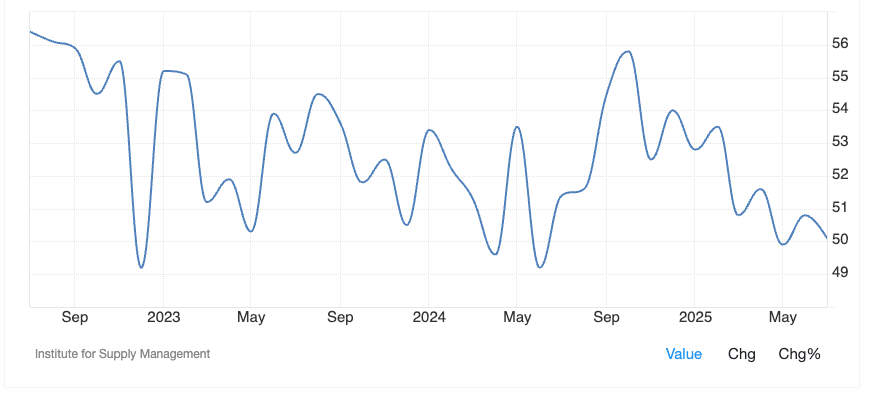

Fed Rate Cuts on the Table? Bitcoin Tumbles Below $113K as ISM Services PMI Shakes Markets

Another day, another crypto rollercoaster—Bitcoin just got sucker-punched back under $113,000. Was it the Fed's fault? The ISM Services PMI just dropped like a mic at a central bankers' conference, and suddenly everyone's recalculating their rate-cut fantasies.

Market tremors hit as services sector data flashes warning signs. Traders scrambling, hedges getting slapped on, and Bitcoin—that so-called 'digital gold'—acting more like digital fool's gold today. The Fed's next move just got murkier than a Wall Street analyst's conflict-of-interest statement.

Here's the kicker: when traditional markets catch a cold, crypto still sneezes like it's got the plague. Maybe Satoshi should've coded a 'decouple from legacy finance' button. Until then, grab your charts and pray—the only certainty right now is volatility.

Compounding that sign of economic weakness was a stagflationary signal embedded in the report, the Prices Paid subindex, which shot up to a cycle high of 69.9.

"Tariffs are causing additional costs as we continue to purchase equipment and supplies ... the cost is significant enough that we are postponing other projects to accommodate these cost changes," read one comment from the report.

Neither crypto nor traditional markets took kindly to the Tuesday data, with Bitcoin (BTC) pulling back from above $114,000 to $112,800, lower by nearly 2% over the past 24 hours. The Nasdaq reversed from earlier gains to a 0.5% loss.

Fed cut now?"The data always suffers big revisions when the economy is at an inflection point, like a recession," wrote economist Mark Zandi after the big downward jobs revisions Friday.

"The economy is on the precipice of recession," he continued. "Consumer spending has flatlined, construction and manufacturing are contracting, and employment is set to fall. With inflation on the rise, it's tough for the Fed to come to the rescue."

Longtime managers at Hoisington Investment Management, Lacy Hunt and Van Hoisington aren't so sure the Fed can wait. Calling inflation gains from tariffs temporary and a first-round effect, Hunt and Hoisington say the second, third and later round contractionary effects are of far more import.

"The Fed needs to be quickly moving to an accommodative policy," they concluded. "The Fed will be ill advised to wait ... The far more critical consideration is the coming contraction in global economic activity."