spiked to $284 million on Sunday from under $160 million a day prior. The rally came as major derivatives venues, including Binance, introduced ZORA perpetual contracts with leverage up to 50x — widening directional access and drawing speculative capital into the market.

These listings have likely compressed spreads and deepened liquidity, fueling both spot and Leveraged positioning in the Base ecosystem token.

The ZORA token was launched in April via a retroactive airdrop to early users, leaving a relatively tight free float.