Bitcoin’s Bullish Vibe Fades in Options Market as Inflation Fears Intensify

Bitcoin's long-term optimism is taking a hit—and the options market is flashing warning signs.

Inflation jitters are sucking the oxygen out of crypto's rally, leaving traders scrambling to hedge against downside risks. The once-unshakable faith in BTC's moonward trajectory? It's looking shaky.

Options traders—usually the biggest crypto cheerleaders—are suddenly playing defense. Call buying has dried up, and put volumes are creeping higher. Translation: the smart money isn't betting on new highs anymore.

Why the cold feet? Blame the Fed's inflation fight. Every rate hike whispers the same threat to risk assets: liquidity is getting scarcer. Even crypto's 'digital gold' narrative struggles when real yields start biting.

But let's be real—this is crypto. Sentiment shifts faster than a DeFi exploit. Today's fear could be tomorrow's FOMO fuel. After all, nothing pumps portfolios like freshly printed money... if the Fed blinks first.

*Cynical finance jab*: Traders treating BTC options like a crystal ball? Cute. The only reliable pattern is Wall Street overreacting in both directions.

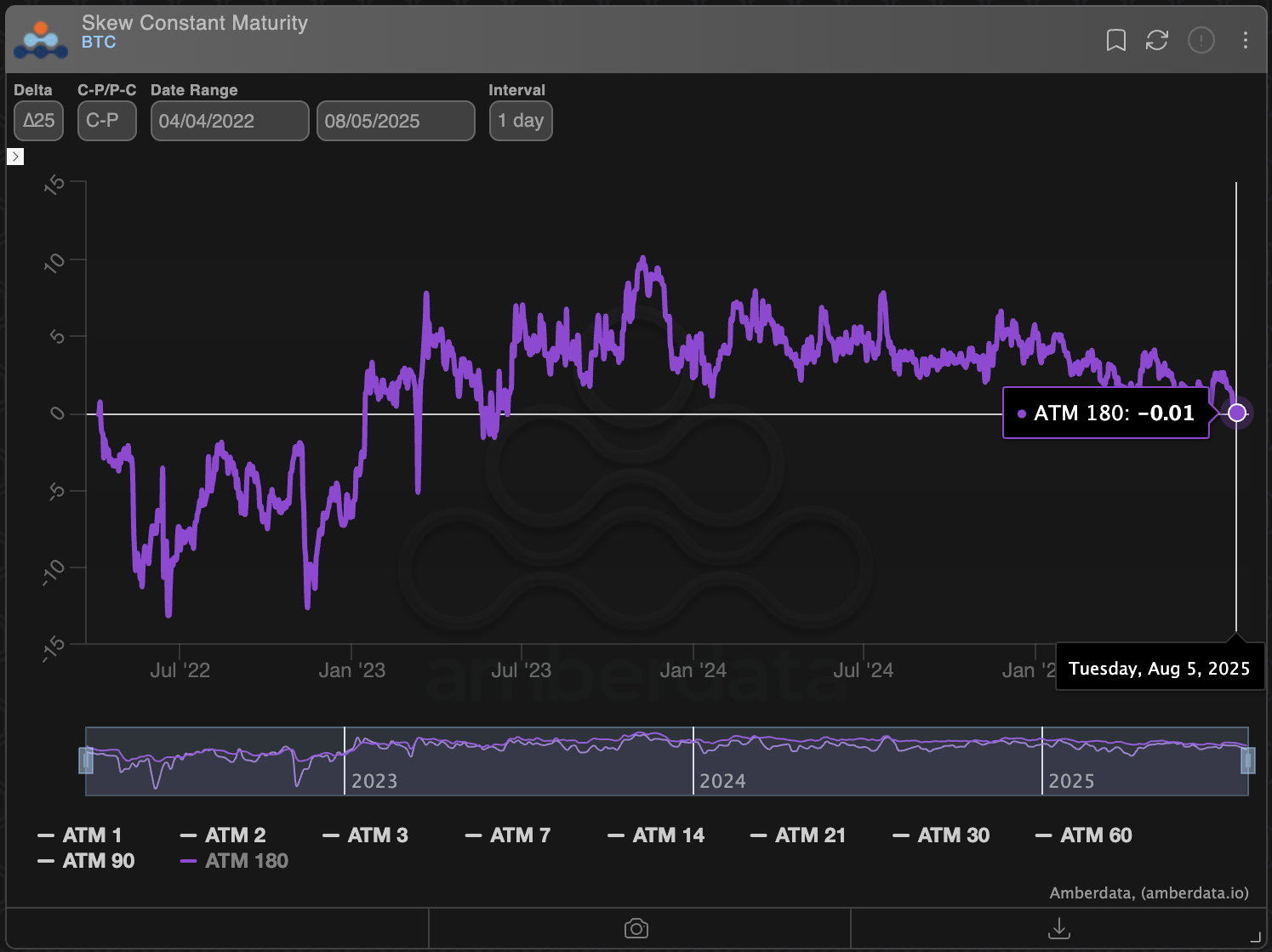

The neutral shift in the 180-day skew could be partly driven by structured products selling higher strike call options to generate additional yield on top of the spot market holdings.

The popularity of the so-called covered call strategy could be driving the call implied volatility lower relative to puts.

Macro jitters

BTC fell over 4% last week, nearly testing its former record high of $11,965, as the Core PCE, the Fed's preferred inflation measure, rose in June, while nonfarm payrolls disappointed, stoking concerns about the economy.

The price drop has pushed short-term skews below zero, a sign of traders seeking downside protection through puts.

According to Ardern, the inflationary effects of "supply chain impulses" are already showing up in economic data.

"Although falling auto prices in the last CPI report offset rising prices for other goods, one thing is undeniable: the impulse from the West Coast of the Pacific has reached the East Coast, and retailers are already trying to pass on tariffs and a host of associated costs to consumers. While wholesalers and commodity trading firms are working to smooth supply chains, price increases will still occur, albeit more moderately or "delayed by several months," Ardern noted, explaining the renewed neutrality of the long-term BTC options.

According to JPMorgan, President Donald Trump's tariffs are likely to elevate inflation in the second half of the year.

"Global CORE inflation is projected to increase to 3.4% (annualized rate) in the second half of 2025, largely due to a tariff-related U.S. spike," analysts at the investment bank noted, adding that cost pressures will likely be concentrated in the U.S.

An uptick in inflation could make it harder for the Fed to cut rates. TRUMP has repeatedly criticized the central bank for keeping rates elevated at 4.25%.

Traders will receive the ISM non-manufacturing PMI later Tuesday, providing insights into inflation in the service sector, which accounts for a significant portion of the U.S. economy. It will be followed by July CPI and PPI releases later this week.