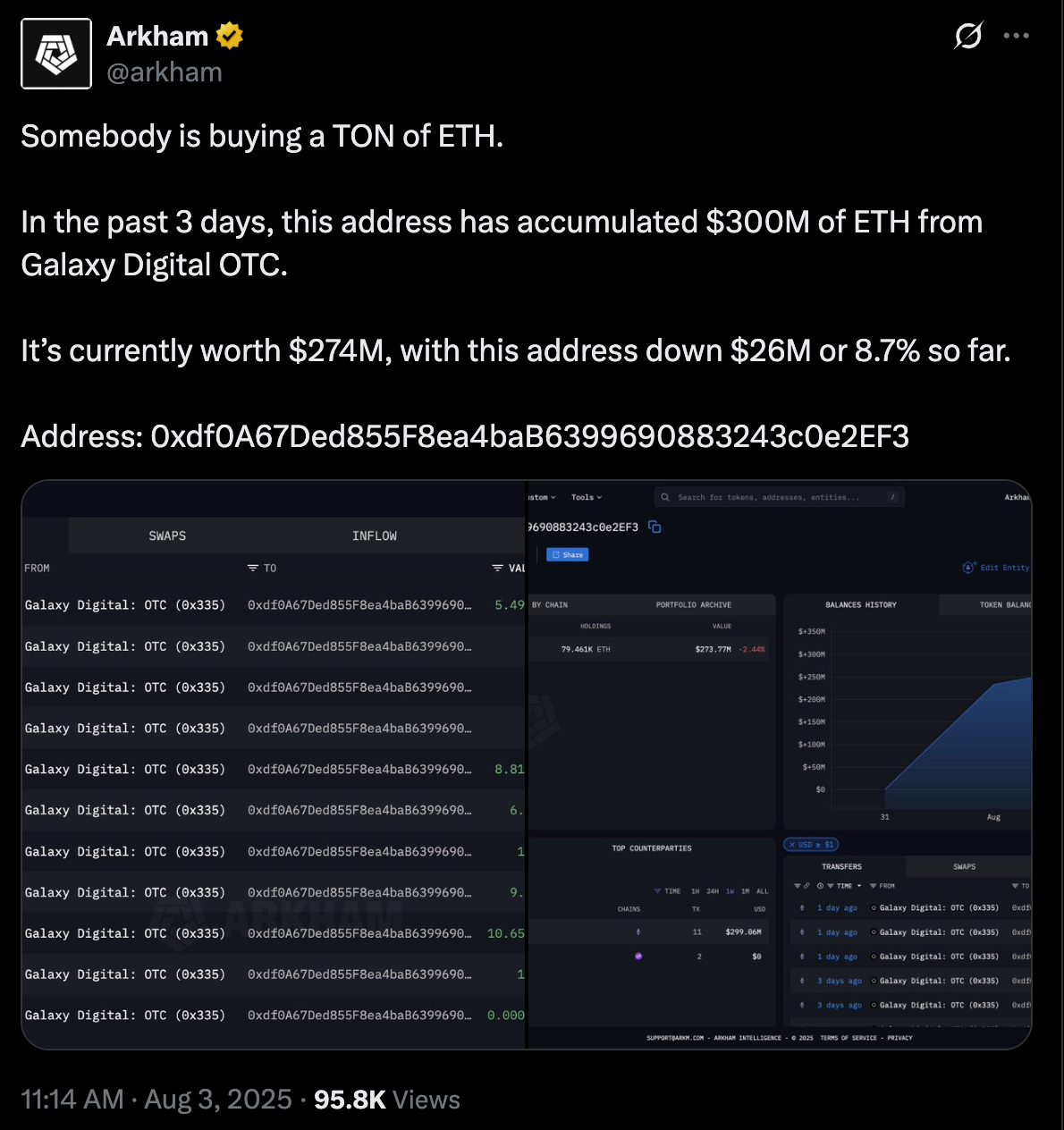

Whales Bet Big on ETH: $300M Buying Spree Defies 10% Price Drop – Bullish Divergence Ahead?

Ethereum’s price tanks 10% in a week—but crypto whales just dumped $300M into ETH. Are they seeing something retail isn’t?

Whales vs. Weak Hands

While panic sellers flee, institutional players are gobbling up Ethereum at a discount. Classic ‘buy when there’s blood in the streets’ play—or are they just hedging their NFT monkey JPEG losses?

Technical Tug-of-War

The divergence between price action and whale accumulation screams ‘accumulation phase.’ Then again, so did that ‘generational buying opportunity’ before Luna cratered. Crypto never learns.

The Bottom Line

Either ETH’s about to rip past $3K again, or these ‘smart money’ players just got rekt trying to catch a falling knife. Place your bets—Wall Street’s playing with house money anyway.

A fresh bout of macro jitters, sparked by the buoyant U.S. dollar and Friday's disappointing U.S. jobs data, has put the crypto market on the back foot.

Bitcoin, the largest digital asset by market value, has held relatively resilient, down just 4.5% for the week. BTC's outperformance relative ETH confirms the change in market sentiment sentiment against ETH that was first signaled by the options market.