Standard Chartered Drops Bombshell: Ethereum Treasury Stocks Outshine ETH ETFs for Maximum Gains

Wall Street's latest crypto twist? Skip the ETF middlemen. Standard Chartered just slapped a 'buy' rating on Ethereum-linked equities—calling them the smarter play than spot ETH funds. Who needs regulatory approval when you've got corporate balance sheets?

The institutional pivot no one saw coming

While retail investors queue up for ETH ETF scraps, the smart money's eyeing public companies holding ETH reserves. Treasury plays offer direct exposure without the fund manager markup—and apparently, the bank's analysts think that's worth 20% upside over ETF equivalents.

A cynical trader's paradise

Nothing screams 'bull market' like financial institutions rediscovering equities... right as ETH flirts with all-time highs. Classic case of 'follow the money'—until the music stops.

To be sure, the analyst said that he doesn't see any reason for the NAV to go below 1.0, as these treasury firms provide investors with "regulatory arbitrage opportunities."

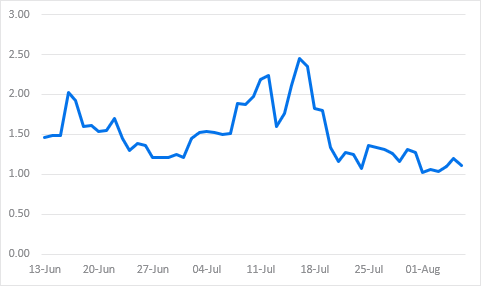

Kendrick also highlighted that these treasury companies have bought just as much ETH as U.S.-listed spot exchange-traded funds (ETFs) since June.

Both groups now hold around 1.6% of the total circulating ETH supply — just under 2,000 ETH — over that time period, adding to his call that both the treasury stocks and ETF holders now provide similar exposure to ETH, all else being equal.

The combination of these two factors is now adding to his thesis that ETH treasury plays are a better buying opportunities than ETFs. "Given NAV multiples are currently just above 1 I see the ETH treasury companies as a better asset to buy than the US spot ETH ETFs," he said.

Standard Chartered is maintaining its year-end price target of $4,000 for ether. ETH is currently trading at $3,652, up 2% over the past 24 hours.